New | Hong Kong’s Central office space in demand as Mainland Chinese banks seen expanding

Property consultants have high hopes about the demand for Grade A office space in Hong Kong, as mainland financial institutions are likely to build a bigger footprint in the city due to Beijing’s “Going Out” policy.

Some analysts said that a weakening mainland economy would slow demand of office space in Central but rents in the area would still go up this year due to extremely low vacancy rates of 1.7 per cent as of the second quarter of 2015.

International property consultant Colliers International expected more mid-sized mainland banks would open offices in Hong Kong.

“Assuming a second batch of 15 mid-sized commercial banks in China set up their full offices in the next five years, the impact on Central will be a new demand of 450,000 square feet,” said Simon Lo, Executive Director of Asia Research & Advisory of Colliers International.

The assumption was based on the previous expansion pace by mainland banks.

“There were seven city commercial banks obtaining full service licenses in Hong Kong in the past five years. We believe the expansion pace will double as the approval time has shortened,” said Lo.

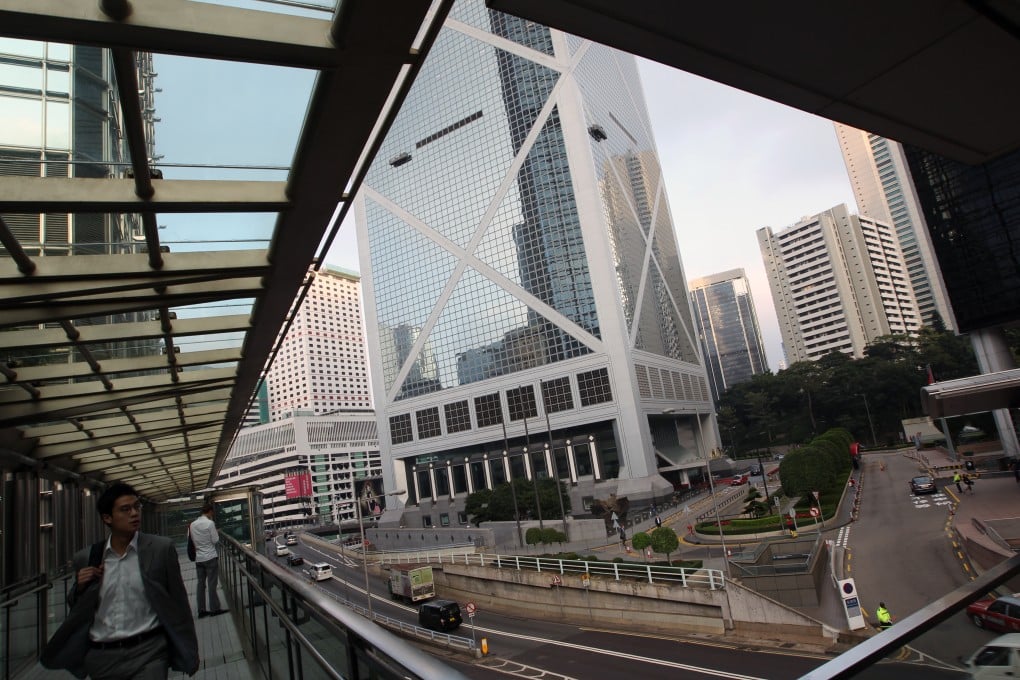

Hong Kong has a long history serving as a financial platform for big Chinese banks. For example, the Bank of China opened its first branch in Hong Kong as far back as 1917, the first Chinese state-owned bank to do so. Nowadays, in terms of real estate, these state-owned giants each occupy at least 100,000 sq ft in Central.