Huawei, Xiaomi lead Chinese brands’ stranglehold on world’s largest smartphone market

The top smartphone brands are extending their dominance in China, with five companies now accounting for three in every four handsets sold in the world’s largest market.

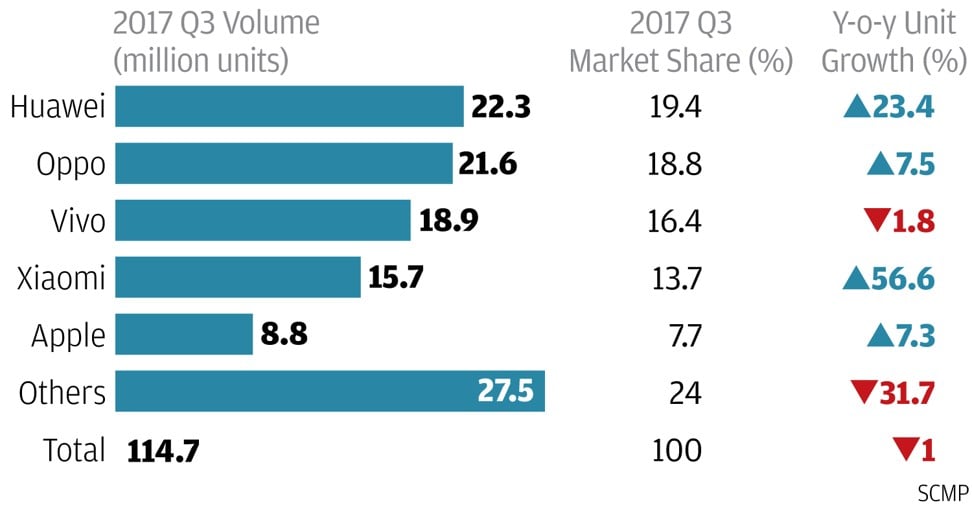

Huawei led the pack, boosting its market share by more than a fifth to 19.4 per cent in the third quarter, according to preliminary figures released by industry researcher IDC on Monday. Together with Oppo, Vivo, Xiaomi and Apple, the five smartphone brands are gaining at the expense of smaller, lesser-known makes, which saw their collective share drop by about a third from a year earlier.

“Even though the market is getting saturated in China, smartphone companies are still aggressive in trying to steal market share from their competitors,” said Tay Xiaohan, IDC’s research manager. All of the top smartphone players will need to either to maintain or increase their marketing activities in the coming quarters as competition intensifies, she said.

Smaller players will find it increasingly difficult to keep up with the high-spending market leaders, with Huawei and Xiaomi joining the likes of Oppo and Vivo in spending aggressively to sponsor key television programmes, including a popular hip-hop talent show, Tay said.

Competition is also likely to come in part from Apple, which recently launched its flagship iPhone X and iPhone 8 in China. Apple was the only foreign brand in the top five with a 7.7 per cent share, an increase from 7.1 per cent a year earlier.

Apple has high hopes for the new iPhone X in its Greater China market, comprising the mainland, Hong Kong and Taiwan, where revenue in its fiscal third quarter ended July 1, fell 10 per cent year on year to about US$8 billion.

Mainland Chinese consumers account for about a third of all iPhone users globally, according to research firm Newzoo. It estimated the mainland had 243 million iPhone users as of July, 33 per cent of the worldwide total.

The increasing dominance of the top five brands is a major cause of worry for the rest of the handset makers, according to Hattie He, a research analyst with Canalys. Competition among the top vendors in China will remain tight with no clear winner going into the last quarter of the year, He said in an October 30 report.