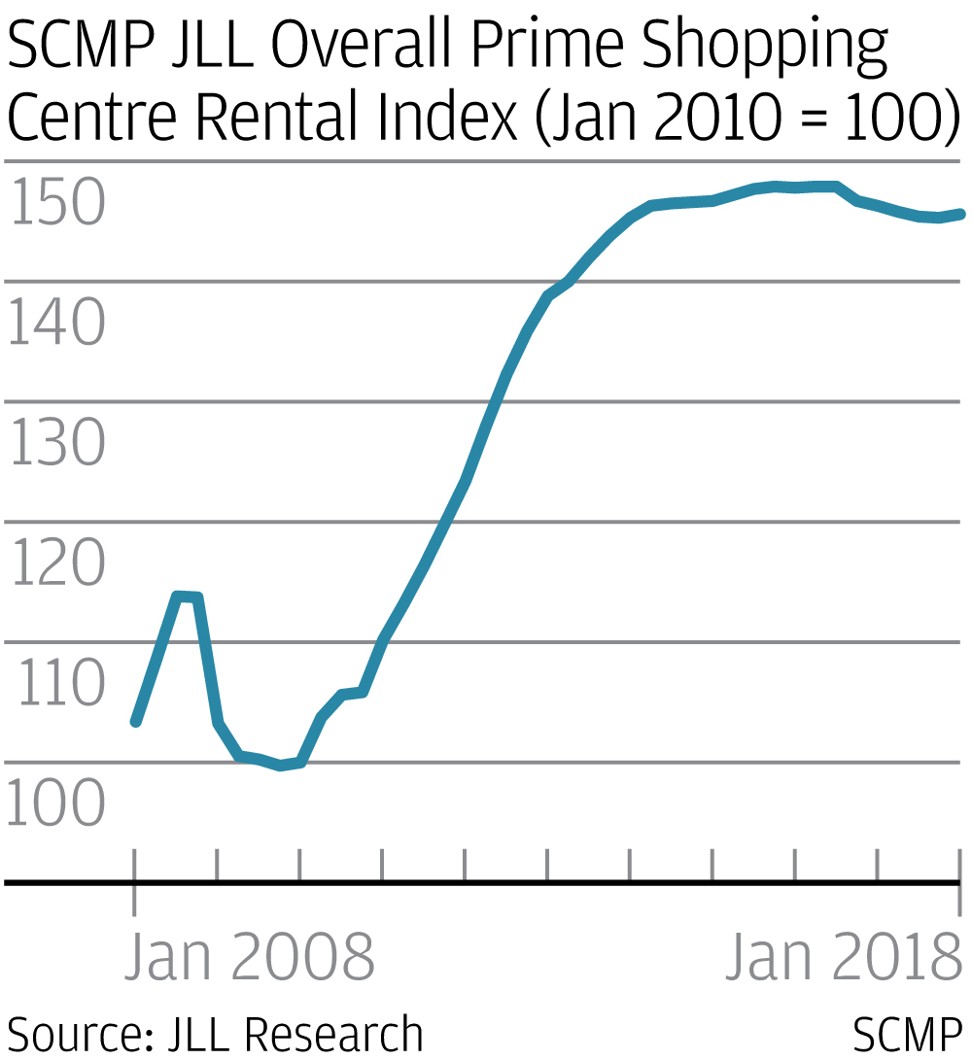

Hong Kong’s shopping mall rents rise for the first time in a year as foot traffic improves

The SCMP-JLL prime shopping centre rental index shows rents ticked up 0.2 per cent in the December-ended quarter, reflecting the first gain in a year

Hong Kong’s prime shopping centres recorded growth in rental rates for the first time in three quarters, lifted by improving retail sales as local consumers enjoyed the wealth effects brought by rising property and stock prices.

Rental rates rose 0.2 per cent to 145.6 in the December-ended quarter, reflecting the first increase since the fourth quarter of 2016, according to the SCMP-JLL Prime Shopping Centre Rental Index.

The index tracks leasing at 30 prime shopping centres including Harbour City in Tsim Sha Tsui, Times Square in Causeway Bay and IFC Mall in Central.

“It is the first quarterly improvement recorded since January, 2016,” said Terence Chan, head of retail at JLL, “The rebound is mainly driven by growth in retail sales and the rebound in tourist arrivals. The recent bull run in the stock market has reaped strong gains for local people, which has helped to drive consumption.”

Kevin Lam, executive director and head of business space, retail and office services at Cushman & Wakefield, said cosmetics and sportswear retailers recorded improved sales during the Christmas and New Year holiday period compared when compared with 2016.

“Cosmetics tenants have registered double-digit growth in sales. In general, sales of affordable luxury goods have had an overall improvement,” he said.

Hong Kong’s retail sales jumped 7.5 per cent to HK$38.7 billion (US$4.95 billion) in November, the biggest year-on-year increase in almost three years, backing predictions that the industry is on track for a full recovery.

Meanwhile, wealth effects from soaring home and stock prices also encourage more spending, said Lam.

Hong Kong’s Hang Seng Index was up 36 per cent in 2017, while prices for pre-owned homes advanced 14 per cent last year to a record high.

Among new trends, landlords of shopping centres are more willing lease space to entertainment tenants as a way to diversify their retail mix. As a general rule, tenants geared towards entertainment can only afford a tenth of the rents charged to luxury jewellery and watch retailers during the height of the retail boom in 2013.

“Hong Kong has a lack of entertainment. Landlords are betting on the trade to offer hands-on, unique experience that will draw shoppers and increase dwell time in their shopping centres,” said Chan of JLL.

He added that the lower rents extended to entertainment operators was designed to tap shifting preferences among shoppers.

“Technology is getting advanced. The operators can introduce and update the new games easily into the market,” he said. “We believe virtual reality is another entertainment industry that will expand in Hong Kong, particularly in core shopping districts.”

Recent examples include a 13,000 square foot go-kart track with cafe at Kcp, Kowloon City, a 9,000 sq ft restaurant with a mini-golf course at Fashion Walk in Causeway Bay, a 6,000 sq ft indoor park at PopCorn Two, Tseung Kwan O, a 7,000 sq ft climbing wall and a 1,800 sq ft indoor playground at Paradise Mall at Heng Fa Chuen, Chai Wan.

Helen Mak, senior director and head of retail services at Knight Frank said landlords have raised the non-retail tenant mix to as much as 30 per cent, from 20 per cent previously, to lure shopping footfall.

“Entertainment and dining out cannot be replaced by the internet. We have seen more cinemas and specially design restaurants that aim to retain shoppers inside the mall,” she said.