Property to take less of the GDP load

Investment in real estate is seen easing back from role as a driver of growth on the mainland amid demand doubts and economic transition

Property investment will be less of a driver for the broader mainland economy this year, despite the central government's strong urbanisation push, economists said.

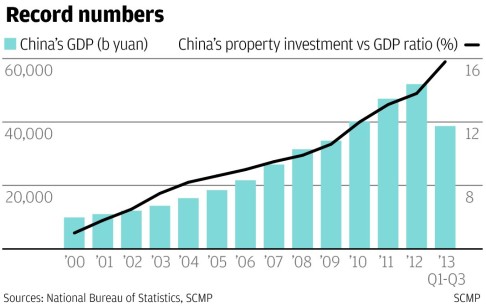

Property investment accounted for 15.8 per cent of the mainland's gross domestic product in the first three quarters of last year, a record high and a big jump from the 5 per cent contribution in 2000.

The ratio has stayed above 10 per cent since 2009 and the industry, which affects more than 40 other sectors including metals and home appliances, has stood out and provided a cushion to slowing growth in the world's second-largest economy.

"The property sector will remain a bright spot in the Chinese economy in 2014, but be a weaker driver," said Qi Jingmei, a senior researcher at the State Information Centre, a top government think tank in Beijing.

That is an outcome of changes within the property sector as well as the mainland's efforts to rebalance its economy to rely more on consumption rather than investment.

The peak of China’s property investment growth has passed

Economists have long argued that the mainland's frothy real estate sector, with fat, albeit narrowing profit margins, attracts too much cash and hinders the development of industries that could help the economy move up the global value chain.

"The peak of China's property investment growth has passed," said Hao Hong, managing director of research at BOCOM International in Hong Kong, pointing out that in the mainland's new urbanisation push, efforts would focus on integrating rural people into urban life and its social welfare net, rather than the mere expansion of cities.

An index measuring average new home prices in 288 major cities is at a record high - 10 per cent higher than its previous peak in September 2011 - according to CRIC, a mainland real estate data and research provider. That has priced out many middle-class families and resulted in housing gluts in a number of second and third-tier cities, including Wenzhou and Ordos.

Qi said housing oversupply would spread out this year, although the four first-tier cities - Beijing, Shanghai, Shenzhen and Guangzhou - would be spared due to a steady influx of job seekers. "Our trips in Hangzhou find many families already have two or even three homes," Qi said. "I really don't know where more demand will come from."

The polarisation of housing markets has led developers to increase their land banks in big cities, pushing up land prices and pointing to even higher home prices this year. Land sale revenues in first-tier cities rose 195 per cent to 441.7 billion yuan (HK$560.2 billion) in the first 11 months of last year, CRIC said.

That will probably invite tighter measures to curb housing inflation in first-tier and some second-tier cities this year, while authorities in cities suffering oversupply may quietly relax existing restrictions to revive demand - a move that economists say is likely to be in vain.

"The supply-demand imbalance will extend to more cities," said Wei Yao, China economist with Societe Generale in Hong Kong. "Home prices in big cities will continue to rise next year, but they are not sufficient to lift [real estate investment] growth across the nation."

She added that tight monetary conditions this year would also limit developers' expansion plans, projecting that growth in mainland real estate investment would slow to around 17 to 18 per cent, down from an annual rise of 19.5 per cent in the first 11 months of last year.

Mainland banks have cut mortgage loans in recent months as their annual lending quota ran out. That may not only be a year-end ritual, but indicates a strategic reduction of exposure to the property sector, some industry analysts said.