Tsing Yi’s HK$3.2 million estate flat sets record as Hong Kong’s housing market fever persists

With median price of homes rising for 26 straight months, buyers - especially first-time owners fresh in the workforce - are increasingly looking at lived-in and subsidised property for options

Hong Kong’s first-time homebuyers, priced out of prime locations in the world’s priciest residential market, are casting their eyes to the city’s public housing estates in blue-collar neighbourhoods, driving up the prices of subsidised homes which were previously reserved for low-income households.

A 30-year-old studio unit measuring 150 square feet (14 square metres) at the Cheung On Estate in Tsing Yi in the New Territories has been advertised for HK$3.2 million (US$408,000), or a record HK$21,333 per sq ft, making it the most expensive apartment converted from subsidised housing.

Hong Kong’s taxpayers provide housing subsidies for residents who earn less than HK$11,540 a month, or have less than HK$249,000 in assets. Public housing can be sold on the open market after owners pay a premium based on market prices, which could be up to 60 per cent of value.

With the median price of homes rising for 26 consecutive months - sales agents see 2018 prices increasing by 15 per cent - property buyers, especially first-time owners fresh in the workforce, are increasingly looking at lived-in and subsidised property for options.

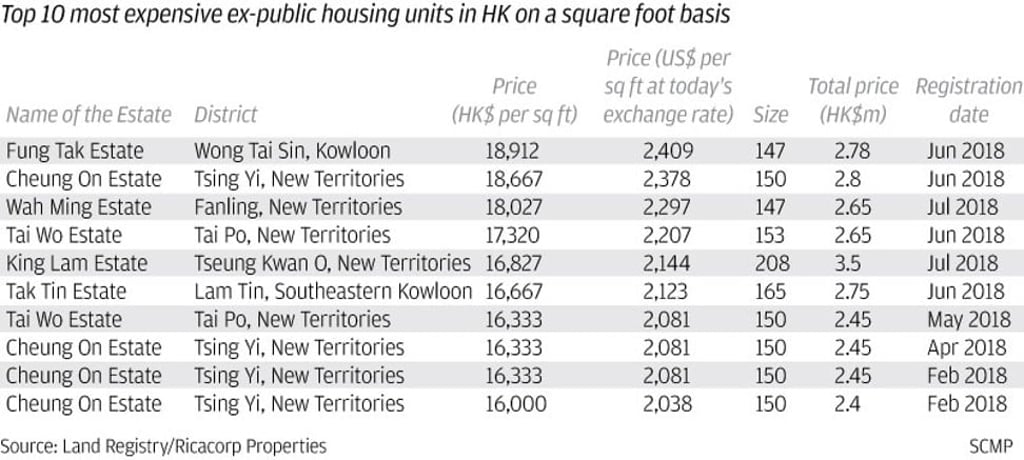

The current record holder for the most expensive ex-public housing unit on the open market was reported in June. A 147 sq ft unit in the 27-year-old Fung Tak Estate in Kowloon’s Wong Tai Sin, known as “a community of grass roots,” was sold for HK$2.78 million, according to Ricacorp Properties’ data.