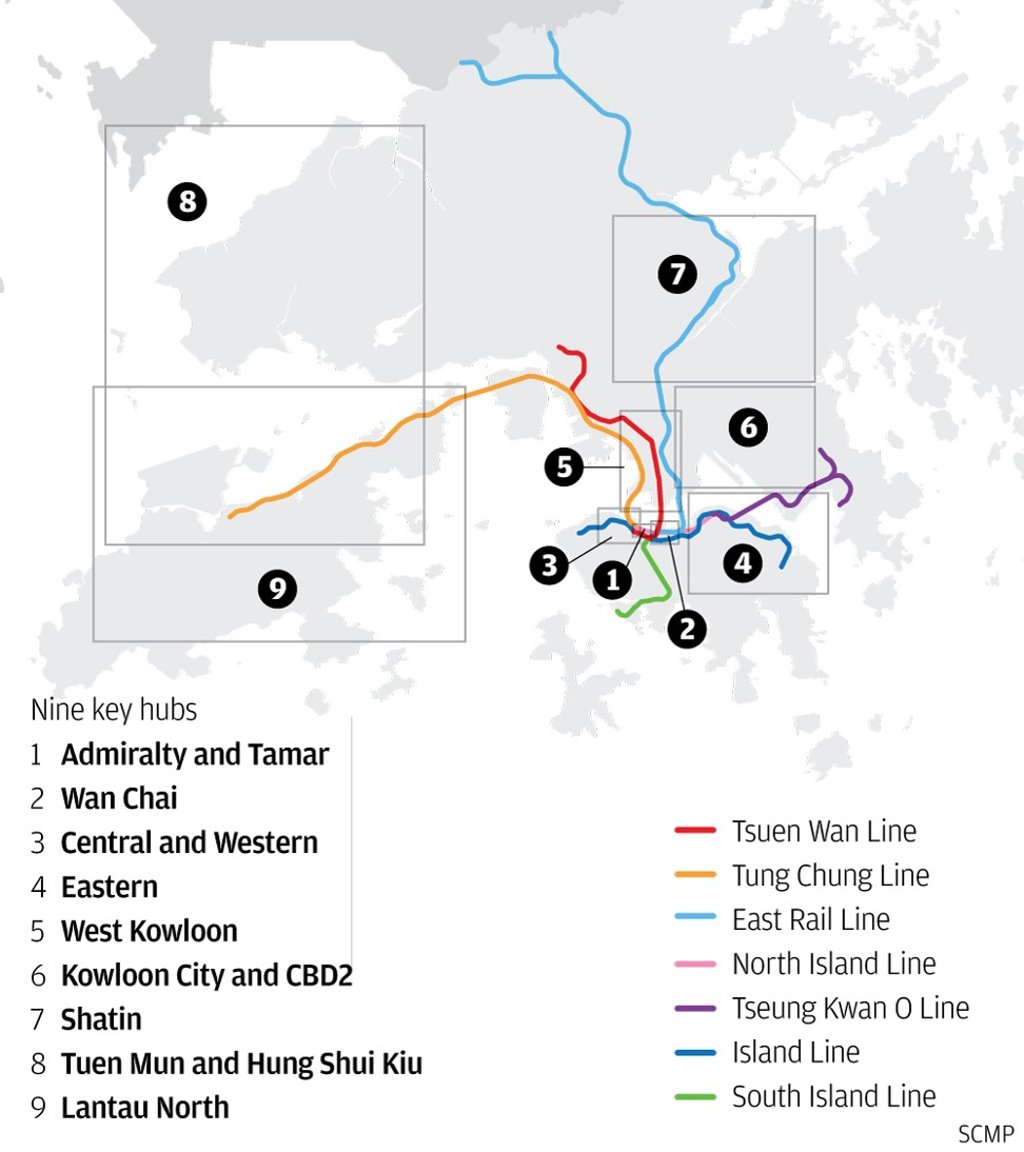

New transport projects will create nine hubs in Hong Kong, boost property, says Colliers International

- Office rents are expected to narrow between Central and nearby business districts

- Property prices will be boosted in Admiralty and Tamar, Wan Chai, Central and Western districts, Eastern district, West Kowloon, Kowloon City, Sha Tin, Tuen Mun and Hung Shui Kiu and Lantau North

New railway lines and road networks will lead to the emergence of nine office, retail, business and cultural hubs in Hong Kong over the next five to seven years, according to a new study by property consultancy Colliers International Hong Kong.

Property in the districts of Admiralty and Tamar, Wan Chai, Central and Western districts, Eastern districts, West Kowloon, Kowloon City, Sha Tin, Tuen Mun and Hung Shui Kiu and Lantau North will report a boost in prices amid improved potential, the study, released last week, said.

Office rents are expected to narrow between Central and nearby business districts, in particular. Nigel Smith, managing director at Colliers International Hong Kong, said office rents in Central were currently about 50 per cent higher than in these districts. He, however, did not say by how much would office rents here catch up with those in Central, the world’s most expensive.

Office rents in Hong Kong have averaged US$193.67 per square foot over the past 10 years, according to Knight Frank.

Greater connectivity within the city will allow Hong Kong to capitalise on the role it will play in the development of the “Greater Bay Area”, the initiative by Beijing linking the special administrative regions of Hong Kong and Macau with nine neighbouring cities in the southern Guangdong province into an economic powerhouse.

The 11 economies cover a total area of more than 56,500 square kilometres and were worth US$1.58 trillion in 2017.