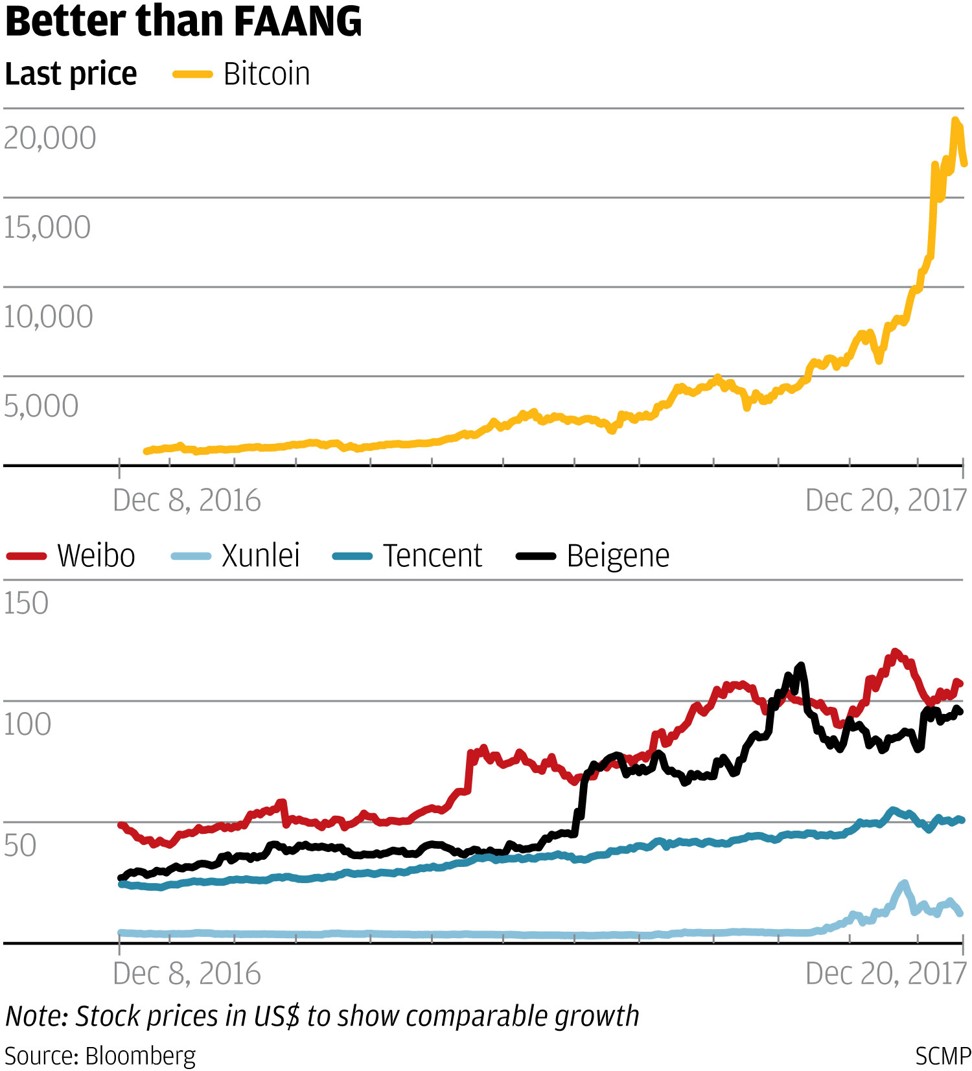

Five hi-tech investments that trumped Facebook, Apple, Amazon, Netflix, Google in 2017

Shares of Facebook, Apple, Amazon, Netflix and Google may have jumped more than 50 per cent this year, but these do not even come close to the gains made by four Chinese tech stocks and the runaway success of bitcoin.

If you thought gains of more than 50 per cent recorded by shares of technology vanguards Facebook, Apple, Amazon, Netflix, Google or Tesla would amount to a big score this year, then think again.

With slightly more than a week to go before the end of this year, here are five hi-tech investments, some more well known than the others, which have bested the performance of those US companies’ shares.

Bitcoin

Year to date gain: 1,892 per cent

The price of bitcoin, tagged by investors as “gold 2.0”, has surged about 19 times to about US$18,800 from US$998 in early January, according to recent quotes from the Luxembourg-based Bitstamp exchange.

Those worries, however, did not stop the cryptocurrency’s ascent as it started trading in early December on CME, the world’s biggest futures exchange. It marked another sign that Wall Street has accepted bitcoin as a mainstream investment.

Xunlei

YTD gain: 277.2 per cent

The Shenzhen-based provider of internet services, including network download, video playback, digital content and online games, is among a growing number of small publicly traded companies to benefit from the rapid increase in value of cryptocurrencies.

Xunlei was recently on a tear – its share price rising about six-fold to become one of the best-performing stocks on the Nasdaq – after a subsidiary introduced a cryptocurrency project called “Wanke coin mining” in October.

The company, however, later distanced itself from that project amid the Chinese government’s clampdown on initial coin offerings. Worries over the project led to an internal scuffle with an associate company, Shenzhen Xunlei Big Data Information Services.

Wang Chuan, a co-founder of Chinese smartphone supplier Xiaomi, recently took over as chairman of Xunlei, putting an end to that dispute.

BeiGene

YTD gain: 219.4 per cent

The Beijing-based biopharmaceutical company hit a home run this year amid a global boom in the immunotherapy market. It has developed four clinical stage therapies designed to boost patients’ immune system in cancer treatment.

It recently completed building a manufacturing plant in Suzhou Industrial Park, located in the eastern-central coastal province of Jiangsu.

With a market capitalisation of about US$4 billion, BeiGene landed a US$1.39 billion deal in July with American biotechnology giant Celgene that marked the biggest overseas licensing of drugs developed in China to date.

That represented the second major endorsement for BeiGene after it signed a global partnership with Merck Serono, the biopharmaceutical division of Merck, in 2013.

Weibo Corp

YTD gain: 166 per cent

The Nasdaq-traded Chinese social media operator, which runs the Twitter-like microblogging service Sina Weibo, had eclipsed its US rival in terms of market capitalisation in February this year.

Headquartered in Beijing, Weibo added 79 million monthly active users year on year in the third quarter to swell its total user base to 376 million – about 46 million more subscribers than Twitter.

Weibo also made a net profit of US$101.1 million in the quarter ended September 30, while Twitter reported a net loss of US$21 million in the same period.

Tencent Holdings

YTD gain: 111.5 per cent

As this year winds down, tech stocks have posted remarkable gains. The S&P North American technology index has jumped 38 per cent against a 20 per cent increase for the S&P 500 index. The Hang Seng Composite Information Technology Index has surged 88 per cent against the broader benchmark’s 33 per cent rise.

Market experts expect to see continued rosy prospects in 2018.

“For next year, I’m bullish on the combination of online and offline [retail], manufacturing upgrades and applications of artificial intelligence in sectors such as health care, education and finance,” said Zheng Linghui, founder and chief executive of Jianyihui, a Beijing-based investors’ community.

In its latest outlook on US stocks, JP Morgan said “the strong momentum is likely to spill into next year, especially with a positive outcome for corporate tax reform and continued growth out of emerging markets including China”.

For China Merchants Securities, it predicted next year’s A-share investments to “focus on medium to high-end consumption, tech innovation and the green low-carbon sectors”.