Hong Kong home buying demand dampened by borrowing costs, trade war

Hong Kong’s housing sentiment has cooled amid rising pessimism about the outlook for the world’s least affordable housing market.

Hit by rising borrowing costs for the first time in 12 years and the fallout of the worsening US-China trade war, housing demand has declined, housing statistics show.

Developers have been offering lower prices and adding sweeteners to entice buyers, as more investment banks joined the chorus suggesting home prices could plunge by up to 15 per cent in the next 12 months.

“Investors are generally more sensitive than individual buyers and are cashing in,” said Lai Wing-to, a veteran investor who owns about HK$15 billion (US$1.92 billion) of property assets.

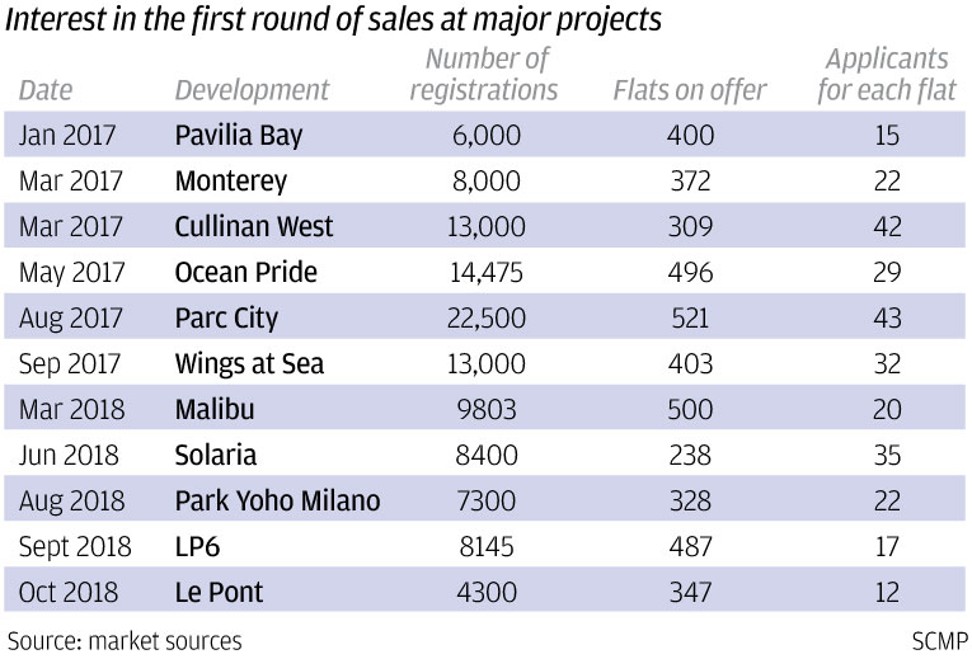

Among the indicators, the number of registrations for prospective buyers in the first round sale of major new projects dropped significantly after peaking in August 2017.

“The number of registrations [for new projects] somehow reflects market sentiment,” said Ken Chan, sales director at Ricacorp Properties.

Parc City, built by Chinachem Group, close to MTR’s Tsuen Wan West station, was brought to market at what appears to have been the height of the current property cycle. The project, launched in August last year, attracted 22,500 registrants for 521 flats in the first round, or about 43 potential buyers for each unit.

Investors accounted for about 30 per cent of registrants at Parc City, according to Midland Realty.

“The market sentiment [in the last 12 months] was better than present,” Chan said.

Parc City’s release date coincided with the strongest market sentiment in five years, according to Chan.

The release also surpassed previous records set by two projects built by Sun Hung Kai Properties, including Cullinan West atop Nam Cheong Station and Villa Esplanada in Tsing Yi, launched in March 2017 and June 1997 respectively.

The anticipation of further interest rate rises appears to be a factor weighing on the market, following the move last week by 11 local banks to tighten mortgage lending rates by 12.5 basis points.

One case in point was the Le Pont development in Tuen Mun. The project developer, Vanke Property, (Hong Kong) registered about 4,300 potential buyers for the first batch of 347 flats, meaning only 12 home seekers were competing per unit.

Vanke had offered a preferential mortgage scheme with Bank of China (Hong Kong) and priced the flats at less than those at a neighbouring 30-year-old bloc being sold in the secondary market.

Units in Parc City were starting from HK$9,878 per square foot, versus the nearby Leung King Estate, where prices range from HK$12,000 to HK$14,000 per sq ft.

Chan said buyers were becoming skittish because of concerns over the rising financial burden that accompanies higher monthly mortgage payments.

For example, the 12.5 basis points increase would boost mortgage repayments for a 30-year loan of HK$4 million by HK$3,100 a year, according to mReferral Mortgage Brokerage Services.

“The market is no longer bullish home prices will trend upwards any more,” said Lee Shu-kam, associate head of economics and finance at Hong Kong Shue Yan University.

Lee said market sentiment has cooled drastically since Parc City’s sale last year. He added that those not in immediate need of housing would likely postpone their buying decisions until the direction of the market became more clear.