China property prices seen rising further as investment growth slows

Could this be the breakout year for the mainland property market?

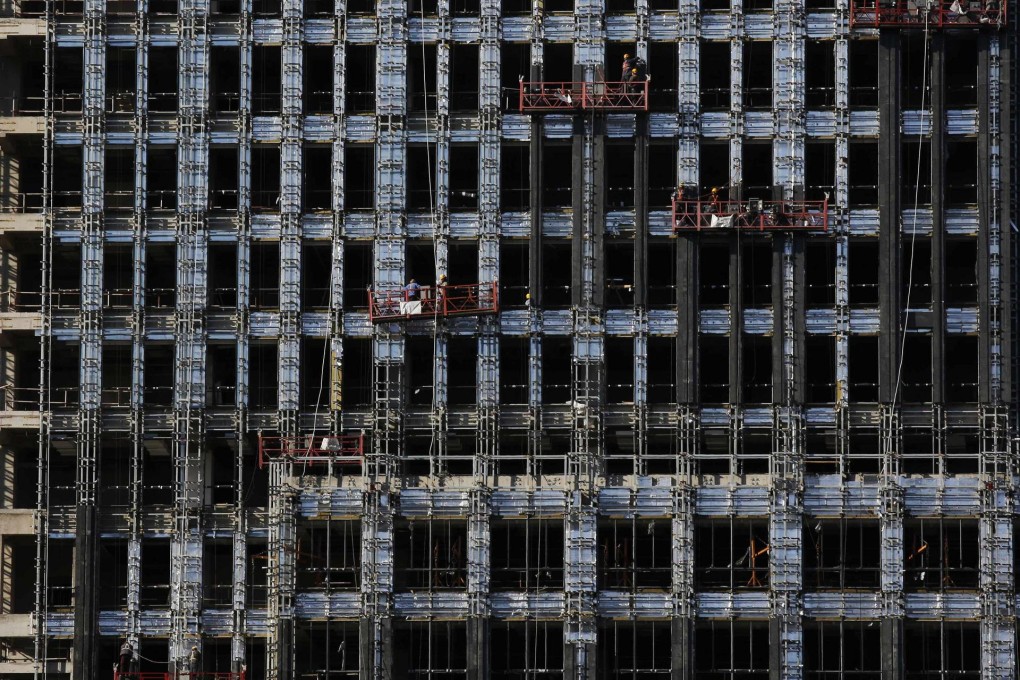

Analysts expect real estate investment growth, a key driver of the economy, will slow this year, even as home prices in top cities rise to unsustainable levels before a bursting of the asset bubble.

Eliza Liu, chief economist of CCB International Securities in Hong Kong, said real estate investment is losing steam and expects the sector's investment growth to fall to 15 per cent this year, a record low and a steep fall from 19.8 per cent last year.

"The bubble risks of the Chinese economy are mainly in the property sector now," she said. During this quarter, policymakers must decide how to deflate the housing bubble while also ensuring sufficient liquidity to boost the real economy. What actions they take will decide the performance of the economy for the rest of the year.

The property sector, with its much higher - though narrowing - profit margin, as compared with manufacturing and other industries, is a magnet for capital seeking quick returns. The result will be more rampant shadow banking and soaring home prices across the country.