Corridors of power: ‘Belt and Road Initiative’ will bolster trade while strengthening Beijing’s economic and political influence

China’s Poly Group and GCL Group take advantage of investment void left in Ethiopia by retreating Russian and Malaysian companies to help African country’s first liquefied natural gas export project

Last November, 60 lorries containing Chinese-made goods completed a landmark, 3,100km journey from Kashgar in China’s Xinjiang province to Pakistan’s port city of Gwadar on the southwestern coast of Balochistan. The merchandise was transported from there by sea to various destinations in Africa.

In Ethiopia, China’s Poly Group and GCL Grouptook advantage of an investment void left by retreating Russian and Malaysian companies to help the African country in its first liquefied natural gas export project that involves major infrastructure programmes in Djibouti in the horn of Africa.

Both projects show the grand scale and vast reach of Beijing’s trade and economic strategy, “Belt and Road Initiative”, that will see more than 1.5 trillion yuan (HK$1.72 trillion) ploughed into an infrastructure investment network stretching more than 10,000km in 60 countries and affecting the lives of 4.4 billion people in Asia, Europe, the Middle East and Africa.

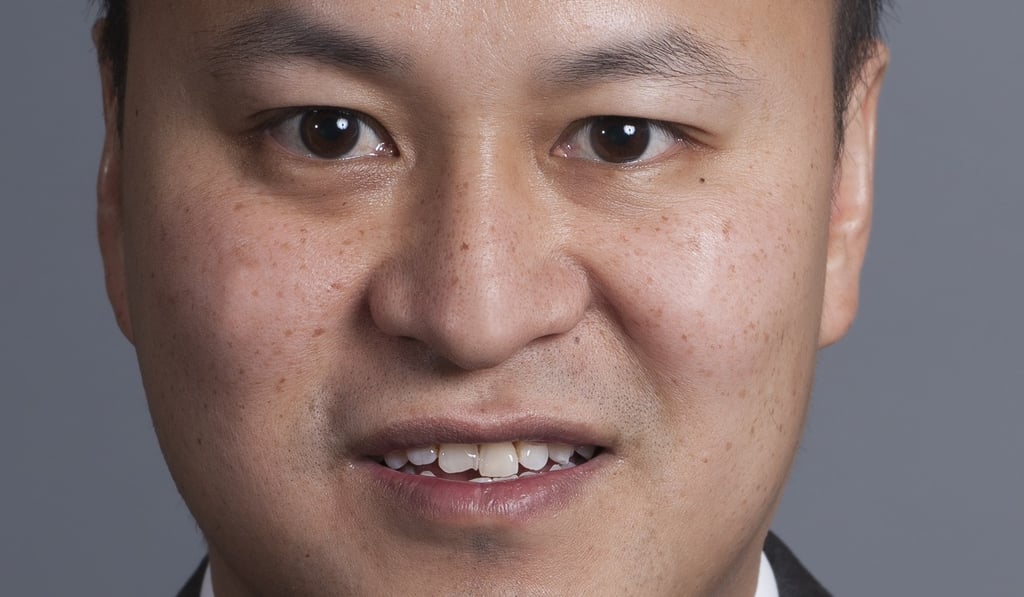

“It’s about Chinese and foreign partnerships in the ‘Belt and Road Intiative’,” says Lau, whose firm is involved in the Pakistan and Ethiopia-Djibouti projects. “This is one of the key things to stress. It’s a joint initiative led by China, working with local parties to make it happen.

“Other parties that are interested can join in – it attracts international co-operation. A lot of these projects will be supported by Chinese money, and also non-Chinese money.”

Barton Yu, chairman and president of POLY-GCL, said at the launch: “This is an important energy project for POLY-GCL Petroleum Group in our endeavour to co-operate with the governments of Djibouti and Ethiopia. It will enhance the well-being of the Djiboutian and Ethiopian peoples, while creating a positive impact on China’s energy security.”

The belt and road objective is to bolster trade while strengthening Beijing’s economic and political influence in the countries and territories that embrace the concept.

A lot of these projects will be supported by Chinese money, and also non-Chinese money

Gwadar port is part of the China-Pakistan Corridor offering a short cut to the Middle East, and eliminating the need to go through the Strait of Malacca off Malaysia’s west coast. There will be an investment of more than US$45 billion on energy, information and communication technology (ICT) transport and involves Bangladesh, Bhutan, the Maldives, India, Nepal, Pakistan and Sri Lanka.

There are six economic corridors on the belt and road land routes. Others are:

New Eurasian Land Bridge (Jiangsu province to Rotterdam, the Netherlands): This will connect China and Europe using almost 11,000km of roads and rail networks highlighted by a train line from Lianyungang to Kazakhstan via Xinjiang. Countries involved are Albania, Bosnia, Bulgaria, Croatia, the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Macedonia, Poland, Romania, Serbia, the Netherlands and Germany.

China-Mongolia-Russia Corridor (Beijing, Tianjin, Hebei, Dalian to Russia): China has signed US$25 billion worth of contracts for high-speed rail, energy, infrastructure and aerospace with Belarus, Russia and Kazakhstan as they look to make use of existing rail lines and build a northern route that connects to western Europe. Moldova is also part of the plan.

China-Central Asia-West Asia Corridor: Oil and natural gas will play a key role on a route that will involve key Middle Eastern and central Asian countries. A Chinese group acquired a 64.5 per cent stake in the Kumport container terminal in Turkey in September 2015.

China-Indochina Peninsula Corridor (Pearl River Delta Circle of Guangzhou, Hong Kong and Shenzhen to Southeast Asia): This route aims to challengeJapan and South Korea’s influence in markets they dominate and includes the Gemas-Johor Bahru rail route.

Bangladesh-China-India-Myanmar Corridor: Key components of this corridor that connects China with South Asia involve investment in telecoms, steel, solar energy and film.

The 21st Century Maritime Silk Road (MSR) is a sister, sea-going route to the overland “belt” that allows for trade, cultural exchanges and investment via connected bodies of ocean.

While China is trying to limit the use of the Malacca Strait, the key route between Malaysia and Indonesia has a role to play, whileeastern Malaysia will fall under it with nearly US$2 billion of Chinese investment in the port of Kuantan.

China is also tapping up Myanmar and will build a deep-sea port and industrial park in Kyaukphyu.

The US$1.4 billion Colombo Port City venture in Sri Lanka is part of the MSR reach into south Asian countries such as the Maldives and Pakistan.

India was open to becoming part of the belt and road landscape when previous prime minister Manmohan Singh was in charge, but interest has waned since Narendra Modi came to power.

In any case, one of the main aims of the MSR is to gain quick access to Africa and Europe. Senegal, Tanzania, Gabon, Mozambique and Ghana are among the other African countries to have come aboard.

China is also eyeing an expansion of the Suez Canal with Egypt joining the MSR set-up. Chinese investments will help to upgrade the Port Said facility and improve the canal’s capacity.

The port of Piraeus in Greece is part of MSR’s gateway to Europe with Chinese company Cosco buying a majority share in a HK$3.23 billion deal.