Why prices of Tsuen Wan’s one-bedroom flats have dived the most in 3 months

Buyers have snapped up close to 4,000 new flats in Tsuen Wan to date this year, allowing developers to pocket more than US$5.3 billion

Prices for one-bedroom new flats in Hong Kong’s Tsuen Wan district – which at one point shot up to a jaw-dropping HK$10 million (US$1.28 million) – have tumbled the most after ChinaChem Group adopted a reverse sales tactic of offloading its latest project at this year’s lowest prices for the area.

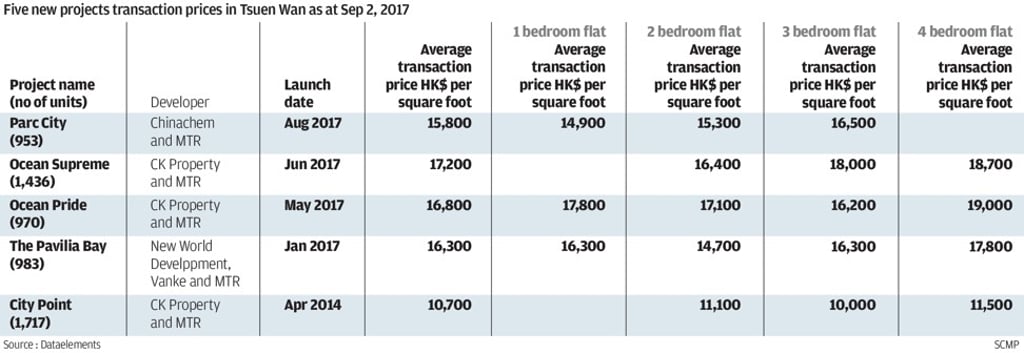

One-bedroom flats at Parc City, located next to the West Rail’s Tsuen Wan West station,were sold at an average transaction price of HK$14,900 per square foot, or 16 per cent lower than those at the adjacent development, Ocean Pride built by Cheung Kong Property (Holdings) in May, according to property data provider Dataelements, which tracked the sales in Hong Kong’s primary residential market.

Ocean Pride’s one bedroom flat had fetched an average of HK$17,800 per sq ft then, while similar unitsat New World Development’s joint venture project, Pavilia Bay, were sold at an average price of HK$16,300 per sq ft in January.

The survey also showed that average transaction price for the entire Parc City project was HK$15,800 per square foot, which was the lowest price for all new flats so far this year.

It is very obvious that ChinaChem is in a hurry to sell their new flats because they understand that there will be a huge new supply in the next three to four years

But Louis Chan, Asia-Pacific vice-chairman and managing director for residential sales at Centaline Property Agency pointed out that it was more a case of different developers adopting different strategies.