Hong Kong property investment abroad doubles

Cooling measures at home and the recovery by markets worldwide trigger an outflow of US$4b for 29 office properties costing US$2.5m or over

Investments by Hong Kong-based fund managers, institutions and individuals in commercial properties around the world have almost doubled in the last 12 months.

The capital exodus has been triggered by the government's property-cooling measures and a recovery in global markets.

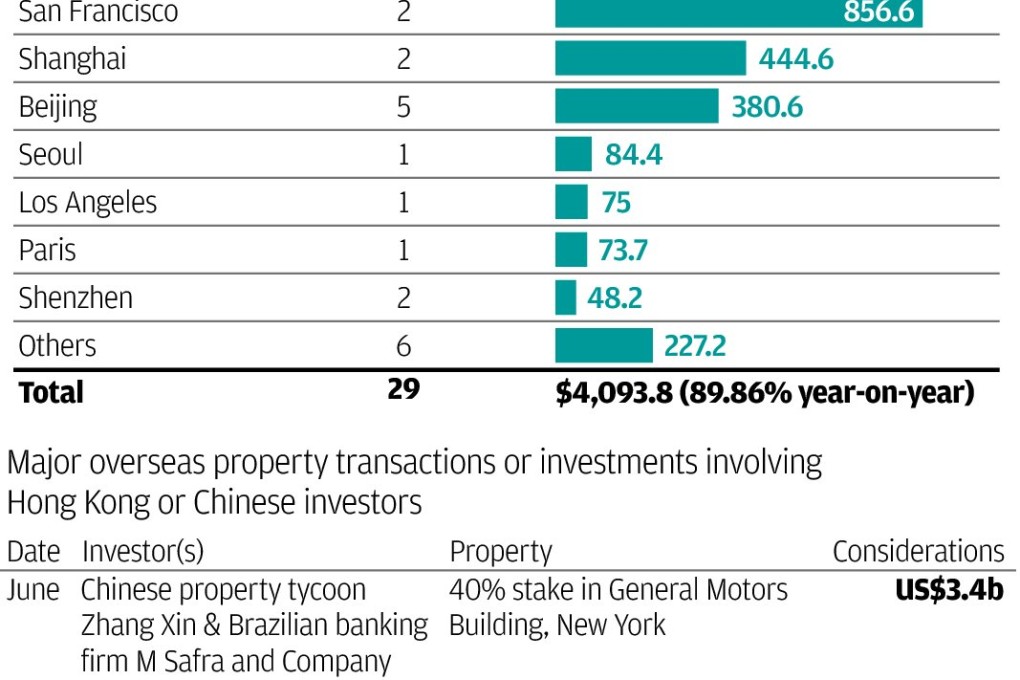

Figures retrieved on Monday from the database of global property research firm Real Capital Analytics show that investments totalling US$4.09 billion poured out of Hong Kong in the past year to purchase 29 office properties worldwide with price tags of US$2.5 million or above.

That figure was up nearly 90 per cent from US$2.16 billion year-on-year, while the number of transactions was up 164 per cent from 11 deals.

London was the top destination for the investment flows, with seven office premises purchased by Hong Kong funds in the last 12 months totalling US$1.02 billion, followed by Singapore at US$884 million.

Richard Kirke, managing director of the Hong Kong office of Colliers International, said policy restrictions on the property market in Hong Kong and the mainland had driven Chinese investors to foreign markets, where yields were higher.