Developers’ hoard of empty flats aggravates Hong Kong’s housing crisis. Will a tax fix it?

Hong Kong builders stockpile thousands of flats as they look for higher prices

Close to 300 flats lie disturbingly vacant in a completed new residential development in Ho Man Tin, even as the Hong Kong government struggles to resolve the perennial short supply of housing in the world’s most expensive property market.

The 1,429-unit Mantin Heights project in Ho Man Tin was completed last year, but the developer, Kerry Properties, still hangs on to a fifth or about 300 completed flats, offering them in small numbers either through private tender or public sales.

About 1,130 units had been sold as of April 7, according to figures available from the Sales of First-hand Residential Properties Authority website, which regulates the sales of new flats.

Kerry Properties has released some 96 sales at Mantin Heights, with just one unit offered for tender on several occasions since it went on sale in 2016.

“It is the largest number of sales arrangement in a project I have ever seen,” said Sammy Po Siu-ming, the chief executive of Midland Realty’s residential department. “By releasing a small number of units each time, it has been effective in generating strong sales response which has allowed it to raise prices and maximise profit.”

Po noted that prices at Mantin Heights had increased by some 20 per cent.

About 15 minutes’ drive from Mantin Heights stands another development, located at 279 Prince Edward Road West and completed in 2015 by Yuexie Property. The Hong Kong-listed company sold the 14-storey vacant building comprising 18 units to Grand Ming Group Holdings, also listed in Hong Kong, last August for HK$820 million (US$104.4 million), a stock exchange filing showed.

So far, Grand Ming has sold just one flat in the development – a 1,304 square feet three-bedroom unit through tender for HK$48.08 million on April 8. The project has been renamed Cristallo.

Plans for the remaining 17 flats were not clear.

“Such practice is no different from hoarding flats,” said Lee Wing-tat, chairman of policy think tank Land Watch. “It is not right for developers [to be] holding completed flats when there is a housing shortage in the city.”

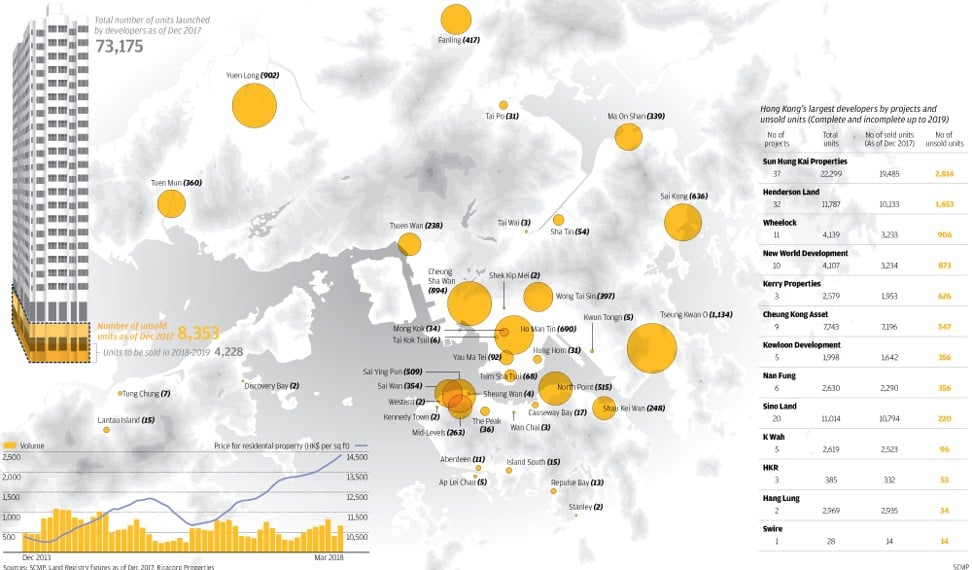

There were 9,000 unsold flats in private completed developments as of December, of which 5,000 were completed in 2017, up from 1,000 in 2016, according to data from the Rating and Valuation Department.

Details on their owners and locations were not available.

