Advertisement

Manila beats Boston, Paris, Tokyo as world’s hottest luxury home market

- Manila’s luxury home prices shot up 11 per cent last year, Knight Frank says

- Beijing ranked 26th and Hong Kong 47th in terms of luxury home price increases

Reading Time:3 minutes

Why you can trust SCMP

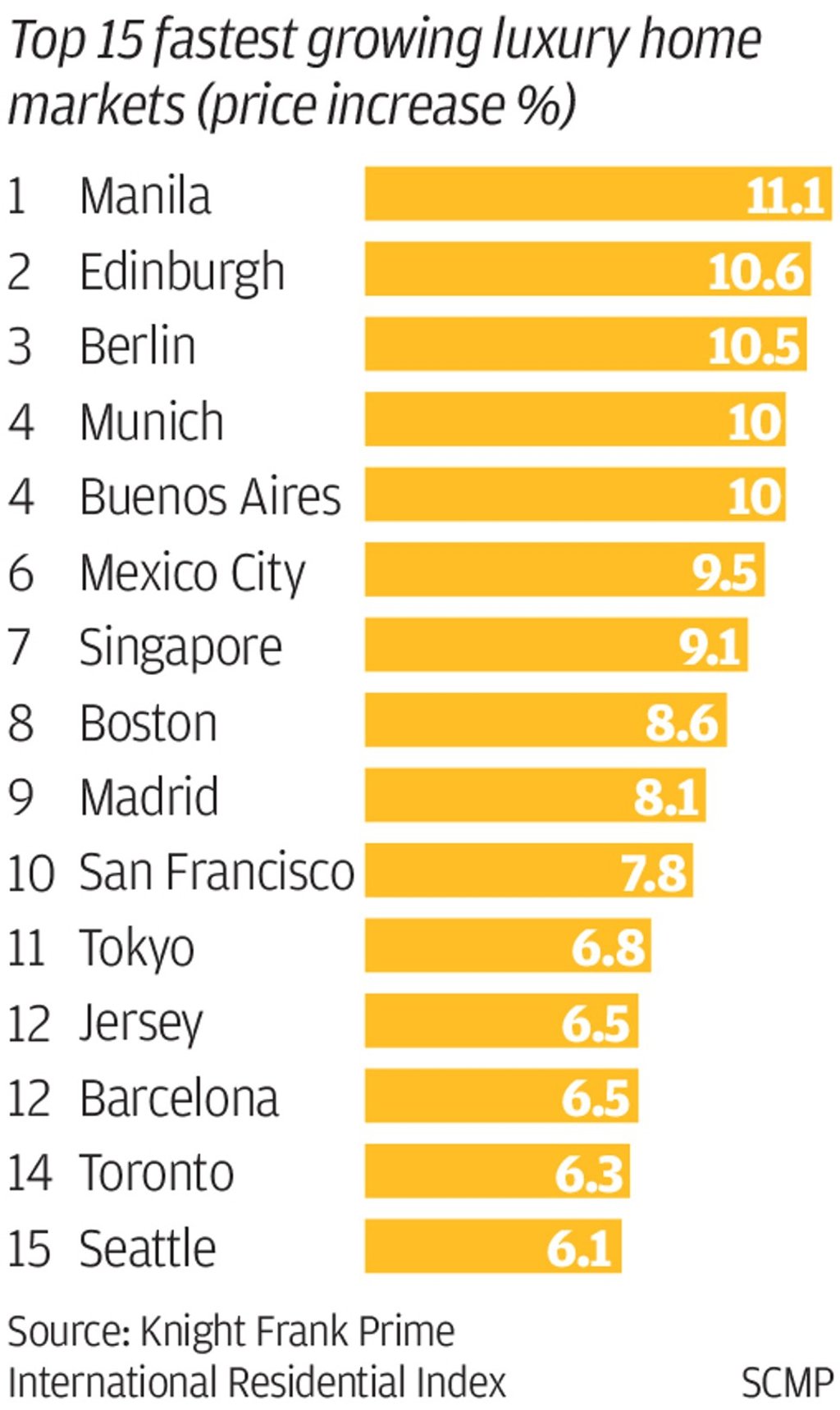

Manila is the hottest luxury home market in the world, beating out the likes of Boston, Tokyo and Paris, property consultancy Knight Frank said.

Luxury prices shot up 11 per cent in 2018, as the capital city of the Philippines got a boost from a robust economy, shortage of luxury homes and increased appetite for them by wealthy foreigners living there.

The ranking of 100 cities is based solely on how much their luxury home prices increased last year.

Advertisement

The only other Asian city in the top 10 list was Singapore, where prices jumped 9.1 per cent.

Tokyo came in 11th, rising by 6.8 per cent; Paris, 19th, up by 5.3 per cent, and London, 91st, down by 4.4 per cent.

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x