Hong Kong’s stamp duty is beating the wrong heads and does nothing to lower property prices

Investments at home and from abroad for residential properties in Hong Kong showed no sign of slowing as the government’s revenue from extra stamp duty aimed to cool the market rose to a seven-month high of HK$3 billion last month ...

SCMP Business, July 12

Let’s get rid of one misperception right away – this business of “and from abroad”, which has so many people believing that it is foreign speculators who are driving prices up.

In a letter to the editor barely two months ago, the Principle Assistant Secretary for Transport & Housing, Joyce Kok, in a vain boast of victory over speculators, made it plain that she cannot blame foreigners.

She admitted that purchases by non-local entities accounted for only 1.5 per cent of total transactions in the first quarter, down from 4.5 per cent in late 2012, before the introduction of a rank piece of xenophobia, the buyers stamp duty, which slapped a 15 per cent stamp duty on foreign buyers.

To me, even 4.5 per cent was very low for all the hoopla about foreigners (read mainland Chinese) wrecking the market for local buyers. But 1.5 per cent is virtually nothing. Let’s have no more of this “from abroad” talk.

Am I really to believe that it’s foreign speculators who are pushing up the market in shoebox estate flats? This is rather a phenomenon of local home buyers.

In her letter, Ms Kok also made it plain that even local speculators are not to blame for the continued rise of property prices.

She pointed out that only 0.7 per cent of total property transactions in the first quarter involved confirmor transactions, or resale within 24 months, as opposed to 20 per cent before introduction of the special stamp duty in 2010 on rapid resale.

I shall believe it. These are hard figures and they say that local speculative activity (we have already established that it’s really only local) has become insignificant since 2010.

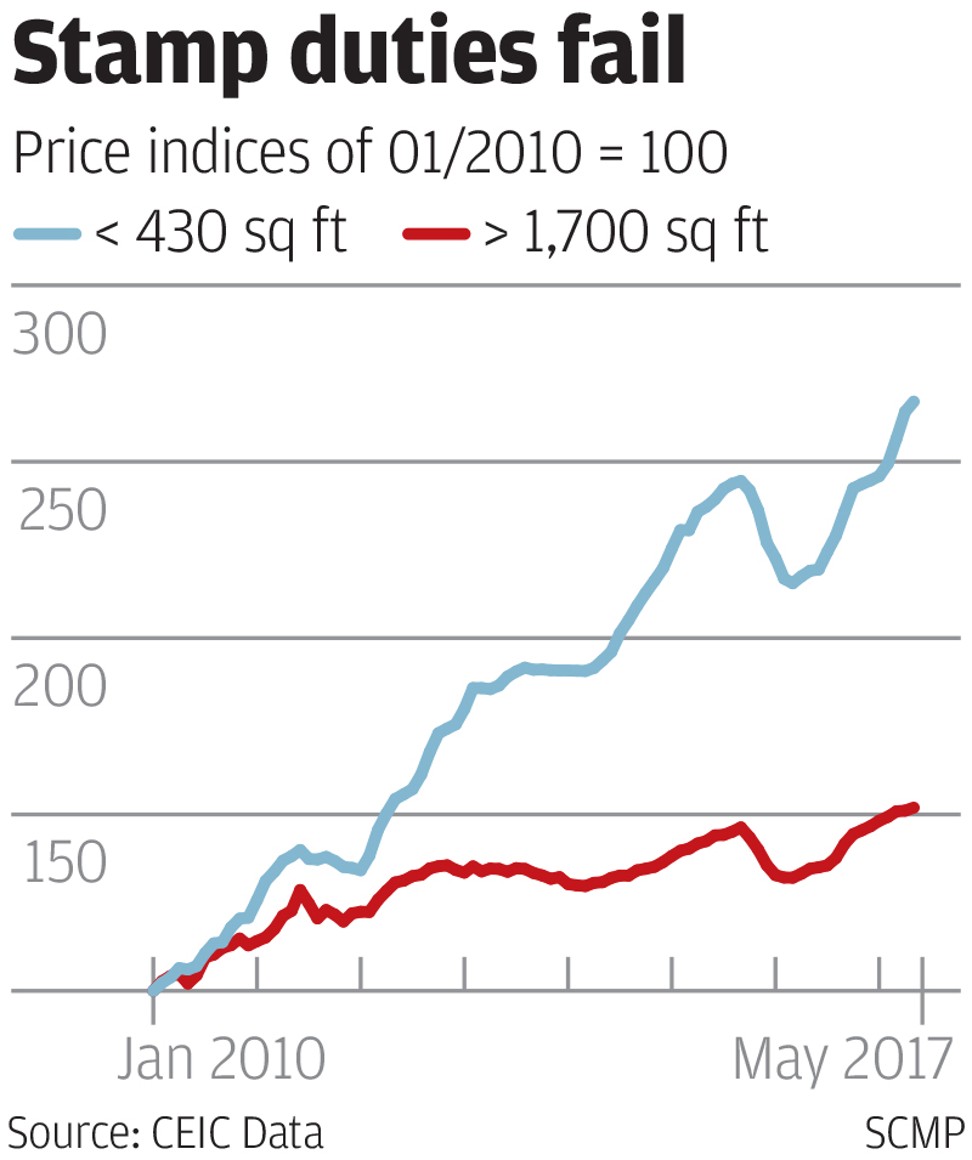

Instead, overall residential prices have risen 140 per cent since the beginning of 2010 with prices in the shoebox sector up 167 per cent.

Take note that these price increases have been particularly pronounced over the last year although we now have three different stamp duties to hit people who have the temerity to buy their own homes.

Will someone also please tell me why these punitive measures, which add considerably to the burdens of ordinary local homebuyers, are maintained for even a day longer, when there is nothing for which these homebuyers need to be punished, and when these measures do not hold down prices?

Will some please clarify for me how our government can in all justice now keep the HK$2.96 billion (US$379 million) that it extracted in these stamp duties in June alone, rather than return that money forthwith, with full apologies for ever having taken it in the first place?

It’s ordinary blameless Hong Kong people that we bash on the head with this club, and for no good reason. Why?