Call for action on Hong Kong property developers’ opaque sales and stockpiling tactics

Hoarding or keeping a portion of the flats in a completed residential development is not strictly illegal under Hong Kong laws as there are no rules and regulations that explicitly forbid this.

But the rapid increase in the number of empty units has finally forced the government to take action.

Last month, Financial Secretary Paul Chan Mo-po said that the government was studying the possibility of imposing a vacancy tax on developers after noting a “significant increase in the number of empty flats” in 2017.

Land Watch’s Lee said developers’ move to keep empty flats will further fuel price increases.

Hong Kong’s home prices have surged for 23 consecutive months, the longest stretch for a property bull market in a quarter of a century, making the city the world’s costliest urban centre to live and work.

Apart from Henderson Land Development, other major developers approached by South China Morning Post declined to disclose the number of completed unsold flats in their portfolio.

Henderson Land said they had 177 completed unsold flats, while Kerry Properties and Sun Hung Kai Properties (SHKP) said no data was available. New World Development did not reply before the publishing deadline.

But data obtained by the Post showed more than 40 per cent of the 9,000 unsold flats were held by developers.

As of December 2017, SHKP had the largest inventory of empty unsold flats, numbering about 1,000.

About 114 units in phase one of SHKP’s Ultima development in Ho Man Tin, completed in 2015, remain unsold, while 549 units in phase two of Grand Yoho in Yuen Long were vacant.

New World Development holds more than 500 completed unsold flats, largely at Mount Pavilia in Sai Kung, which was ready in 2016.

The lack of clear-cut guidelines that specify the period when developers should offer for sale all flats in a residential project is a loophole that certain developers were exploiting, said Lee.

“The government should close the loophole by imposing a rule requiring developers to release all units in a development on the market in six months after receiving pre-sale consent,” said Lee, adding that it is the most effective way to stop hoarding of flats.

Lee supported the vacancy tax but said it could take one to two years to seek approval from Legislative Council before the law can be enacted.

Lawrence Poon Wing-cheung, senior lecturer at City University of Hong Kong’s department of building science and technology, said the meaning of “vacancy” is hard to define, particularly in the secondary market.

“Will you consider taxing a flat in the secondary market being used as storage?” he asked.

Poon suggested that the government should simply tax the developers for holding on to new empty flats.

Besides the issue of empty flats, there were concerns about developers opting to sell new flats by private tender, which could inflate prices and put buyers at a disadvantage.

“The lack of transparency enables developers to create an impression that units have been sold for record breaking prices one after another,” said Lee.

Previously, developers just offered penthouses or special units for tender, but it was now being widely used for entire developments.

For instance, SHKP is offering its Victoria Harbour project in North Point only by tender.

So far only 12 of the 355 units at the nearly completed project have been sold since it was released last December.

Flats sold through tender also benefit developers. For instance, a 1,585 sq ft flat on 11th floor at Victoria Harbour sold in January for HK$102.84 million, or HK$64,887 per sq ft, setting a record in the Eastern District.

All flats at Mount Nicholson on The Peak developed by Wheelock and Co and Nan Fung Development were sold by tender, with one flat fetching HK$132,060 per sq ft, making it the most expensive apartment in Asia.

In a written reply to South China Morning Post, Kerry Properties said: “It has been scheduling sales of properties in pace with market demand and project completions.”

“The company will continue to plan and fine-tune its sales activities in accordance with market demand and response,” the statement added.

SHKP said that some of its large-scale projects were released in batches based on market conditions and that flat sales by tender was not uncommon for niche residential properties in Hong Kong such as Victoria Harbour. “Given the rarity and unique qualities of the sea view facing units of three to four bedrooms are being sold by tendering, while for the studio to two-bedroom units, price lists will be provided in the next stage of our sales,” SHKP said.

Cindy Kwan Kit-ying, director at Citic Pacific Property Agents, a wholly owned subsidiary of Citic, said Hong Kong’s vacancy rate was still low at 3.5 per cent.

“Vacancy tax will not have a severe impact on developers,” she said.