New | Wanda Commercial Properties faces tough challenge under new ‘asset-light’ strategy that focuses on service income

Property group’s shares drop 5.9 per cent following analysts’ downward revisions on share price outlook

The “asset-light” approach of Dalian Wanda Commercial Properties has come under fire from analysts who warn that the pioneering strategy that relies on management fees and other services income could negatively impact its bottom line.

Two investment banks lowered their target price for the company’s Hong Kong-listed shares, citing concerns over the strategy which relies solely on fees from services related to project management while working with a financial backer who will front capital and take full equity in the project.

“Wanda’s transition to an asset-light model could be bumpy,” Bank of America Merrill Lynch said in a report.

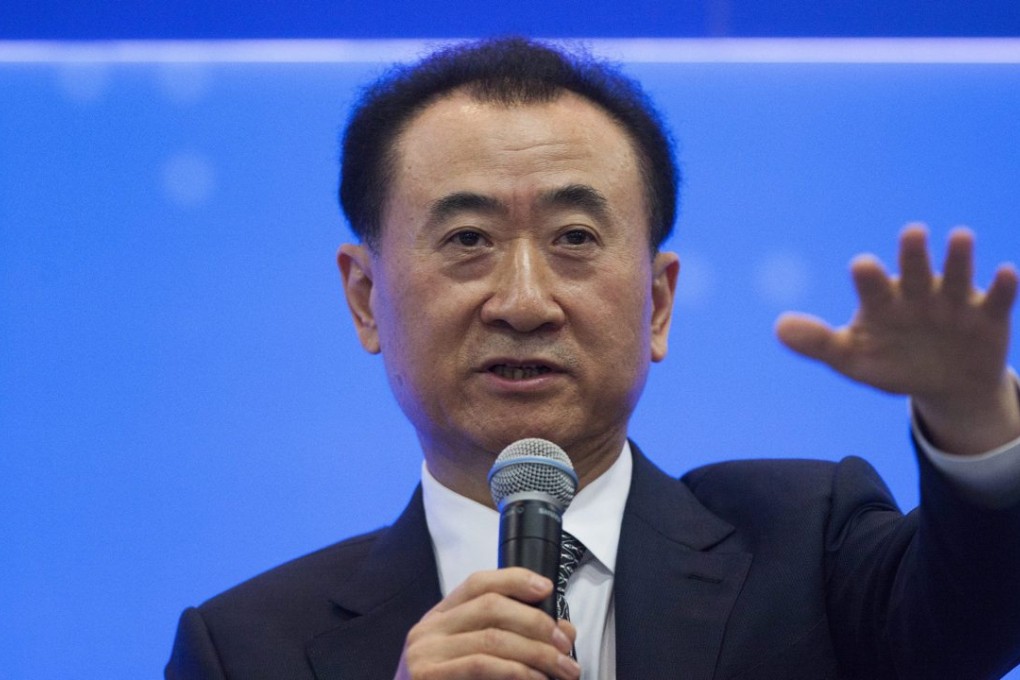

The company is controlled by China’s richest man Wang Jianlin.

Wanda’s shares plunged 5.9 per cent Tuesday to HK$34.40, their lowest since its listing in Hong Kong in 2014.

Investors will likely await evidence in the second half of 2016 or the first half of 2017 to see if its new single-mall format, which will allocated less space for achor tenants, can achieve the 10 per cent yield and meet the 7 per cent return target for project investors, said BofA Merrill Lynch.

BofA Merrill Lynch cut Wanda Commercial’s share target price 8 per cent to HK$55.