China's property push abroad to deepen, says JLL

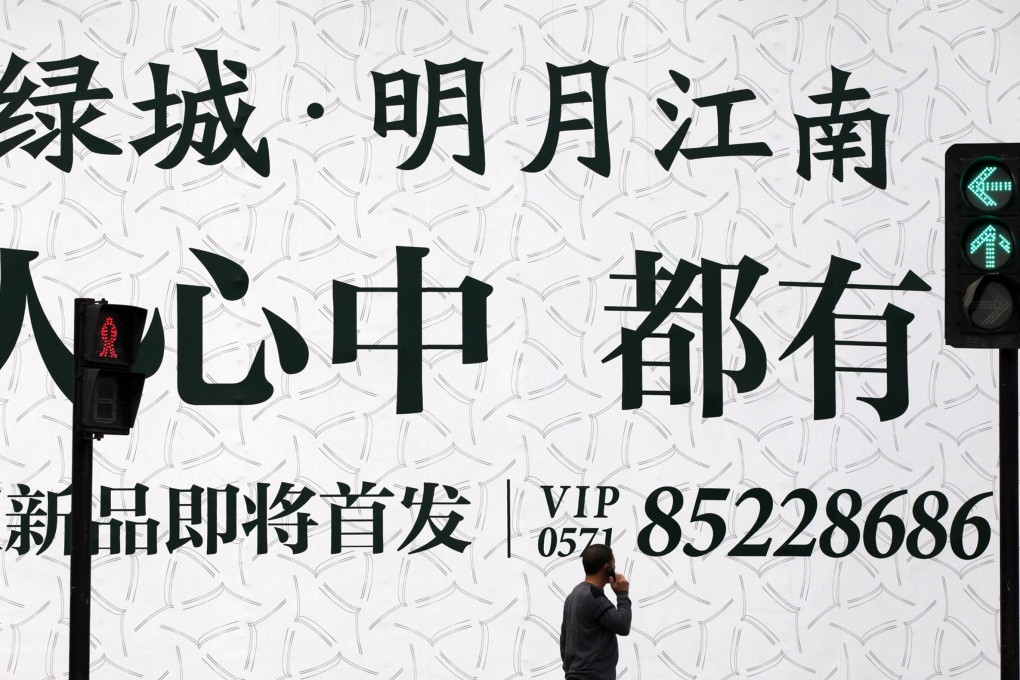

The Chinese investment surge that has helped reshape the skylines of the world's gateway's cities is set to deepen as part of a long-term capital shift, consultancy JLL says.

The Chinese investment surge that has helped reshape the skylines of the world's gateway's cities is set to deepen as part of a long-term capital shift, consultancy JLL says.

"This is not a cyclical thing; it is a long-term structural shift," said Alistair Meadows, international director, Asia International Capital Group, at JLL.

He expects mainland developers will continue their focus on residential and commercial developments in prime global cites for at least the next three years.

Meadows said the trend would be strengthened by policy changes on the mainland that encouraged developers and investors to diversify abroad.

The mainland real estate sector is weighed down by burdens including tight financing and high inventories. Migration and education are also seen as factors spurring overseas investment.

Overall Chinese outbound investment in property rose 17 per cent to US$5.4 billion from January to the end of June, with commercial investment accounting for nearly US$4 billion of that total, according to JLL.