First-quarter foreign funds in Guangzhou, Shenzhen real estate top 2018 total as global investors find allure in Greater Bay Area

- Foreign interest in commercial property in two cities expected to continue after overseas investors pour US$1.09 billion in first quarter

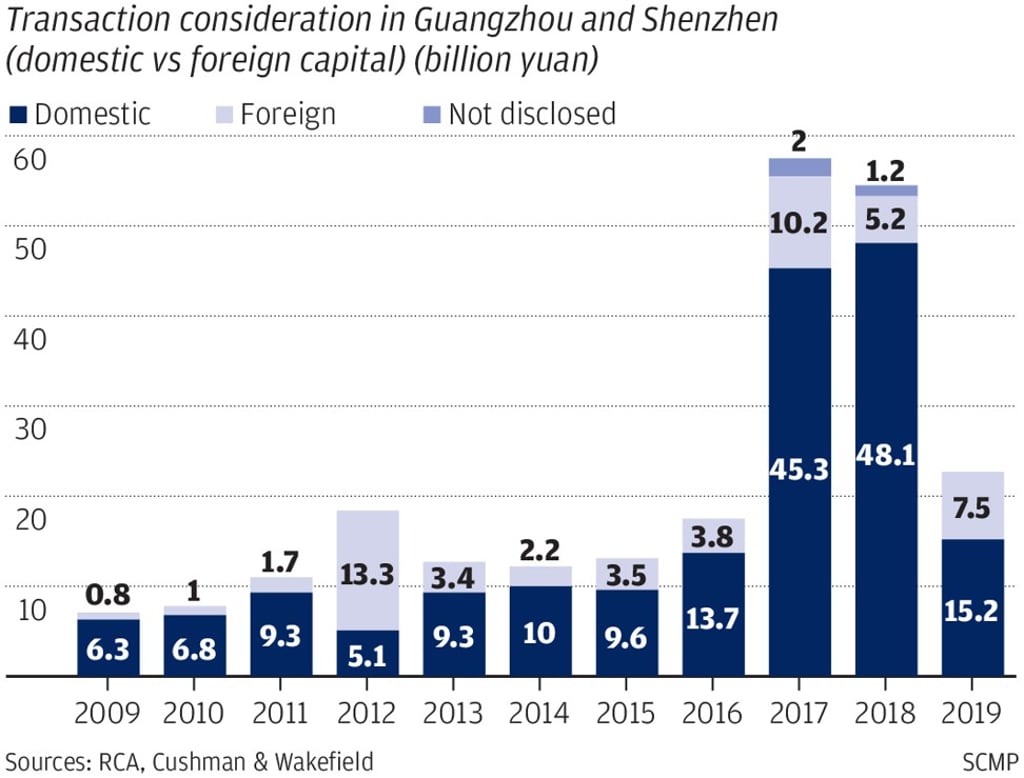

Foreign investment in real estate in Guangzhou and Shenzhen, two core cities in Beijing’s Greater Bay Area scheme, hit 7.5 billion yuan (US$1.09 billion) in the first quarter of the year, up by nearly half from the 5.2 billion yuan seen in all of 2018.

According to the latest report from property consultancy Cushman & Wakefield, foreign investment in the two cities accounted for 33 per cent of the 22.7 billion yuan invested in the two cities in the first quarter.

“The [bay area] initiative has really shone the spotlight on Shenzhen and Guangzhou in terms of the growth prospects there, attracting more foreign investors,” said Reed Hatcher, director and head of research in Hong Kong at Cushman & Wakefield. “What we’ve seen in the first quarter is really the continuation of a trend we’ve seen in the past couple of years as foreign investors have become more active in the two cities. We expect this interest will continue over the course of this year.”

Even with the worsening US-China trade war, and the uncertainty over the Chinese economy, Hatcher said he believed that commercial real estate – sought after by foreign investors – in the two cities would remain resilient.

“Of course, that depends to some degree on how long the trade tensions go on. But even as trade tensions heated up late last year, we didn’t see any discernible drop in investment in commercial property in the two cities,” he said.