Why Hong Kong residential property management fees are Asia’s highest

Hong Kong residential property prices are not only the world’s highest, but its property management fees also top the list in Asia. Here’s why

Sabrina Wong and her family moved into their perfect home this summer, an all new 1,200 square feet flat at the posh Pavilia Hill development nestled in the coveted Tin Hau area.

Designed by a global architect firm and renowned landscape and interior designers, Wong’s new flat in the development of five towers stand out among a cluster of old properties in the area.

The estate has a 19,700 sq ft club house with a reading room, an indoor pool and gym which residents have free admission and use of towels, as well as a 15,800 sq ft communal garden and play area.

For utmost privacy, each unit of the 358-unit development by New World Development and Hip Shing Hong, has its own private lift lobby. Each floor has only two units.

Wong had happily paid HK$36 million (US$4.6 million) for all of that, until the question on the price of maintenance surfaced.

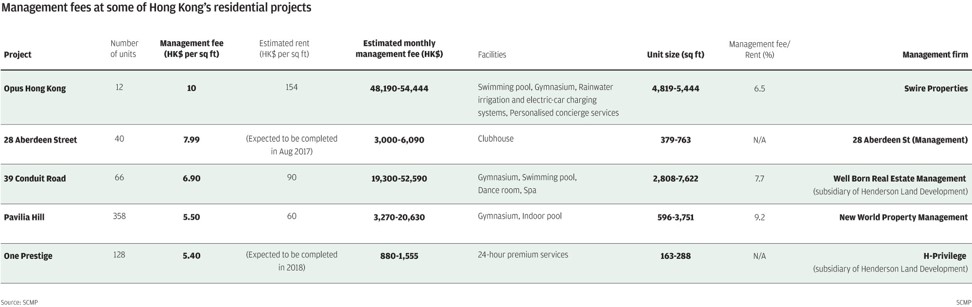

For every square foot of the flat that she owns, she has to pay HK$5.50, or a monthly management fee of HK$6,600 (US$843.50) to New World Property Management, a subsidiary of the developer that manages the estate.

Although the per square foot price of HK$30,000 that Wong had paid for the flat was not the highest in Hong Kong, Pavilia Hill’s management fee by square foot, is clearly one of highest in the city.

“It is a bit high,” conceded Wong, even though she can afford it.

The monthly fee is nearly double the HK$3,600 management fee she had paid for her previous similar sized flat and the use of a 35,000 sq ft club house at the 26-year-old 809-unit Pacific Palisades in North Point Hill, which is a stone’s throw away.

“We were told by the management firm that they needed to hire additional night shift security guards as more owners have started to move in. The fee will likely increase by a further 10 per cent next year,” Wong said.

The fee will likely increase by a further 10 per cent next year

Wong and her neighbours doubt if additional guards were even necessary as the residential towers have installed smart card access system and surveillance cameras.

The impending fee increase has also raised concern among the development’s newly formed owners’ corporation, which has the authority to remove the manager of the property, and decide where the money should be spent.

“[Property] management is a labour intensive industry. Staff cost accounts for 50 per cent of the fee,” said Gary Yeung Man-kai, general manager at Shui On Property Management, which manages as many as 30,000 units in Hong Kong.

“The fee also varies from the number of units in a development and the scale of the recreational club facilities.”

Developments with fewer units would bear higher fees, compared with larger developments. Residents of the 651-unit luxury development, Robinson Place, in Mid-Levels only pay HK$2.40 per sq ft, while those of the 40-unit 28 Aberdeen Street development, in Sai Yung Pun pay HK$7.99 per sq ft.

By industry practice, a property management firm will charge an estimated five to seven per cent on top of the estimated annual total expenditure for the estate as its income, or so-called manager emolument. The current rates represented a substantial reduction in the past five years from the previous 12 per cent due to increasing competition, industry experts said.

This means that in theory, the more money a housing estate spends on managing the premises, the more its property manager stands to earn.

Hong Kong developers’ penchant for opulently decorated lobbies with chandeliers and an array of hotel style services such staff in uniforms have therefore, come at a cost to the occupants and owners like Wong.

[Property] management is a labour intensive industry. Staff cost accounts for 50 per cent of the fee

As developers often make the first appointments of property managers for their developments, many said it provides the convenient loophole to overcharge Hong Kong owners who are already paying Asia’s highest property management fees.

But developers like Nan Fung disagree.

“The Hong Kong government encourages owners to form owners’ corporations to monitor the performance of property management companies,” argued Donald Choi Wun-hing, the managing director of Nan Fung Development. “No one else is better positioned than owners to supervise their performance.”

Choi said it was up to the owners’ corporation to negotiate with the property firm on the level of levy and the services required.

He said the sector was highly competitive, where owners would change management firms without batting an eyelid if they underperformed. A firm could hardly survive if it only increases its fees without raising its service standards, he added.

Services also covered the design and layout of common areas, shared facilities such as car park, lift lobbies and materials used for the fitting out of public areas, according to Swire Properties, whose Opus Hong Kong development charges HK$10 per sq ft in management fee.

