Risks hang over surge in high-yield bonds

Mainland developers dominate this year's issuance, more than half of which is unrated, heightening fears about a slump

Each day seems to bring news of a fresh bond from a mainland property developer. The debt issues are a favourite of private banking clients, which have been known to buy as much as half of a given deal. But this sector is cyclical, concentrated, and - if recent history is anything to go on - risky.

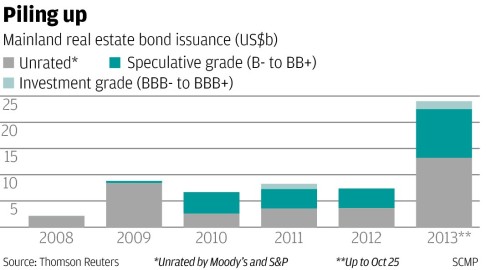

Mainland property bond issuance has amounted to US$23.7 billion in the year to date, almost three times the volume of the previous record in 2009.

Only one of the property bonds that priced this year was investment grade - a US$1.5 billion deal for China Overseas Land & Investment that closed on October 23 - and, indeed, only a handful of the mainland property issuers are in triple B territory.

A boom in onshore issuance by mainland developers meant that just over half of the total issuance (by dollar amount) in the year to date was not rated by the main agencies, Moody's Investors Service or Standard & Poor's, according to Thomson Reuters.

The surge in issuance has escalated the concentration risk of the sector, with mainland property bonds accounting for about half of all Asian high-yield issuance.

Issuance from mainland developers makes up 40 per cent of the JP Morgan Asia Credit Index Non-Investment Grade Corporate Index. That means that fund managers specialising in Asian high-yield debt are more or less compelled to buy mainland property funds if they want to track benchmarks such as the JACI index.

Investors identify Asian high-yield with Chinese property, which invites the question of what would happen to the Asian high-yield market if the mainland property sector careered into one of its occasional cyclical busts.

"If a couple of [property] firms are in a distressed situation because of market forces, property controls, a market slowdown, and so on, and if you had a market-weighted exposure of 50 per cent to the sector … it would be a negative outcome," said Bryan Collins of Fidelity, a manager of Asia's largest high-yield fund.

"You'd be asking questions about your exposure to Asia generally, to the currencies, to the banks - if something was happening at a wider level."

Coupons on mainland property bonds frequently come in the double-digit range - China Aoyuan Property brought a bond this year with a 13.875 per cent coupon, and Wuzhou International did one for 13.75 per cent.

There is even talk of privately placed structured deals that pay total annual returns to investors in the realm of 20 to 25 per cent. Put simply, issuers' coupon commitments are high, which could stretch their ability to meet interest costs down the line.

"If there is a slowdown in property sales, the property firms that have issued particularly high-yielding instruments may have problems meeting their coupon payments. If the macro economy has problems, the real estate sector may have issues given the cyclicality of their cash flows," said Deepak Dangayach, the head of Asian high yield at Deutsche Bank.

The high coupon costs do not suggest in itself an issuer is particularly risky. Many firms are paying big yields because they are coming to the market for the first time. Once established, their funding costs come down. For example, Shanghai developer CIFI did its first offshore bond in April, paying a 12.25 per cent coupon. The bond has since traded to 112 for a yield of 9 per cent, which implies that if CIFI did a deal today, it would come at about a quarter of the interest cost it paid six months ago.

Moreover, the mainland property sector is generating strong revenues and profits, which suggests ample ability to repay debt.

"The Chinese property developers are experiencing a record year in terms of sales. Typically, the profit margin for property firms is in excess of 30 per cent. If they pay a 10 per cent coupon on a bond and make a 30 per cent return, the financing makes sense," said a bond banker at a large British institution.

However, this is a highly cyclical industry rife with policy risk and prone to regular wrenching downturns.

Neo-China Land ran into trouble during the global financial crisis. At its nadir, the company's credit was rated CC by Standard & Poor's, implying the firm was "highly vulnerable". Shanghai Industrial injected HK$2.75 billion into the firm in January 2010, rescuing it.

SPG Land, which develops high-end homes in the Yangtze River Delta, was also in trouble earlier this year before Greenland Holding bailed it out in May with a HK$3 billion cash injection.

Hangzhou-based Greentown was in a "very difficult situation" last year, according to chairman Song Weiping, because of property cooling measures on the mainland. Hong Kong's Wharf saved the firm in June last year, paying HK$5.1 billion to take control of the entity.

S&P downgraded shopping mall developer Renhe Commercial to CCC in April on the expectation the firm would miss interest payments on notes in the coming months.

"The developers are buying a lot of land. If the market were to turn quickly, they could get burned," S&P said.

The property bond market is also unusually reliant on orders from private banking clients. Such investors like the high yield on the securities, and the private bank allocation on single-B property developers typically ranges from 30 to 40 per cent.

This allocation hit 52 per cent on a US$700 million bond brought by Greenland last month, a banker involved in the offer said.

But private banking clients do not have the tools to make complex pricing calls on new or unrated credits, creating concern about their heavy involvement in this market. The Hong Kong Monetary Authority last year sent a questionnaire to private banks in Hong Kong that asked about their sale of high-yield bonds, most of which comes from the mainland property sector.

At about the same time, the Securities and Futures Commission put out a circular that flagged the risks in high-yield bonds.

Private banking clients are typically offered a discount of 25 to 50 basis points on the mainland property bonds. Many clients flip the bonds to lock in their profit. It makes the market volatile, and the fact that issuers lean on such individual investors using such tactics concerns some investors in the institutional sphere.

"There is a moral hazard. If you are providing a short-term incentive to an investor making a medium to long-term commitment, you could ask whether that is appropriate," said Collins, who added that the private banking discount was an entirely Asian phenomenon.

Whatever one's views on this market, everyone agrees there is going to be a lot more issuance. There are more than 60,000 developers on the mainland, S&P estimates, of which fewer than 50 are rated, suggesting this is just the beginning.