China’s gaming industry suffers revenue slowdown as new government body kills approval of upcoming titles

The State Administration of Radio and Television, which is in charge of monitoring games and other entertainment content, has not given licenses to any new games since March 28

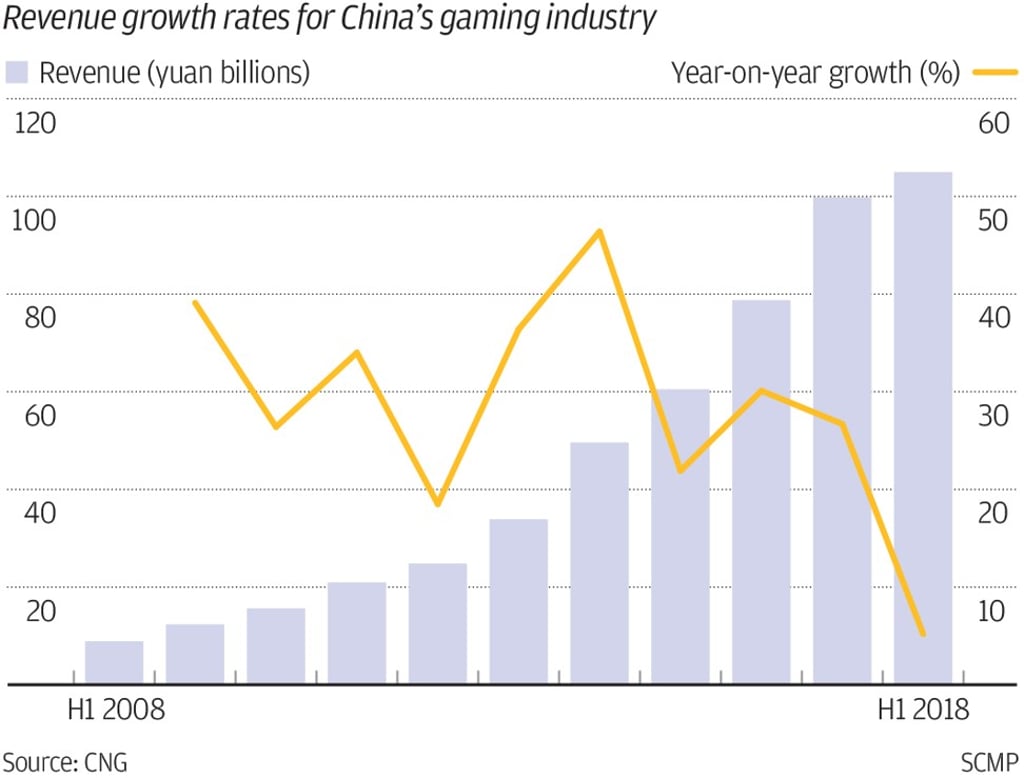

China’s gaming industry – the world’s biggest in terms of users and revenue – is suffering its slowest growth in at least a decade, amid a months-long halt on government approval of new games.

In the first half of 2018, China’s gaming market recorded total revenue of 105 billion yuan (US$15 billion), up 5% from the same period last year, according to Beijing-based research firm CNG and China’s official gaming association GPC. This is the first time that the market has had single-digit growth since at least 2009, according to the CNG and GPC report released last week.

Mobile gaming accounted for the bulk of revenue in the first half, but year-on-year growth plunged to 13% from 50%. Overall, China’s gamer base continued to grow and surpassed 527 million people in the first half, with 458 million of these mobile gamers.

China’s two gaming giants – Tencent Holdings and NetEase – are behind all of the 10 highest-grossing mobile games in the first half, and the top spot goes to Tencent’s blockbuster battle arena title Honor of King, according to the CNG report.

The report was released last week on the sidelines of ChinaJoy in Shanghai, China’s biggest gaming convention. During presentations and panel discussions at the event, industry players attributed the slowing revenue growth to factors ranging from a saturated market to the rise of short video apps such as Douyin and Kuaishou, which now take up nearly 9 per cent of the time Chinese people spend on their smartphones, according to data provider QuestMobile.