Will Hong Kong home prices fall 30pc in next 12 months?

The property market could reach a turning point in the third-quarter as transaction volumes start to ease this month, say analysts

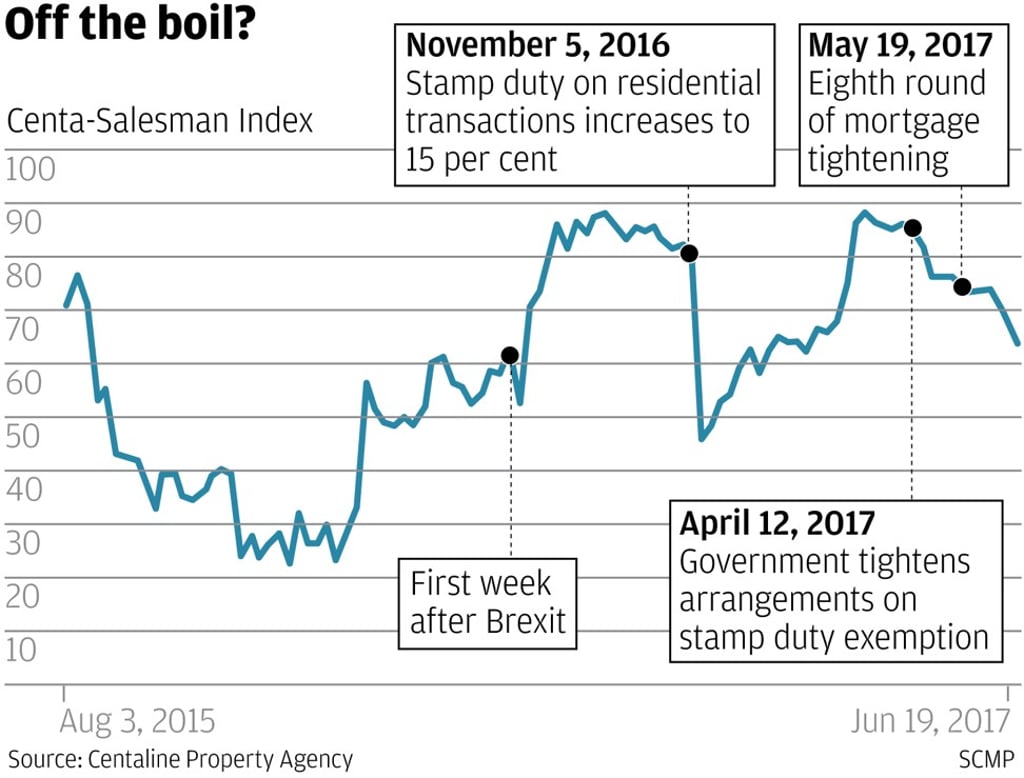

Hong Kong home prices, already the world’s highest, have shown signs of easing with more experts predicting that the market could reach a turning point in the third quarter of the year.

Industry watchers expect home prices to fall as much as 30 per cent in the next 12 months.

“We have seen rising default cases in the past couple of weeks as a result of credit tightening by banks,” said Alfred Lau, a property analyst at Bocom International.

The correction would deepen should Hong Kong raise rates further in the wake of potential hikes by the US Federal Reserve as outlined in its plans to shrink the size of its balance sheet, said Lau who is predicting the 30-per cent decline.

Lau’s projection is more drastic than Deutsche Bank’s forecast of 50-per cent drop over the next 10 years as a rapidly ageing population and increased supply of new flats will dent demand.