Who buys multiple apartments in Hong Kong when most struggle to own one? Here’s a list

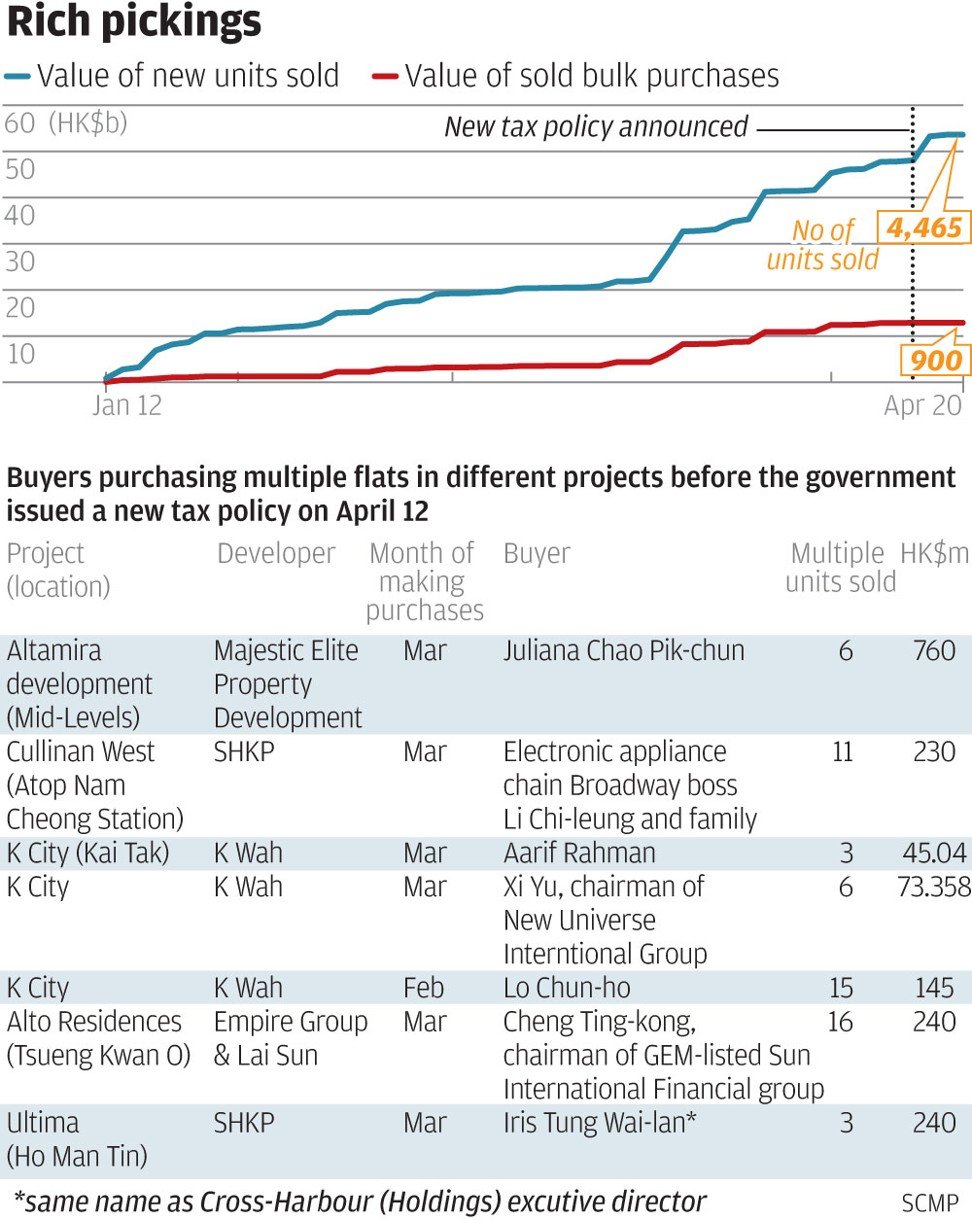

Purchases of multiple apartment units on a single contract surged to a record HK$13 billion since January, almost a quarter of all purchases in the same period.

