Behind the great firewall, China’s internet is thriving – even in rural areas

Even with more than 772 million internet users, China’s internet penetration of 55.8 per cent among the lowest in G20 countries – but that could be about to change as rural China becomes the next battleground for the online revolution

When farmer Hu Guizhi got her first smartphone last year, she mastered a new skill that would end up saving lots of trips to town: online payments.

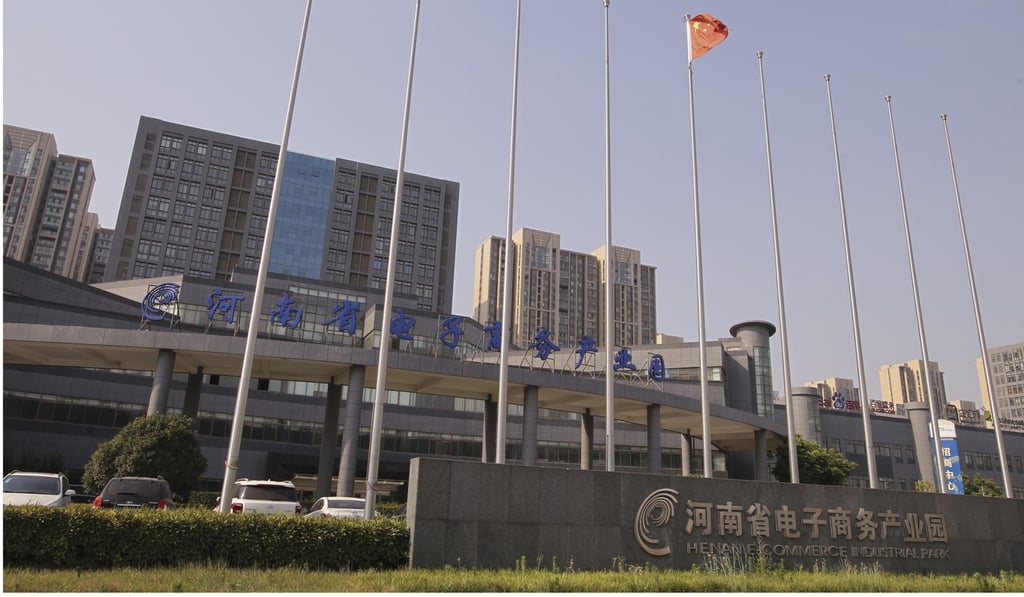

“Now I send red packets, shop online, top up my phone, and pay utility bills with just a touch. It couldn’t be more convenient,” said the 55-year-old whose farm is in a small county about 400 kilometres from Zhengzhou city, location of the world’s largest iPhone factory.

For many rural dwellers like Hu, smartphone-enabled payments have gone beyond novelty, to become ubiquitous methods of paying for goods and services in supermarkets, restaurants, clinics and even street vendors.

Hu is one of the 7.93 million people from rural China, a number bigger than the entire population of Hong Kong, who joined the country’s newest group of internet users last year.