Taiwan biotech firm eyes Hong Kong IPO for push into mainland China market for cornea transplants

ACRO Biomedical plans a reverse takeover to place its assets into a Hong Kong holding company

ACRO Biomedical, a Taiwan-based developer of skin, bone and cornea graft materials, plans to restructure via a reverse takeover and seek an initial public share offer in Hong Kong so that it can tap into the mainland China market.

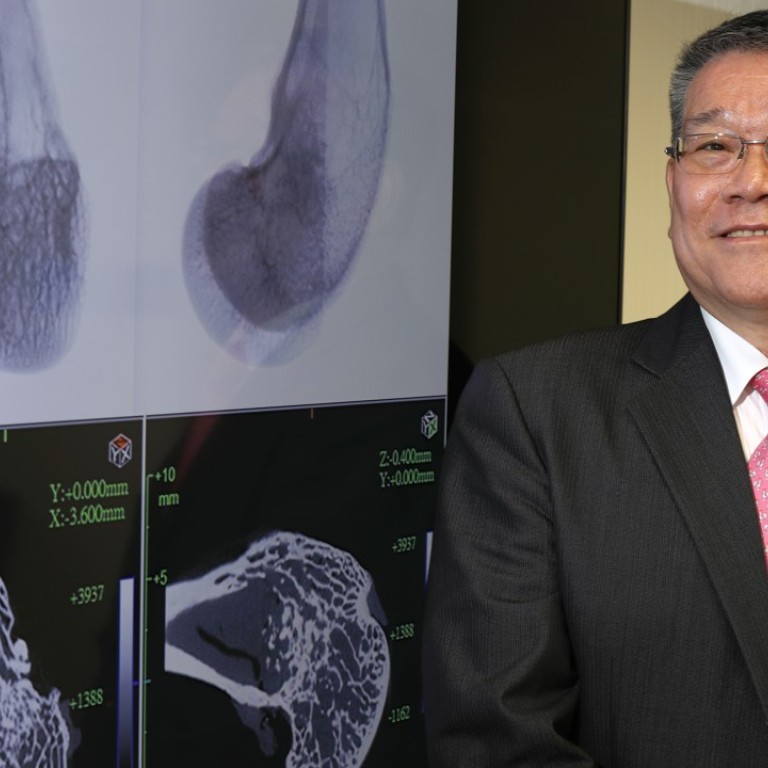

The company, based in the southern city of Kaohsiung, has raised some NT$200 million (US$6.8 million) from “friends and family” since its inception in 2014 and aims to raise a further US$6 million by next month, chief executive Hsieh Dar-jen said in an interview.

Hsieh, the former chief executive of Taiwan-listed collagen-based medical devices developer Sunmax Biotechnology and holder of a doctorate in cell molecular biology, is seeking investment from institutional investors to help the company meet Hong Kong’s new listing requirements for biotechnology firms that do not have a profit track record.

These include a minimum market capitalisation of HK$1.5 billion (US$191.2 million) at the time of listing and at least one “sophisticated” investor six months before listing.

“Our talent cost in Taiwan is lower [than in the United States], but the downside is that our market capitalisation is small,” he said in the interview on Tuesday. “We must increase our equity capital to bolster our market cap.”

ACRO plans a reverse takeover that will see its assets owned by a Hong Kong holding company, to help it get around Taipei’s restrictions on Taiwanese firms investing in mainland China.

The company said it had completed in 2016 what it called the world’s first successful canine corneal graft, which was conducted on a five-year-old Chihuahua, with no sign of rejection.

It has licensed its cornea product to Australia-based Oculus BioMed, and clinical trials involving about 30 human patients will be conducted in Taiwan by ACRO, Hsieh said. He added that ACRO has filed for patents on its cornea graft technology in the US, South Korea, Japan, India, China, Taiwan and in Europe, all of which are pending approval.

The technology involves the extraction of pig corneas, which are processed to remove cells, lipids and non-collagen proteins so that a “collagen scaffold” is left. The “scaffold” is then transplanted and fused with the hosts’ stem cells to induce the regeneration of a new cornea.

ACRO plans to price its artificial cornea in a way that a graft would be “slight cheaper” than a donated cornea transplant for humans, which costs some NT$300,000 including surgical fees, according to Hsieh.

Some four million people in mainland China are waiting for cornea donations, while only a few dozen are donated per year, Hsieh said.

Hsieh said ACRO has also received approval from the food and drug administrations in Taiwan and the US in the past 12 months to sell its skin and bone graft materials. The company has not filed patent applications in view of the large number of products on the market, he said.

He said it plans to price its skin graft product 20 per cent less than Terudermis, a Japanese rival product, saying that ACRO’s product has a much shorter healing period.