Central London property retains allure despite Britain’s growing divisions, fund says

Last week’s British election, which failed to deliver a single party with a majority mandate, offers up a murky picture of the road ahead, but one which shouldn’t deter those seeking an opportunity to enter the London real estate market, according to one long term advisor who manages £500 million of property investments across the UK.

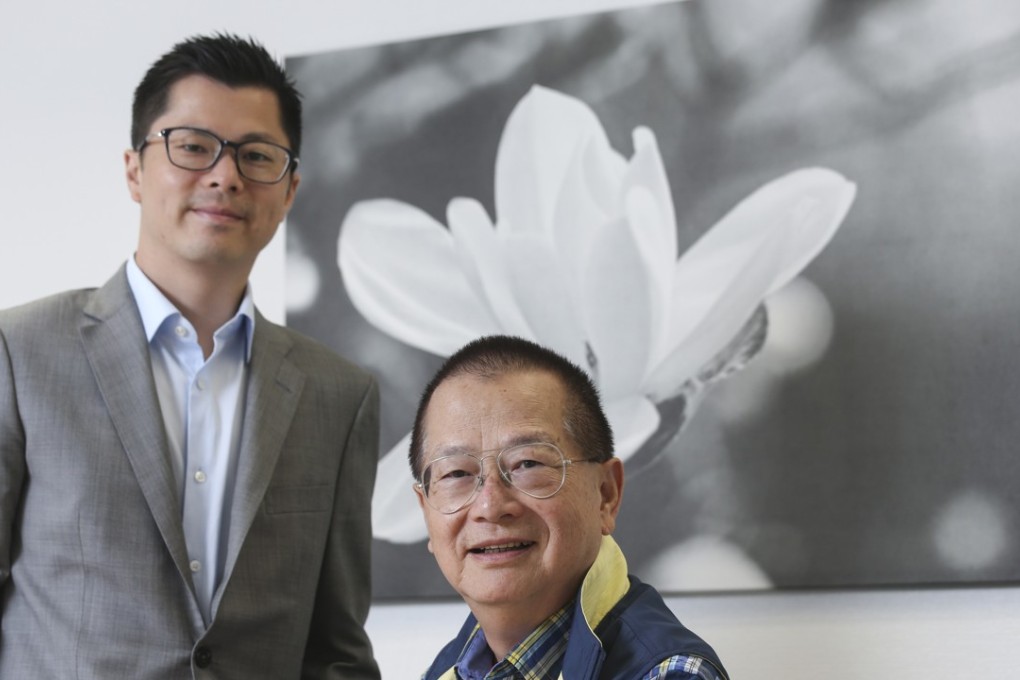

“Our strategy has not changed despite the fact there will be short term uncertainties,” said Thomas Yiu, senior advisor at Joint Treasure International, an advisory that helps manage overseas assets for several rich Hong Kong families.

Last week, Prime Minister Theresa May’s Conservative Party was returned to power with fewer than half of the seats in the legislature, resulting in a hung parliament. The Conservatives are attempting to form a majority government in coalition with other parties, however the result was seen as rebuke to May just as sensitive negotiations over Britain’s exit from the European Union are slated to get underway.

Yiu said his fund was looking beyond the recent newspaper headlines of uncertainties arising from Britain’s inconclusive election and terrorist attacks to focus instead on the appeal of London as a global hub.

The company is comprised of nine core investors, including Henry Cheng Kar-shun and family, the dominant shareholders of New Word Development. Among its recent acquisitions, the advisory bought 3 St James’s Square, one of the most prestigious office locations in central London, for £135 million in May.