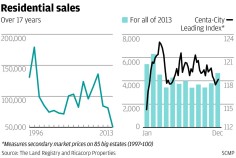

Cooling measures send flat sales crashing to a 17-year low but prices up

Action to avoid housing bubble and new rules on advertising send transactions crashing to a 17-year low, but prices still show 3pc increase

The government's introduction of cooling measures and new rules on the sale of new homes saw home sales drop to their lowest level in 17 years last year.

But at the same time, the Centa-City Leading Index for the mass residential sector showed property prices rose 3.7 per cent.

Patrick Chow Moon-kit, head of research at Ricacorp Properties, said the number of transactions was the lowest since 1996.

Chow said the fall in home sales was due to the introduction of new market-cooling measures in February.

The Residential Properties (First-hand Sales) Ordinance in April, which changed the way flat sizes were advertised, had also contributed.

"The double stamp duties and tightening of mortgage loans have kept investors and end-users who planned to buy a better flat away from the market," he said. "And developers suspended the release of new projects from March to September due to the new ordinance. The primary market has turned active for three months only."

Chow forecast that residential sales would rebound to about 66,000 this year as developers released more new projects, but he said sales of second-hand homes would continue to fall.

Polytechnic University real estate professor Eddie Hui Chi-man said the prices of second-hand properties had levelled out, but that rents rose significantly.

Hui said: "The poor figures show only cash-rich and wealthy people are able to buy flats as new housing supply remains tight and there's a lack of second-hand flats released in the market.

"Many home-seekers will still find it difficult to buy a flat until the new housing supply increases significantly in 2015 and 2016. But by that time, the buyers will face the problem of increasing interest rates."

Justin Chiu Kwok-hung, executive director of Cheung Kong (Holdings), said he expected the company would earn more than HK$30 billion from the sale of homes in five projects in Hong Kong this year.

The company also expects to earn more than 10 billion yuan (HK$12.8 billion) from mainland property sales this year.

Cheung Kong missed its HK$30 billion sales target last year after failing to win consent to launch sales of major projects such as Hemera in Tseung Kwan O and City Point in Tsuen Wan.

"We reaped HK$5 billion in Hong Kong's residential sales last year and 10 billion yuan on the mainland," Chiu said.

The two projects are expected to be offered for sale this year, together with its Diva development in North Point, a project in Tai Po and a joint venture with The Urban Renewal Authority.