Developers pick up residential sites in Tuen Mun with 'conservative' bids

Rising construction costs seen as a factor in the lower than expected bids on Tuen Mun plots

Poor tender results for two Tuen Mun residential sites reflect developers' pessimism about the outlook for the New Territories property market.

The Lands Department said yesterday a site on Tsun Wen Road, near Blossom Court, was sold to Nan Fung Development for around HK$455.88 million or about HK$2,270 per square foot - at least 24 per cent below market expectations.

Another site, on Leung Tak Street, was sold to Sun Hung Kai Properties for HK$430 million, or HK$2,729 per square foot - 8 per cent less than the forecast.

"The prices of mass residential property in the New Territories usually drop first and sharpest among the districts once a price correction happens," said surveyor Albert So Chun-hin. "It is inevitable it would happen again this time."

He added that the supply of new housing would increase in the next two years, with most coming from the New Territories.

"Home prices in the area are facing downward pressure," So said. "Naturally, developers' offers for sites in the New Territories would be conservative."

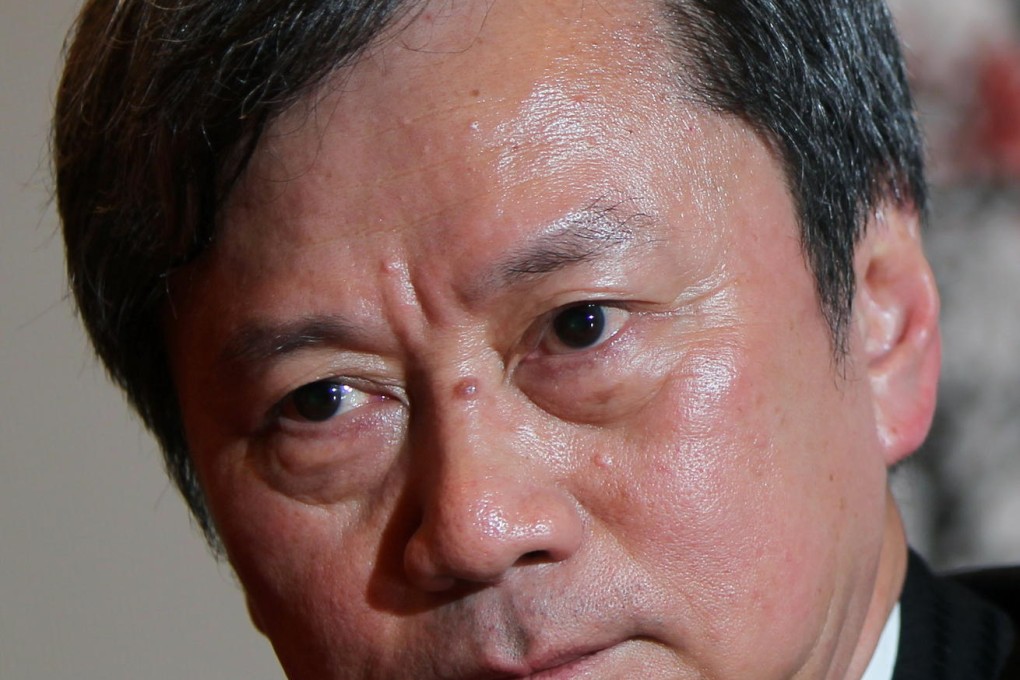

But Nan Fung Development managing director Donald Choi Wun-hing said: "I don't think the site is cheap as the construction cost has increased significantly [which increases the development cost]. Developers also have more choices as the government is increasing land supply."