Tencent steps up move into hyper-casual games with some Voodoo in its business

- French developer Voodoo has launched more than 100 hyper-casual games since 2013 and counts more than 300 million monthly active users

- Its mostly free, simple-to-play mobile games are made cheaply and quickly, relying on advertising for revenue and appealing to the broadest category of players

The stakes are high for Tencent because of the increased interest in video games worldwide amid stay-at-home measures to help contain the spread of Covid-19.

Tencent has been ramping up efforts to develop a large war chest of valuable entertainment content, especially for mobile games in China – the world’s largest smartphone and video games market.

“We look forward to developing new products together for the Asian market, and publishing games created by the many talented game studios in the region,” Voodoo chief executive Alexandre Yazdi wrote on Twitter in response to a TechCrunch report on Monday about Tencent’s investment.

Shenzhen-based Tencent did not immediately reply to an emailed request for comment. Its Voodoo investment, according to various reports, valued the French company at about US$1.4 billion.

Tencent posts 37 per cent quarterly profit increase on back of games as US WeChat ban looms

“Voodoo is interesting because it focuses on hyper-casual games, which aren’t necessarily Tencent’s forte,” said Matthew Kanterman, an analyst at Bloomberg Intelligence.

Hong Kong-listed Tencent mainly owns stakes in companies that make blockbuster desktop and mobile games at a measured pace and with large budgets. These include US-based developers Riot Games, Epic Games, Glu Mobile and Activision Blizzard, as well as South Korean firm CJ Games and Japanese company Aiming. It spent US$8.6 billion to take over Finnish mobile game developer Supercell in 2016.

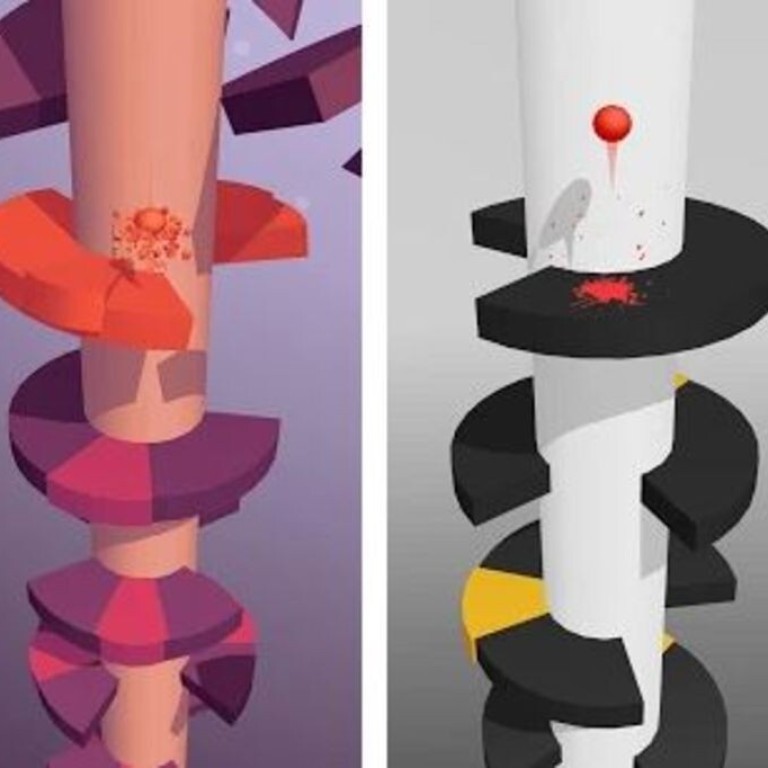

Paris-based Voodoo provides Tencent with additional international scale. The French outfit has launched more than 100 games since it was founded in 2013, and now counts more than 300 million monthly active users. Some of its popular games include Helix Jump, Ball Blast, Car Merger, Baseball Boy! and Crowd City.

Tencent initiates merger of China’s Twitch-like sites Huya and Douyu in move to consolidate gaming lead

“Voodoo had the most downloads of any hyper-casual games maker in 2019,” said Kanterman of Bloomberg Intelligence. “About 1.1 billion downloads.”

Still, the regulatory landscape has always been the highest barrier to success in China’s video games market, according to research firm Niko Partners. Tencent’s latest investment is not expected to face a regulatory issue.

Hyper-casual games that rely on ad revenue, according to a Niko Partners report this month, do not need to be reviewed and granted a publishing licence before launch by regulator the National Press and Publication Administration. That is the same rule for educational games listed in a non-game category on app stores.