Central London property retains allure despite Britain’s growing divisions, fund says

Last week’s British election, which failed to deliver a single party with a majority mandate, offers up a murky picture of the road ahead, but one which shouldn’t deter those seeking an opportunity to enter the London real estate market, according to one long term advisor who manages £500 million of property investments across the UK.

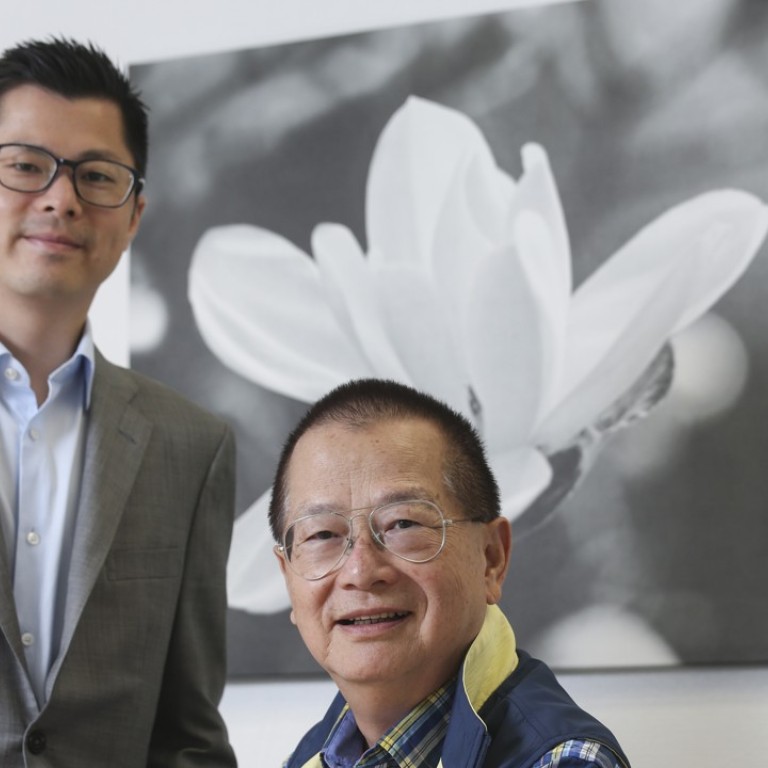

“Our strategy has not changed despite the fact there will be short term uncertainties,” said Thomas Yiu, senior advisor at Joint Treasure International, an advisory that helps manage overseas assets for several rich Hong Kong families.

Last week, Prime Minister Theresa May’s Conservative Party was returned to power with fewer than half of the seats in the legislature, resulting in a hung parliament. The Conservatives are attempting to form a majority government in coalition with other parties, however the result was seen as rebuke to May just as sensitive negotiations over Britain’s exit from the European Union are slated to get underway.

Yiu said his fund was looking beyond the recent newspaper headlines of uncertainties arising from Britain’s inconclusive election and terrorist attacks to focus instead on the appeal of London as a global hub.

The company is comprised of nine core investors, including Henry Cheng Kar-shun and family, the dominant shareholders of New Word Development. Among its recent acquisitions, the advisory bought 3 St James’s Square, one of the most prestigious office locations in central London, for £135 million in May.

Joint Treasure has built up an investment portfolio of UK properties worth more than £500 million.

“We only focus on Central London where it is more resilient should a dramatic change in investment environment take place,” he said.

Indicative of the resilience of London, Hong Kong institutional investors have poured in more than £2.4 billion into the city’s real estate in recent times, ignoring concerns over Brexit and domestic terrorism.

“When we invest in a city, we have to take into consideration how we will exit our investment. Will it get buyers’ interest even if the market economy is deteriorating?” he said.

For instance, Manchester provides an attractive yield of about 4.5 per cent to 5 per cent, but the market would definitely be less liquid than Central London in the event of a downturn.

With the British pound trading sharply down from its pre-EU referendum level last year, London properties are more affordable.

“London is an international hub attracting money from Russia, the Middle East, Europe and Asia. And its tax system is also in favour to foreign investors as there are no capital gains taxes on commercial property transactions,” he said.

But Canada, the US, and the Euro-zone impose a capital gain taxes of as much as 40 per cent, he said.

The company, originally known as Polylinks, was co-founded by Thomas’s father Daniel Yiu who left BNP Paribas after 20 years at the investment bank, to advise private and public companies on investing in overseas real estate. Beatrice Cheung was also a co-founder of the venture launched in 1992.

“At that time, only a few Hong Kong Chinese families engaged in overseas real estate acquisitions,” said Daniel Yiu.

The firm was involved in various notable transactions which include advising a consortium headed by the late Cheng Yu-tung and his son Henry Cheng and Vincent Lo Hong-sui of Shui On Group to purchase the 76-acre Riverside South luxury residential development project in Manhattan, New York in 1994.

Daniel Yiu set his eye on Japan in the early 2000s.

As more investors expressed an interested in joining the fund, he set up a new company, with an investment focus in London in 2008.

The firm also advised Chow Tai Fook Enterprises, which controls New World Development, to buy the site and business of Japanese department store Sogo Department Store in Causeway Bay for HK$3.53 billion in 2001 under a joint venture with Joseph Lau of Chinese Estates Holdings.