Lai Sun Development earnings driven by rentals and property sales

Lai Sun Development recorded core earnings of HK$333.2 million for the year to July, driven by stronger rental income and property sales.

Lai Sun Development recorded core earnings of HK$333.2 million for the year to July, driven by stronger rental income and property sales.

The company posted an underlying loss, excluding property revaluations, of HK$201.4 million a year earlier.

For the year to July, the group, which owns three investment properties in Hong Kong - Cheung Sha Wan Plaza, Causeway Bay Plaza II and Lai Sun Commercial Centre - said gross rental income rose 15.7 per cent to HK$502.3 million.

Turnover from property sales jumped to HK$1.04 billion owing to strong sales at its Ocean One residential project in Yau Tong, up from HK$100.3 million a year earlier.

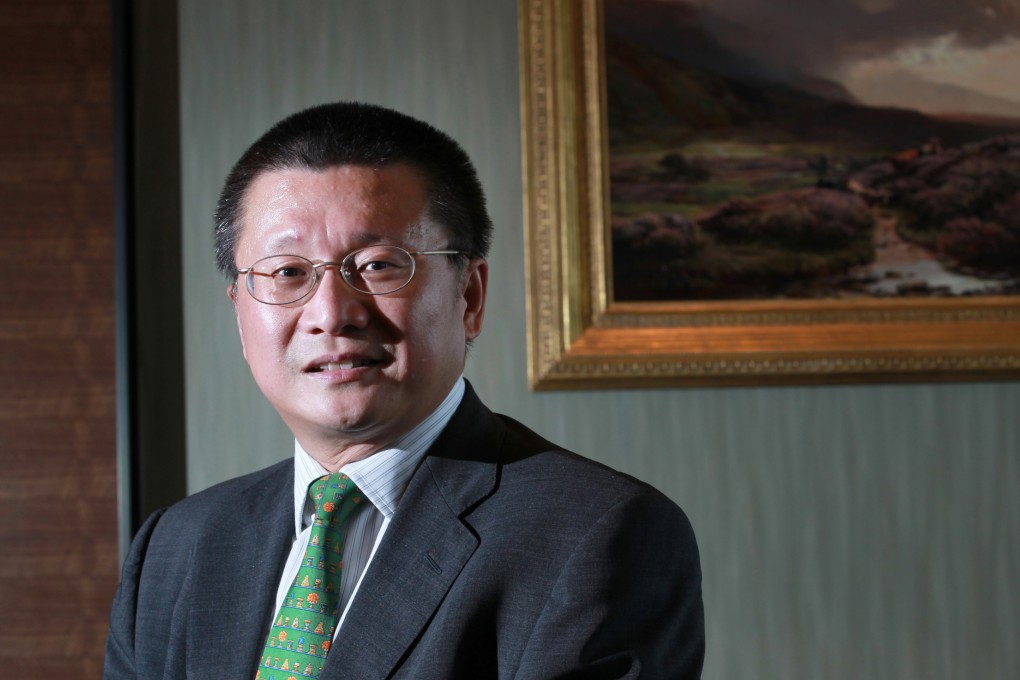

Deputy chairman Chew Fook Aun said he expected solid demand in the luxury residential market, adding "we have no plan to offer discounts".

Net profit, including revaluation gains on investment properties, declined 42.3 per cent to HK$1.47 billion.