Hong Kong investors keen on overseas assets should now focus on extended-stay hotel market

As more investors become educated about the sector, this relatively new asset class is becoming more recognised for its high growth potential

Hong Kong investors’ recent buying spree of trophy overseas office buildings, such as the record £1.3 billion (US$1.7 billion) purchase in London of the popularly christened Walkie Talkie building, has been in the spotlight.

But it is not just commercial towers that Hong Kong investors have been enthusiastically buying abroad. Hotel and leisure sector assets have also been topping their shopping list and one area that is particularly causing excitement is the extended-stay market.

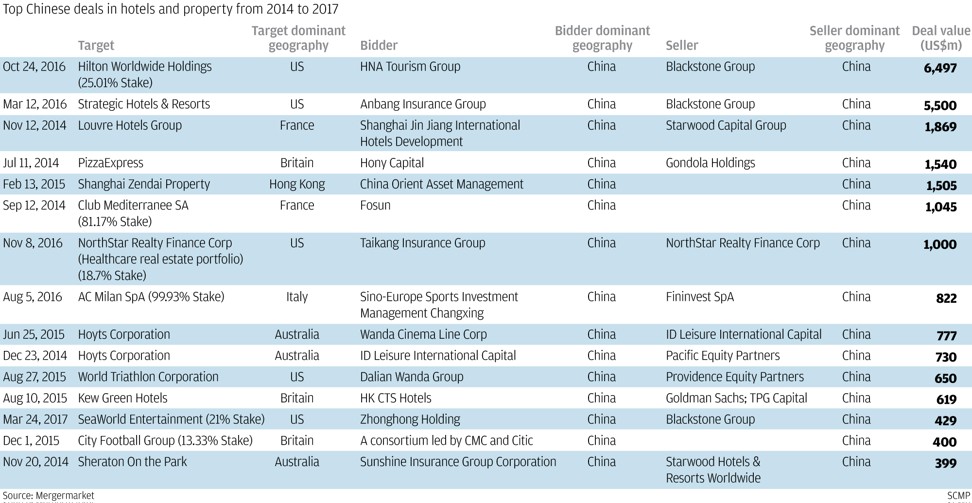

Hong Kong investors have been very active overseas in the traditional hotel market. In the UK alone, recent acquisitions include HK CTS Hotels buying Kew Green Hotels for £400 million and Hongkong and Shanghai Hotels buying a 50 per cent stake in the Peninsula London hotel development next to Hyde Park for £107.5 million. But, tipped as the future of the hotel industry with high growth prospects is the extended-stay accommodation market.

This market subsector comprises self-catering accommodation, such as serviced apartments and aparthotels, which is increasingly sought after by leisure and business travellers who value flexibility and independence.

The opportunity is particularly strong in Europe, where the market is very underdeveloped compared to the US. Even there though, extended-stay hotels account for less than 10 per cent of total room supply and have been the fastest growing segment of the US lodging industry for the last three decades.

In the UK alone, with pent-up demand for this type of accommodation, international real estate consultancy Savills forecasts an additional 2,600 units being delivered over 2017 – which equates to a 13.8 per cent increase on 2016 stock levels – and a further 16 per cent increase to about 23,000 units by 2020. Furthermore, during 2017 there will be growth of over 20 per cent in the regional markets, in particular Manchester and Edinburgh, which will expand by 73 per cent and 62 per cent respectively. Although these cities have started from a low base, such growth should not be ignored.

The popularity of the extended-stay sector is confirmed in a survey by STR, a data provider and analysis company, which in May 2017 for London extended-stay accommodation reported a year on year occupancy increase of 4.7 per cent to 78 per cent, while average daily rate increased by 10.9 per cent to US$235 and revenue per room rose by 16.1 per cent to US$188. Their analysis predicts that the UK’s 20,000 extended-stay units in 2017 will grow by 5 per cent to 2019, outpacing the traditional hotel market.

For investors, the advantages of extended-stay hotels over traditional hotels include considerably lower staffing costs

Initially, traditional investors had difficulty grasping the extended-stay concept. This is now changing as more investors become educated about the sector and this relatively new asset class is becoming more recognised.

Investment transaction volumes in the UK increased by 146 per cent from 2011 to 2016 with extended-stay now accounting for 6 per cent of total investment volumes, compared to just 2 per cent in 2011 – a tripling. However, this is still a drop in the ocean. In London, which is a relatively mature market by European standards, extended-stay hotels only have a market share of 2 per cent – a fifth of current US levels – leaving plenty of room for expansion.

Driving demand for extended-stay accommodation is a fundamental shift in business travel requirements and a generational change in leisure travel. As the world’s economies grow ever more interdependent, companies and people move around the globe more freely. As a result, there has been a significant increase in demand from people on temporary assignments and projects for extended-stay accommodation.

In the case of leisure, the growing cohort of millennial travellers prefer independent accommodation as it provides more of an opportunity to live like a local.

Initially, Airbnb was a source of worry for extended-stay providers. However, it has provided some advantages, alerting more mainstream travellers to the benefits of alternative forms of accommodation other than a traditional hotel room. But, compared to Airbnb, extended-stay hotels offer guests the benefit of professionally run accommodation with a more consistent product offering and a greater menu of hotel services, as well as tending to be more conveniently located in city centres.

For investors, the advantages of extended-stay hotels over traditional hotels include considerably lower staffing costs. For example, traditional hotels will have a restaurant, bar, conference room and other ancillary staff in addition to housekeeping staff. With extended-stay accommodation, staff requirements are limited and housekeeping is outsourced. These hotels are run as limited serviced hotels, but derive four-star hotel room revenue, which often results in gross operating profits above 50 per cent of revenue.

Extended-stay hotels in Europe boast attractive high profit margins and stable cash flows because of high revenues and low operational costs. This, combined with the sector being under developed in Europe – means the extended-stay accommodation sector presents a great opportunity for Hong Kong investors.

Eduard Elias is co-founder of Cycas Hospitality