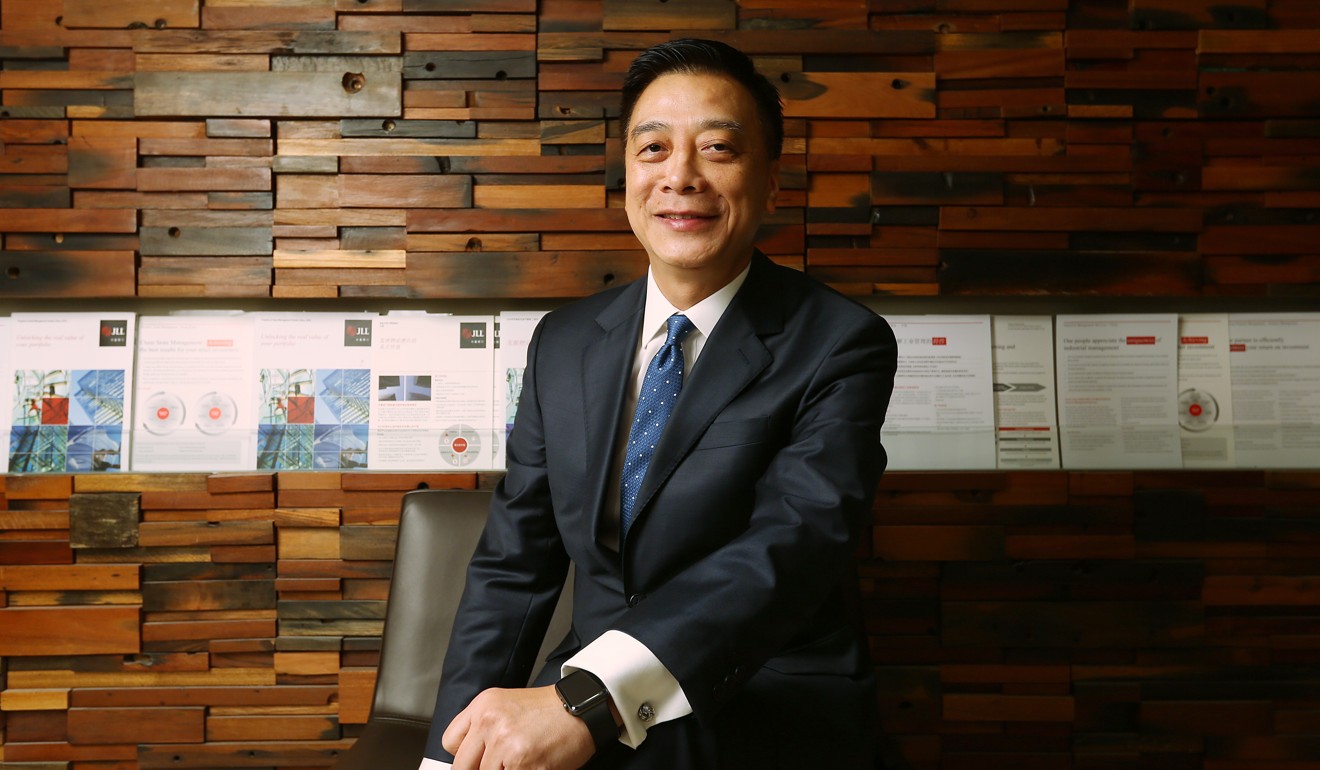

To save on future maintenance costs, JLL head of property management William Lai said a pre-management plan jointly designed by the management firm and developer before a project gets off the ground was necessary.

“The application and use of artificial intelligence will reduce the number of management staff. It could save about 20 per cent of the fee,” Lai said. JLL manages 400 residential, office and industrial projects in the city.

“It hasn’t widely been used in residential buildings. While it cannot replace experienced security guards, it can at least reduce some staff on the front desk,” he said.

For instance, the trend of an unstaffed lobby reception has taken off in Japan and the UK. Other means include setting up acommunity residentialapp for service requests – such as changing a light bulb in the common area – to be met efficiently.

While it cannot replace experienced security guards, it can at least reduce some staff on the front desk

“Developers are now [more] focused in installing AI inside the flats as that appeals to home buyers,” Lai said.

Hong Kong’s property management sector currently employs 200,000 people, and raising the standards was increasingly important to homeowners, said Tony Tse, chairman of the recently-formed Property Management Services Authority (PMSA)to regulate the industry.

“A licensing system will probably be introduced in 2019 to raise professional standards of property management companies,” he said. “Increased transparency is also needed.”

Complaints on property management services were nearly halved in the first seven months of this year to 22, compared with the year-earlier period, according to data from the Consumer Council.

Of the 22 complaints, six were on high management fees.

Wong said she did not necessarily need a staff or doorman in the lobby of her building.

“Sometimes, I get two people running up to open the main gate for me when I come back,” she said. “It’s fine if we have an unstaffed lobby.”