Tencent, China Rapid Finance team up on new online consumer investment products

China Rapid Finance, with 1.2m borrowers on its platform that matches them with third-party lenders, serves as screening party for underlying assets of Licaitong customers

Internet giant Tencent Holdings could be poised to ramp up the operations of its online wealth management service, Licaitong, under a new alliance with China Rapid Finance, operator of the mainland’s largest online consumer lending platform.

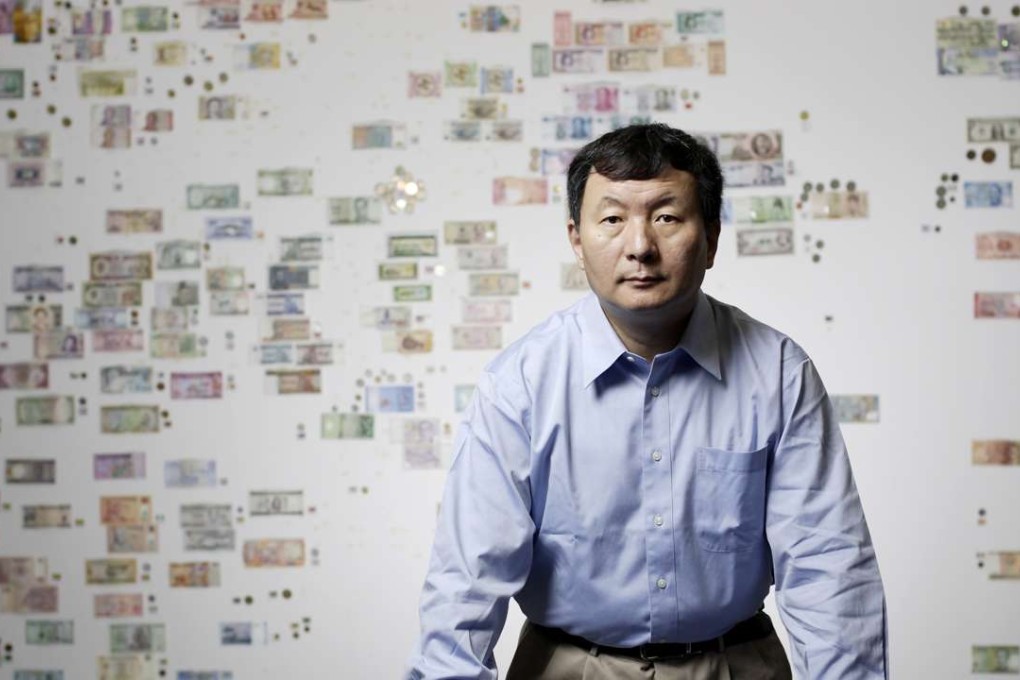

“This collaboration between CRF and Tencent’s Licaitong platform will support the development of inclusive finance in China,” China Rapid Finance founder and chief executive Zane Wang Zhengyu said in a statement on Monday.

China Rapid Finance, which has 1.2 million borrowers on its platform that matches them with third-party lenders, now serves as the screening party for the underlying assets of Licaitong customers.

Wang said the cooperation would help widen the reach of online financial services across the country, especially to the unique market segment that China Rapid Finance serves – the country’s estimated 500 million emerging middle-classes, mobile active, or EMMA, consumers with no credit history.

He pointed out that these EMMA consumers have generated a tremendous amount of data through their online search, social networks, online shopping and payments, all of which China Rapid Finance can analyse using so-called machine learning and big data algorithms.