Generous mortgage plans boost sales of Cheung Kong flats

Mortgage plans offered by finance companies have drawn more buyers to snap up units of Cheung Kong’s Tsuen Wan project, at a slightly increased average price

Increasingly generous mortgage offers by finance companies to counter the government’s credit tightening have helped Cheung Kong Property Holdings sell all 346 units in the second round of sale for its Tsuen Wan residential project.

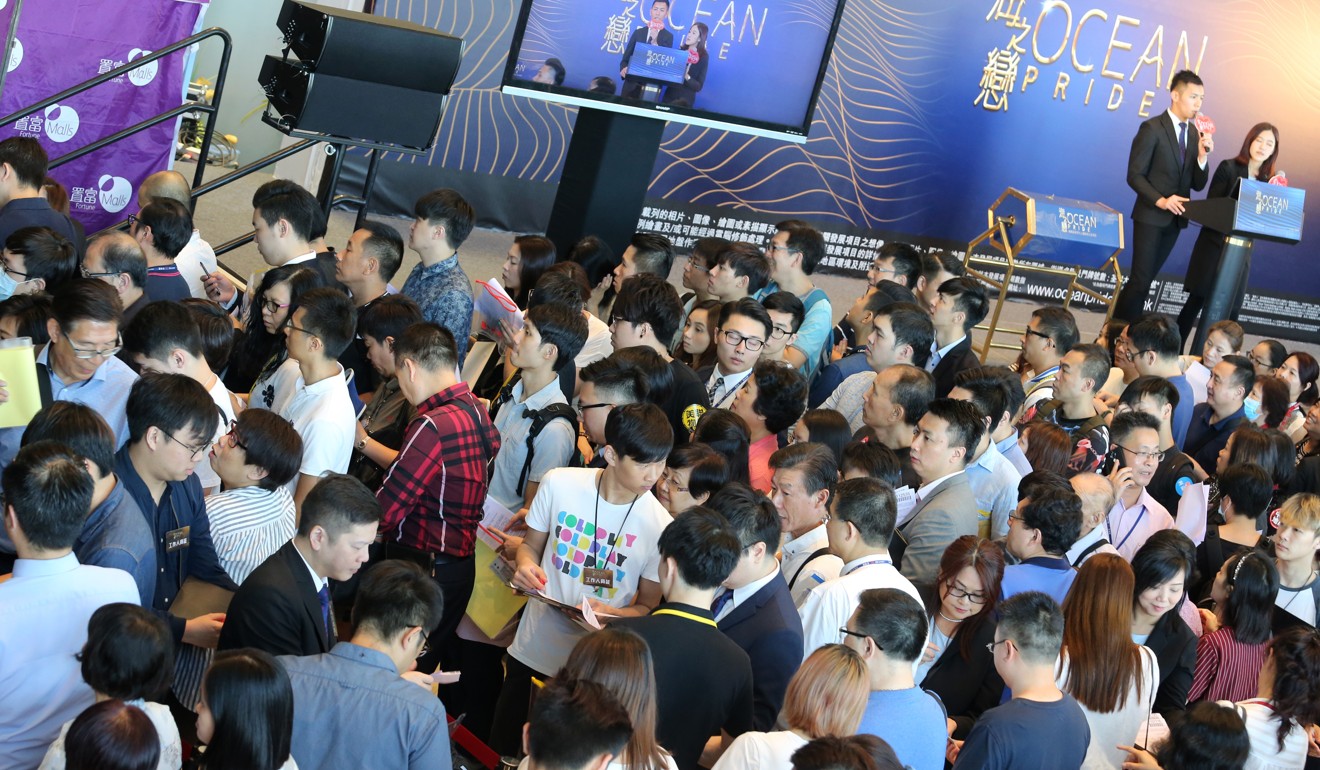

The sales office of the Ocean Pride development were jam packed with hundreds of purchasers and agents who have again flocked to the premise before the registration started at 10am on Wednesday.

CK Property said “all 346 units had been subscribed at 3.45pm.” Together with the first round sale of 496 units, CK has sold 842 units in the two days of sale.

“Half of our clients plan to use the larger mortgage loan to be offered by the developer or the finance companies,” said Sammy Po, chief executive at Midland Realty’s residential department.

Under the new rule, standard bank mortgage ceiling of 30 per cent is imposed on applicants whose income comes from overseas.

Half of our clients plan to use the larger mortgage loan to be offered by the developer or the finance companies

However, buyers choosing this plan would be charged 1 per cent above the prime rate, which now stood at 5 per cent, Referral Mortgage said. It meant that these buyers will be charged an annual 6 per cent, compared about 2.25 per cent standard mortgage loan charged by banks.

The plan will allow borrowers to pay interests only in first three years, and the repayment of the principal of the loan will start in the fourth year.

CK Property, through its financial arm, will offer up to 85 per cent of the flat’s value at 2.25 per cent below prime in the first three years, matching the prime rate from the fourth year.

The attractive financing plan comes after a tightening of mortgage lending rules two weeks ago by

the Hong Kong Monetary Authority, which were aimed to contain the runaway prices that have soared past the industry’s last recorded peak in 2015.

To date, four of Hong Kong’s biggest banks have raised their mortgage rates by 10 basis points to 1.4 percentage points above the city’s interbank offered rate, or Hibor.

The latest batch of Ocean Pride units were offered at an average discounted price of HK$16,038 per square foot, which was still a 2 per cent increase from the price for the first batch sold last Friday.

Prices for Ocean Pride’s higher floor units have risen as much as 10 per cent, said agents

Justin Chiu Kwok-hung, executive director at CK Property said the largest deal involves three units sold for a total of HK$50 million .

“About 40 per cent of buyers are young people who come with parents. They are more worried that they cannot buy the flats than the rising interest rate trend,” said Chiu.