Didi Chuxing valuation could rise amid international expansion, analysts say

- Global expansion is expected to help Didi ‘tell a better story’ when it comes time for the company to go public

- Didi has set a target of serving 800 million monthly active users globally by 2022

“Global expansion helps Didi tell a better story for its IPO and achieve higher valuation if it aims to list in Hong Kong or the US,” said Feng Linyan, a senior automotive analyst at investment research firm EqualOcean. “This is something Didi has to do, despite the steeper cost of operating in these new markets.”

At present, private investments are keeping Didi well-funded to pursue its international expansion plans. As of March, Didi has raised about US$23.2 billion from various major investors including Japanese conglomerate SoftBank Group Corp, Tencent Holdings and Alibaba Group Holding, according to data from venture capital and private equity research firm PitchBook. Alibaba is the parent company of the South China Morning Post.

“There’s also the role that some of Didi’s investors, like SoftBank, may be playing behind the scenes,” said Abishur Prakash, geopolitical futurist at Toronto-based consulting firm Centre for Innovating the Future, about the company’s overseas strategy.

Didi, which recorded more than 1 billion trips in its international markets last year, expects its international operations to underpin future growth, as it targets serving 800 million monthly active users globally by 2022.

Chinese ride-hailing giant Didi Chuxing expands to smaller cities in Australia as part of global push

“We are optimistic about Didi Chuxing’s prospects as it expands into Russia,” said Asad Hussain, mobility analyst at PitchBook. He indicated that Didi has a curated approach to entering new markets, where the company’s services are tailored for local preferences. Uber Technologies, by comparison has a “cookie-cutter” approach to operating in different countries.

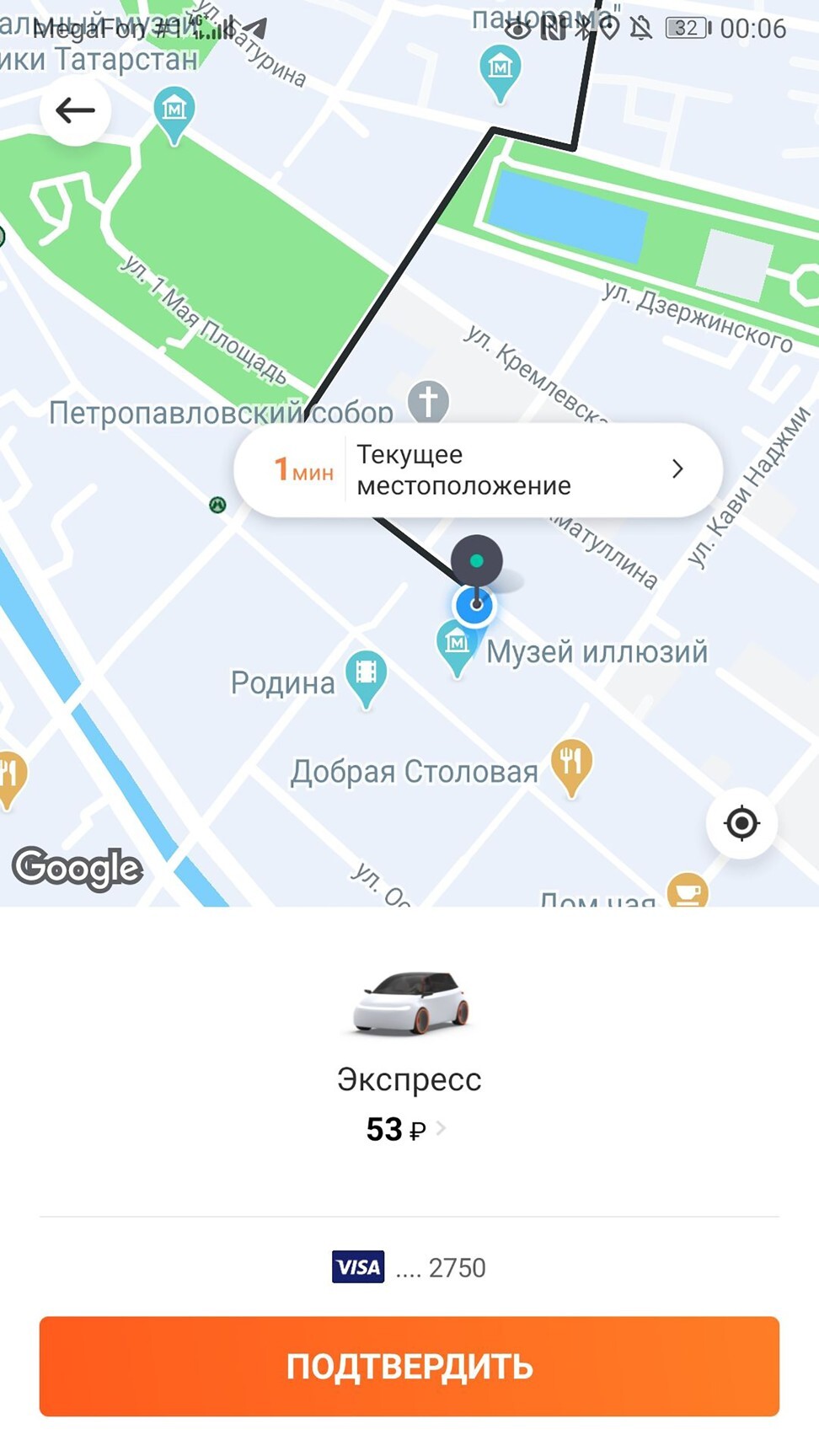

In Russia, President Rustam Minnikhanov of the Republic of Tatarstan vowed to give full support to Didi in a meeting with the company’s representatives in June, according to Russian media reports.

“Kazan has a pro-innovation policy and friendly business environment” a Didi spokesman said on Wednesday.

Russia’s urban transport market – including taxi, car-sharing and carpooling services – is forecast to reach US$26.5 billion by 2025, up from US$9.9 billion in 2018. Didi’s main competition in the country is Uber Technologies-backed Yandex. Taxi.

China’s ride hailing giant Didi Chuxing hiring truck drivers for push into on-demand freight market

In Didi’s home market, competition is expected to grow, as the ride-sharing sector becomes more mature. Didi currently dominates mainland China’s 300 billion yuan (US$44 billion) ride-sharing market, where it has a 90 per cent share.

“Hundreds of ride-hailing platforms of different sizes are operating in China, the competition has been intense and increasing,” industry think tank Forward Research Institute said in a report published last month. It said operators’ survival depend on the market share they control.

Didi has been competing against services aggregators – including Alibaba Group Holding-backed Gaode Maps, Meituan Dianping and Baidu Maps – which allow users to hail a ride from various ride-hailing platforms simultaneously.