Hong Kong’s mega-rich barely break a sweat whenever they snap up multiple apartment units, even as the majority of the city’s residents struggle to own a single unit in the world’s most expensive city.

But paying a higher duty on the property purchases is a different story.

Such was the case for Juliana Chao Pik-chun, the daughter-in-law of Dragonair’s founder Chao Kuang-piu. It was also the case for the chief of the Broadway retail chain Li Chi-leung, and actor/songwriter Aarif Rahman. The three have spent more than HK$1 billion (US$128 million) collectively, buying multiple number of apartment units in one shot in March, according to Land Registry data and reports by agents.

Chao bought six flats, totalling 12,912 square feet, for HK$760 million, or HK$58,767 per square foot, at the Altamira luxury development project at the Mid-Levels on March 13, according to Land Registry data released on Tuesday. She acquired theunits through a tender sale offered by private developer Majestic Elite Property Development.

“The market buying pattern has been distorted by the government tax policy. As there is only one chance for first-time buyers to avoid the stamp duty, investors will maximise the use of their names to buy as many as they can,” said Wong Leung-sing, associate director of research at Centaline Property Agency.

The head of the Broadway chain, Li and his family members, bought 11 units at Cullinan West development atop Nam Cheong Station for HK$230 million on March 17, according to agents.

Rahman, according to data from the Land Registry, bought three units at K.Cityin Kai Tak for HK$45.04 million on the same contract on March 21.

Other multiple flat purchasers who bought ahead of the new tax policy included Cheng Ting-kong, the chairman of Sun International Financial group, who spent HK$240 million on 16 flats at Alto Residences in Tseung Kwan O.

The market buying pattern has been distorted by the government tax policy. As there is only one chance for first-time buyers to avoid the stamp duty, investors will maximise the use of their names to buy as many as they can

The trend surfaced after Hong Kong’s government increased the stamp duty to 15 per cent on all residential transactions for buyers purchasing a second home in November 2016.

The spending spree they embarked on pushed the value of transactions involving single buyers of more than one flat on the same contract to nearly HK$13 billion since January, according to data compiled by property.dataelements.net.

Such deals accounted for 24 per cent of the HK$53.6 billion in total sales value of new flats during the same period.

The rapid increase in the number of multiple-property buyers to avoid higher levies finally triggered the government to plug the loophole in April.

A new policy took effect on April 12, whereby buyers of multiple apartments on the same sales contract must pay 15 per cent stamp duty for each property.

For Chao’s purchases, who was still treated as a first-time buyer, she was required to pay only 4.25 per cent stamp duty of HK$32.3 million, as the deal was concluded before the 15 per cent tax took place. She would have paid HK$114 million if she had bought on or after April 12.

In early March, Xi Yu, the chairman of industrial waste treatment firm New Universe Environmental Group, bought six units at K.City for HK$73.4 million.

Xi, a chemistry graduate from Peking University in 1980, holds 36.26 per cent in the listed firm.

Kenny Tang Sing-hing, the chief executive of Jun Yang Securities, said investing in fixed assets has always been favoured by high-net-worth individuals including chairmen and senior executives of many listed companies.

“As they are likely to reinvest their profits made from the stock market, they prefer diversifying their investments into property to minimise risk,” he said.

“Property investment will provide a stable rental income and enjoy capital appreciation. Previously,

we didn’t know who these wealthy individuals are because they bought the properties through British Virgin Islands-registered companies,” he said. “But their investment became known after corporate buyers are liable to pay a standard 15 per cent stamp duty, up from 8.5 per cent, from November last year.”

Tang noted that high-net-worth investors have been focusing on buying several apartments in new residential developments near or atop stations along the routes of the MTR subway operation.

“It is easier to find tenants or buyers – particularly from the mainland – as they prefer apartments with well developed transport facilities,” he said.

Joseph Tsang, JLL managing director and head of capital markets for Hong Kong, believes the new tax policy would encourage these wealthy individuals to return to buying super deluxe properties again.

“Instead of spending HK$100 million for several apartments in a single contract to avoid paying additional tax, they will put the same amount into a super deluxe property as they cannot take advantage of the tax loophole anymore,” Tsang said.