Hong Kong’s February lived-in home prices rise at the fastest pace in 10 months

The prices of lived-in homes in Hong Kong soared last month at their fastest pace in 10 months, as buyers rushed to get ahead of an expected increase in mortgage rates, while a shortage of available properties forced buyers to raise their bids in the world’s most expensive real estate market.

An index of secondary market home prices rose 5.8 points, or by 1.6 per cent, to 364.1 in February, according to data released by the Rating and Valuation Department, faster than the 1.53 per cent gain in January. The rental index rebounded by 0.1 per cent to 187.5, illustrating an increase in leasing costs, the data showed.

“Property owners aren’t selling until they get a higher offer, as they know there are limited choices available in the secondary market,” said Derek Chan, head of research at Ricacorp Properties in Hong Kong. “It will push up the growth in prices.”

Hong Kong homes shrink as prices soar, and affordability goes out the window

Hong Kong’s home prices have been surging for 23 consecutive months, the longest stretch for a property bull market in a quarter century, making the city the world’s costliest urban centre to live and work in.

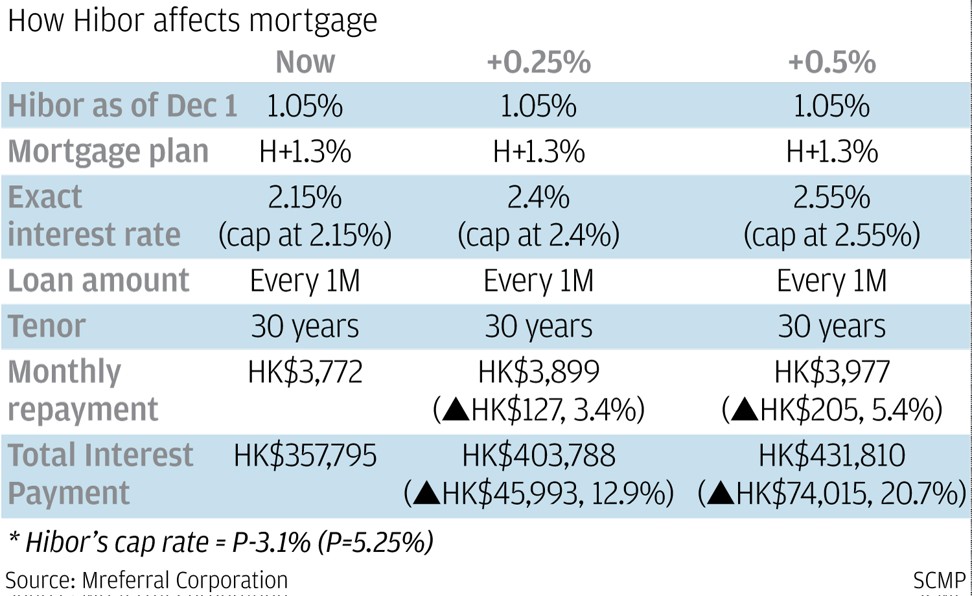

This stretch of gains could falter in the second half of 2018, as the city’s commercial banks are poised to raise their mortgage rates, following six increases in interest rates since December 2015.

Hong Kong’s one-month interbank offered rate, or Hibor, upon which most of the city’s new mortgages are based, rose to 1.03 per cent on Thursday, up from 0.81 per cent a week earlier.

“It will affect buying sentiment,” said Chan.

Midland Realty said home prices have risen by 5.01 per cent in the first quarter, based on its own data.

“It is the largest price growth in the past six quarters,” said Buggle Lau kai-fai, chief analyst at Midland Realty.

The average price for flats smaller than 430 sq ft in Kowloon advanced most, by 4.6 per cent, last month from January, at an average price of HK$13,684 per square foot, while those in New Territories shed 0.13 per cent to HK$12,238 per square foot, according to government data.

“The growth pace is faster than we expected,” said Thomas Lam, a senior director at Knight Frank in Hong Kong. “We saw a mini boom after Lunar New Year celebrations,” he said.

Lunar New Year, which started on February 16, is a traditional peak season for the property market.

In February, Hong Kong’s overall average home prices stood at HK$12,644 per square foot, according to Midland Realty, up 16 per cent from a year ago.

Developers have accelerated the marketing of tiny flats in an attempt to cater to younger homebuyers with limited budgets.

Astro Far East Estate released the price list for its residential project, The Astro, comprised of tiny flats starting from 173 sq ft in Cheung Sha Wan, at a discounted price of HK$3.98 million, or HK$22,479 per square foot.

Meanwhile, a 7,984 sq ft home at No. 17, Mount Nicholson, on The Peak, has sold for HK$780 million, or HK$97,695 per square foot, the sales agent, Wheelock Properties, said on Thursday.