First commercial plot on Kai Tak runway fails to take off as Hong Kong rejects all nine bids for site

- Plot can be developed into a hotel and an office complex totalling a gross floor area of 612,256 sq ft, according to Midland Surveyors

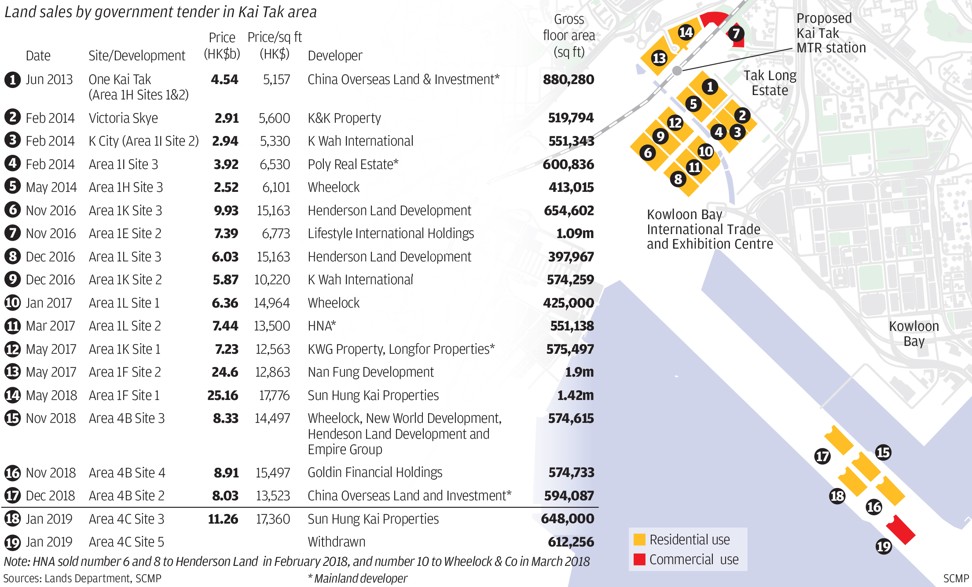

The first commercial plot to be tendered on the runway of Hong Kong’s old airport at Kai Tak was withdrawn from sale on Wednesday, after the Lands Department announced it had rejected all nine tenders received for the land.

That all tenders failed to meet the government’s requirements suggests developers were still cautious about the Hong Kong commercial market, despite comments by analysts that home prices in the city could rise this year.

Sun Hung Kai pays US$1.43 billion for Kai Tak residential plot in subdued tender that underscores downbeat market

“The tendered premiums did not meet the government’s reserve price for the site,” the Lands Department said.

“Developers are very cautious amid a gloomy economic outlook. The trade war is still the biggest concern and has kept them from bidding aggressively,” said Derek Chan, head of research at Hong Kong-based real estate brokerage Ricacorp Properties. “The failed bid … will sour the market sentiment further.”

“This will set a new benchmark,” said Vincent Cheung, a veteran surveyor. “If the government uses Sun Hung Kai’s winning price as reference, and if it does not lower the expected price, the tender will fail once more. Under current circumstances, it may take a very long time for a hotel in Kai Tak to be profitable.”

Others too said an “overly high” valuation by the government amid the current market correction was to blame. “The government thought the price per square foot could be good given its location,” said Charles Chan, managing director of Savills Valuation and Professional Services. “But the market considered the problems in the property sector – so [developers] will be more cautious.”

Chan added: “The market is significantly worse. Home prices have dropped, and commercial property may also go the same way.”

Chan said the Lands Department must amend its valuation to fully reflect the current market situation or more failed tenders could follow.

The plot is valued at between HK$7.96 billion and HK$9.49 billion, or between HK$13,000 and HK$15,500 per square foot, according to global real estate consultants Knight Frank and Colliers International.

Nine bids were received for the tender, which closed on Friday last week, including those from Sun Hung Kai Properties (SHKP), CK Asset Holdings, Great Eagle Holdings, Astute Max, K&K Property, Sino Land, K Wah International, Wharf Real Estate Investment Company and the Far East Consortium.

The Kai Tak plot, measuring 102,043 sq ft, can be developed into a hotel and an office complex totalling a gross floor area of 612,256 sq ft, according to Midland Surveyors, the Hong Kong-based surveying unit of agency Midland Realty.

According to Colliers, the developer is likely to allocate a relatively small portion of the gross floor area, about 184,000 sq ft, to a four to five star hotel with about 180-230 rooms. The hotel is expected to have an average daily room rate of HK$2,500 and a consistent occupancy rate of 85 per cent, which translates to about HK$20,000 per square foot in completion value.

“With consideration to recent headwinds that the tourism market in Hong Kong has faced, we are of the opinion the developer may have softened confidence in the hospitality investment market,” said Hannah Jeong, head of valuations and advisory at Colliers.

Fewer developers submit bids for Kai Tak runway plot even as valuation is slashed to January 2017 levels

As far as retail and office development are concerned, Colliers said it expected gross development value of about HK$20,000 to HK$35,000 per square foot, and noted that the retail portion on the ground floor will be more valuable.

This is the fifth time the government has rejected bids, most recently withdrawing a tender for a luxury residential site on The Peak from sale in October 2018.

The tender withdrawal comes after CLSA, Citibank and JPMorgan recently said Hong Kong home prices will rise by up to 15 per cent from April to December. These financial institutions correctly forecast the current 15 per cent correction in the market.

Sigh of relief as second plot on Hong Kong’s Kai Tak runway fetches more than first

The correction began in August 2018 after a 28-month rally. Hong Kong, meanwhile, remains the least affordable city in the world to own an apartment in.

Analysts said they see a continuation of weak conditions. Office rents in core districts, in particular, will drop by as much as 5 per cent this year, while those in non-core districts will grow by up to 5 per cent as a decentralisation trend continues, said Alan Lok, executive director of advisory and transaction services of office at global consultant CBRE.

Rents in core high street areas and shopping malls will remain flat this year amid declines in consumer spending and economic uncertainty, according to CBRE.

First land plot for sale on the former runway at Kai Tak receives ‘lacklustre’ response from developers

Last week, SHKP agreed to pay HK$11.26 billion, or HK$17,360 per square foot, for a piece of harbourfront residential land on the runway, on which it plans to build luxury apartments with a view of the Victoria Harbour.

Elsewhere, Hong Kong International Construction Investment Management Group, a locally listed arm of debt-laden mainland China developer HNA Group, said it was in discussions with a potential buyer for its last residential plot of land in Kai Tak.