Wheelock sets sales record for a single day’s turnover in Hong Kong’s biggest weekend launch in six years as buyers snap up flats

- Buyers snapped up 1,001 flats, or 87 per cent of 1,148 flats offered at Lohas Park, Tai Po and Ho Man Tin, as of 11pm

- Wheelock Properties sold all 500 flats at the Montara project for more than HK$4 billion in total, setting a record for a single day’s turnover

Hong Kong’s biggest weekend home sale in six years almost sold out, as a double-digit surge in April property transactions gave buyers the confidence that the city’s real estate bull market is here to stay.

A total of 1,148 new flats were offered across the city at Lohas Park, Tai Po and Ho Man Tin. Buyers packed salesrooms to snap up 1,001 new flats, or about 87 per cent of the total, as of 11pm, agents said.

“The market sentiment is good,” said Wheelock Properties’ Managing Director Ricky Wong Kwong-yiu. “Buyers want good investment vehicles. Residential property is a good store of value and there is good potential for appreciation in value.”

April’s home sales rose 52.8 per cent in the city to HK$70.1 billion (US$8.9 billion) from March, as property buyers piled back into the market, convinced that a five-month price correction that ended in December was a fleeting blip of the past. A three-month rally since the start of 2019 persuaded them to return to the market in droves.

Moody’s Investors Service last week revised its 2019 forecast of Hong Kong’s home prices to an increase of between 8 per cent and 10 per cent, compared with last November’s prediction when Moody’s expected home prices to drop by 15 per cent over the subsequent 12 to 18 months.

“Sales of new flats will be hot this month,” said Sammy Po, residential chief executive at Midland Realty, one of the city’s biggest agents, predicting that home prices may rise by more than 3 per cent in May, and return to 2018’s peak. “More than 3,000 new flats could be sold this month, much higher than last month.”

Wheelock Properties received a record 18,000 registrations for its 500 flats at the Montara project in Lohas Park, or an average of 36 bids for every unit available. The flats were offered at an average price of HK$14,704 per square foot after discounts, 3.9 per cent cheaper than the HK$15,304 per sq ft price set last September at LP6 in Lohas Park.

The project sold out for a total haul of more than HK$4 billion, setting a record for a single day’s turnover, Wheelock said.

Developers rush to bid for Kai Tak’s latest residential land plot as bull market returns to Hong Kong’s real estate

“About 100 flats were snapped up by about 40 buyers within the first two hours,” said Wheelock’s managing director Wong. “Three buyers bought four flats each. Three [other] buyers bought three flats each. The biggest customer splurged HK$38.2 million after discounts.”

A family, revealing only their surname Lee, bought four flats on the same floor at Montara for HK$40 million, for their own use, adding that the project was “well worth the price”.

The Suen family bought a three-bedroom unit and a two-bedroom flat for a combined HK$19 million, adding that the first flat is for their own use, while the second will be for rent, for between HK$15,000 and HK$16,000 a month. They expect home prices to rise by another 15 to 20 per cent by the time they are able to move into their new abode in October 2021.

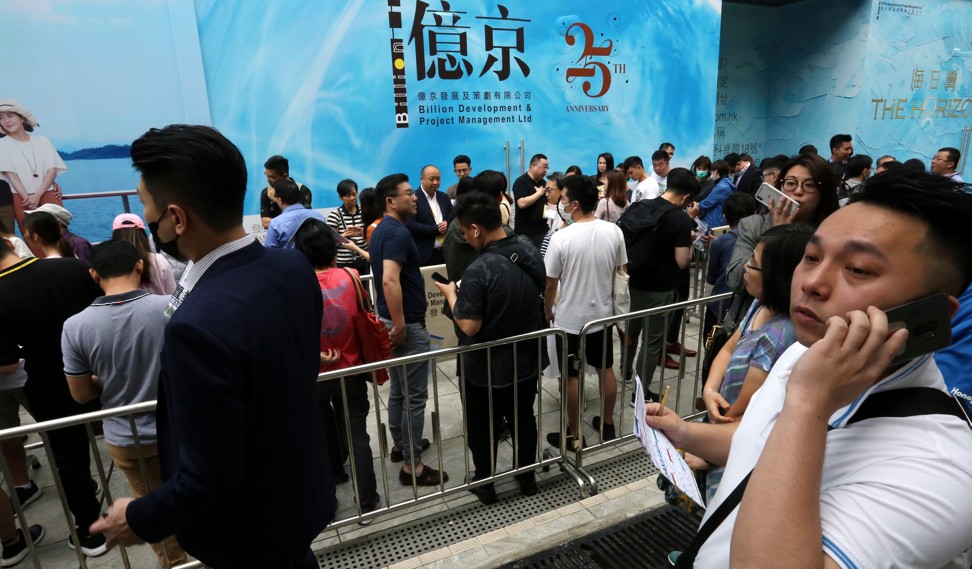

The optimism was shared elsewhere in the city. At the Centra Horizon complex by Billion Development & Project Management in Tai Po’s Pak Shek Kok, 263 units of the 366 flats on offer, or 72 per cent, were sold at an average price of HK$16,163 per sq ft after discounts.

More Hong Kong buyers are out of pocket as opaque practice of sale by tender becomes popular in residential real estate

In Ho Man Tin, New World Development put up 240 units of its Timber House project for sale at HK$24,857 per sq ft, reporting 233 units sold. In To Ka Wan, the developer of City Hub sold all five apartments on offer.

The weekend sale was the biggest since April 2013. It also broke the record set in mid-September 2016, when One Kai Tak by China Overseas Land and Investment, The Papillons by Chinachem Group and Grand Yoho by Sun Hung Kai Properties launched 1,063 flats on the same day.