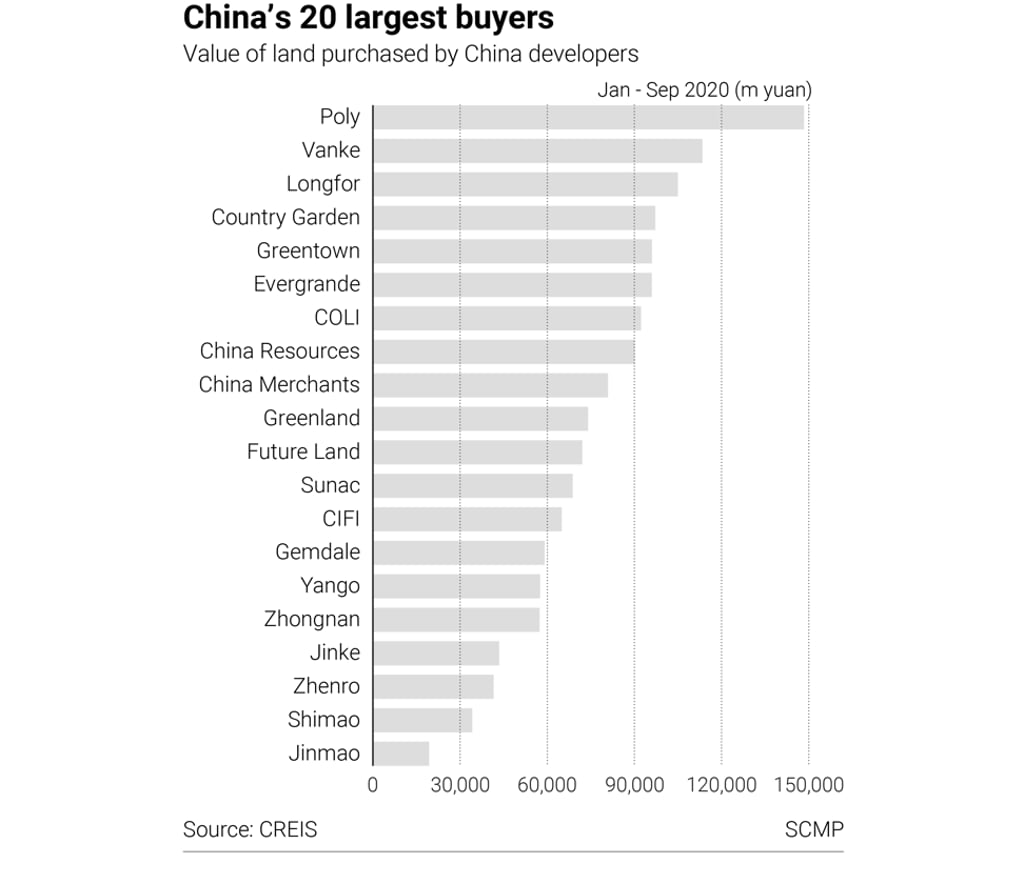

Chinese developers’ spending binge on land acquisitions unabated as it triples to US$228 billion from five years ago

- China’s top 20 developers invested 1.5 trillion yuan between January and September on growing their land bank, up from 500 billion yuan in 2015, report shows

- Most of the land this year was acquired in Wuhan, Changsha, Suzhou, Xian and Chongqing, known as ‘new first tier’ cities

China’s top 20 developers have tripled their spending on land acquisitions in the first nine months of this year compared to five years ago, with most of it focused on “new first tier” cities such as Wuhan, according to a report from a leading research firm.

Most of the land this year was acquired in Wuhan, Changsha, Suzhou, Xian and Chongqing. The five cities are also known as “new-first-tier” cities and share similarities with the four main super first-tier cities of Beijing, Shanghai, Guangzhou and Shenzhen.

“It is noteworthy that the ‘new first-tier’ cities, represented by regional centres such as Chengdu, Xian, Wuhan as well as provincial capitals of developed eastern regions such as Hangzhou and Suzhou, are in rapid development period, ranking high in foreign direct investment and economic growth,” Fang Jin, a research fellow at the Development Research Center of the State Council, a top government’s think tank, wrote in a joint report with consultants PwC.

Chinese developers’ investment on land in tier two and tier three cities jumped by 352 per cent from 287 billion yuan in 2015 to 1.3 trillion yuan in the first nine months, Real Estate Foresight said. However, their investment in tier one cities rose by only 15 per cent in the comparable period.