Increase in Hong Kong mortgage rate will make renting cheaper in seven out of 10 housing estates

Jump to 3 per cent might also cool housing prices, according to research conducted exclusively for South China Morning Post

Seven out of 10 housing estates might find buyers discouraged as renting will become cheaper than mortgage payments when the mortgage rate increases to 3 per cent, which might also finally cool housing prices in the world’s least affordable urban centre to live in, according to research conducted exclusively for the South China Morning Post.

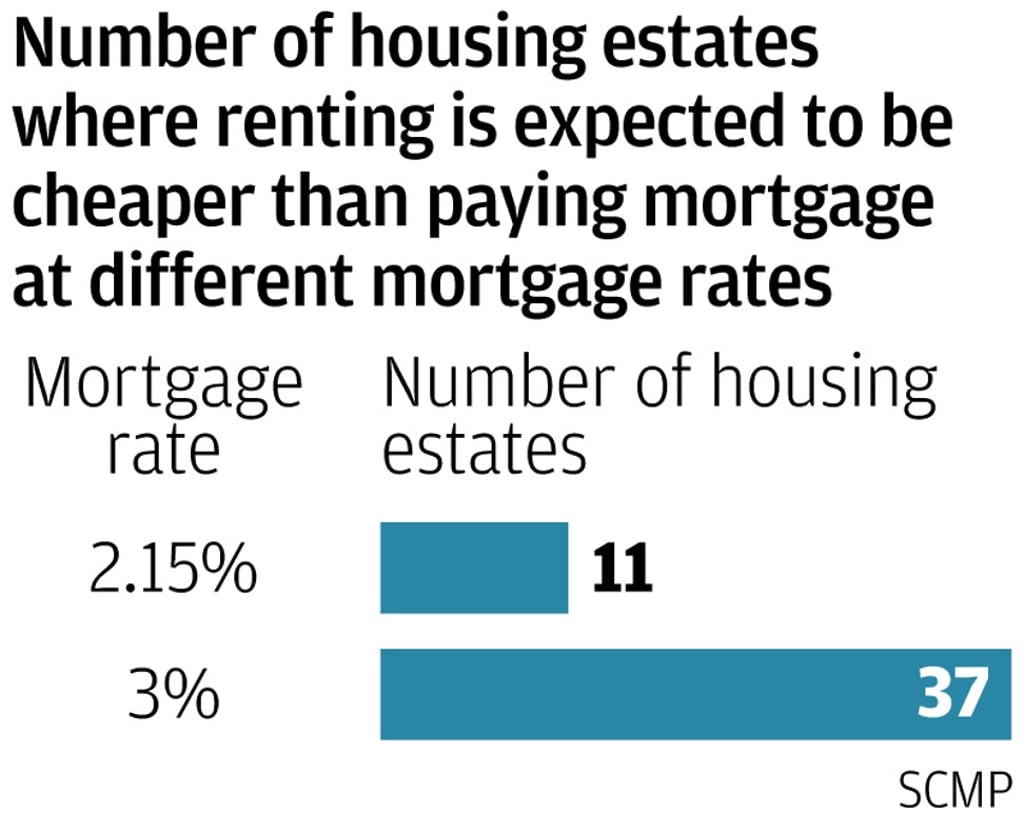

Monthly mortgage instalments will exceed rents in 70 per cent, or 37 out of 50 housing estates, if the mortgage rate increases from the current 2.15 per cent to 3 per cent, said Derek Chan, head of research at Ricacorp Properties.

“At present, this phenomenon only occurs in 11 housing estates. But if the mortgage rate tops 3 per cent, the current trend of buying flats may reverse. Potential buyers may choose to rent instead,” he said.

These 11 housing estates include Park Avenue in Tai Kok Tsui and Yoho Town in Yuen Long. When the mortgage rate tops 3 per cent, Taikoo Shing, Whampoa Garden and Tai Po Centre will be among the 37 housing estates where renting will be cheaper than paying towards a mortgage.

Yearly additional monthly mortgage payments among the 50 estates will range from HK$14,880 for Tin Shui Wai’s Kingswood Villas, to HK$34,776 for Sai Wan Ho’s Grand Promenade, once the rate increases.