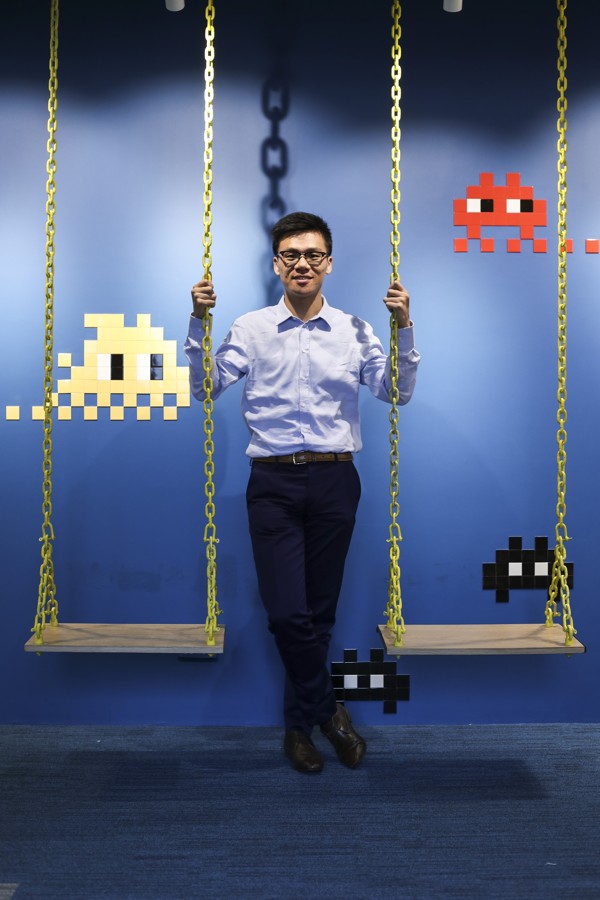

Stan Tang, son of Hong Kong’s retail ‘king’, splashing out on hotels, flats and more shops

HK$10b has been spent so far on 14 hotels and two new residential blocks by Tang’s Living Group, which hopes to have 4,000 rooms operational by mid-2019

Tang Shing-bor, considered Hong Kong’s retail shops ‘king’, who has built up a HK$10 billion investment portfolio this year alone, is now aiming to become one of the city’s top five hoteliers, at a time when his likely competitors are opting to convert their properties into office space amid declining tourist arrivals from the mainland.

Adding 14 hotels and two new residential developments to his property empire – which now comprises 4,000 hotel rooms and serviced apartments – Tang plans to eventually float his son Stan Tang’s, Tang’s Living Group, which manages the family-owned hospitality assets.

“We hope to satisfy local hotel demand after top hotels in Causeway Bay will be pulled down to make way for offices,” said Stan Tang, who is the youngest son and chief executive of many of his family’s businesses among Tang Snr’s heirs.

Tang Jnr is chief executive of 11 separate companies, including Tang’s Living Group

Possible redevelopment plans for five-star hotels such as Crowne Plaza and Excelsior Hotel in Hong Kong’s major tourist belt have been revealed in recent months.

“Our projects are not in central business districts,” he added, referring to his six hotels in Tin Shui Wai, Ting Kau, Kwai Chung and Kwun Tong, that are set to open their doors to paying guests within the next few months.

He said the hotels will target local clientele and those from the mainland and Southeast Asia, adding Hong Kong guests want quality hospitality, citing the shift in activities now being enjoyed by guests from only shopping to wanting more of a family experience.

“Traditional serviced apartments serve the richer middle-class. But because of our locations in residential areas, we will have more facilities to cater to local demand,” he added.

“We hope to serve younger buyers too and raise the living quality of local residents. The rental income generated from the serviced apartments will be reinvested in the hotel business.”

The purchase of the 356-unit TPlus residential development in Tuen Mun for HK$1.2 billion is a good example, he said.

Tang said the project, which comprises Hong Kong’s tiniest flat at just 128 square feet, will be for leasing, offering plenty of shared facilities for youngsters and senior citizens alike, due to their small sizes.

The family business has also acquired another residential project, Patina in Kowloon City, for HK$1.3 billion which will be leased as serviced apartments.

Commercial properties such as retail shops, industrial buildings and shopping malls, Tang said, currently enjoy strong capital gains with an internal rate of return of 30 per cent, excluding leverage.

“The return of the commercial properties transactions to our family business is better than selling flats,” he said. “But profits from hospitality-related businesses are not realised yet.”

Separately, the Tangs have also established a couple of funds targeting retail shops and shopping malls in residential areas – worth HK$3 billion- and HK$2 billion-worth, respectively – from local institutional investors, that he said “may have other sources of capital behind them”.

“That project is about to be completed. We have approached the investors and started the necessary legal processes. We have bought most of assets we will need already,” he said.

“We are like asset managers, trying to create good returns to investors, by buying and selling using investors’ funds.”

He said investing in residential areas can bring stable returns, but these funds offer higher returns than real estate investment trusts (REITs), that generally manage properties in residential areas.

“We target value-added investments such as retail shops. We aim to offer returns of between 5 and 15 per cent in regular interest payments, or one-off capital gains,” he said.

“But the funds are likely to offer institutional investors with higher flexibility, since our company is not listed.”

Meanwhile, he shrugged off worries that the mainland’s capital tightening measures would dampen Hong Kong’s property market.

“I’m optimistic about the property market here. Hong Kong is where East meets West. Capital inflows don’t just come from China. We will have enough capital to support the market despite a potential ease in investments. Don’t forget, interest rates still remain low,” he said.

He also praised his team for playing a key role in his success.

“They have helped set strategies and implement them well, so I can manage so many companies, at just 31 years old with a daughter and a pregnant wife to look after too,” he said.

He also thanked his experienced and well-connected father for teaching him the ropes.

“But I also hope to offer a fresh perspective to the group, with my own new ways of thinking.