China says its semiconductor output picked up in June but still down in first half of year

- Production of integrated circuits in June totalled 322 million units, up 5.7 per cent from last year, according to the National Bureau of Statistics

- However, production of chips from January to June totalled 1,617 million units, down 3 per cent from last year

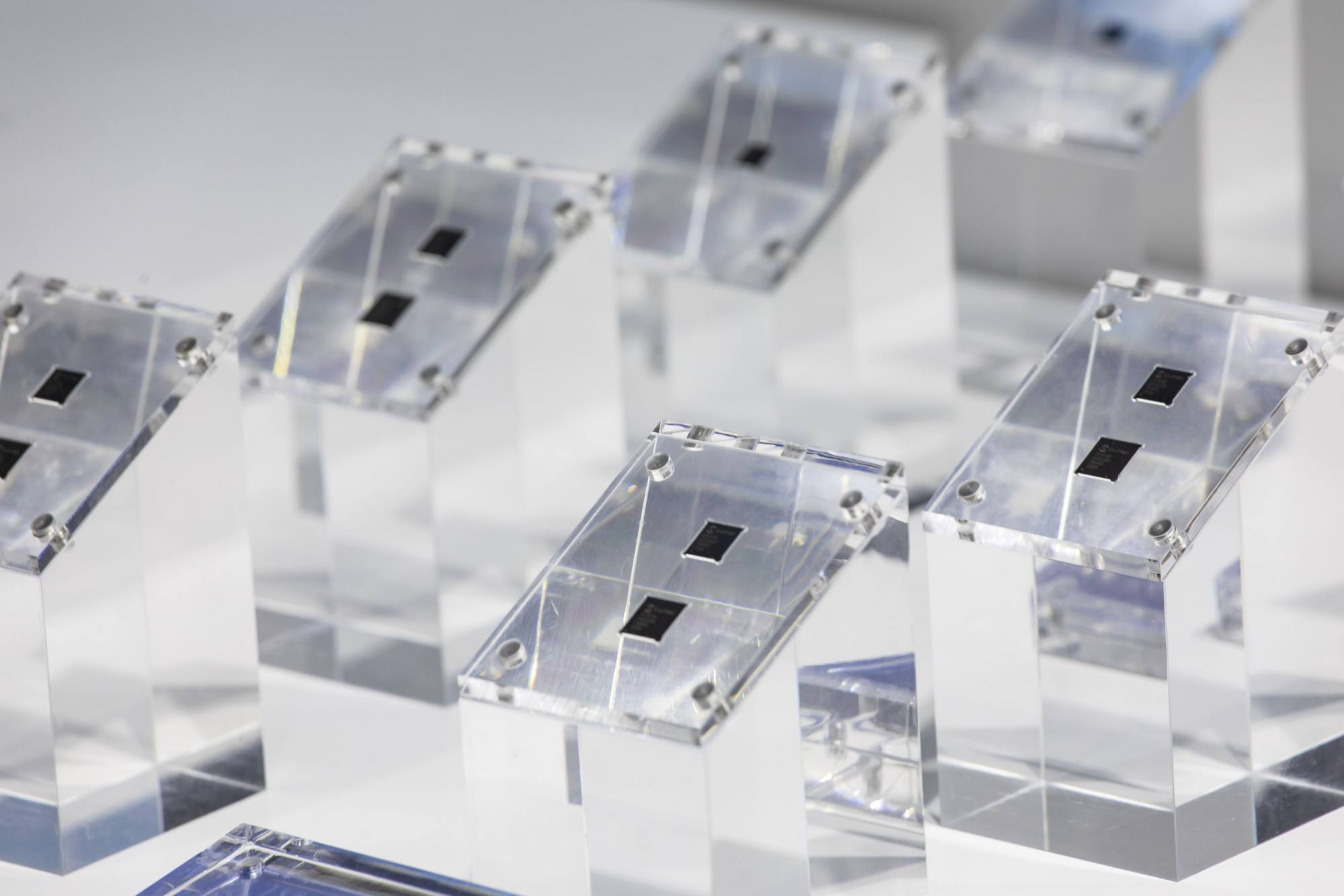

China’s reported integrated circuit (IC) output was up 5.7 per cent in June compared with last year but remained down in the first six months of 2023 as the country’s semiconductor industry continues to struggle with economic headwinds and escalating trade restrictions from the US and its trade allies.

Production of ICs in June totalled 32.2 billion units, marking a recovery from the same period last year, according to data released by the National Bureau of Statistics (NBS) on Monday.

In contrast, June 2022 had reportedly seen chip output fall by over 10 per cent to 28.8 billion units as China’s stringent zero-Covid-19 policies, as well as the war in Ukraine and high global inflation, plagued the industry.

Despite a strong month, the data showed that the output of ICs for the first half of the year was still down 3 per cent from the same period last year, totalling 161.7 billion units.

A half-year decrease in semiconductor output could reflect how economic headwinds and US trade sanctions have affected the production capacity in the world’s largest chip market.

Last October, tighter export controls announced by Washington significantly curbed China’s ability to manufacture and import advanced semiconductors. That move was followed by a joint agreement with Japan and the Netherlands in January to coordinate export controls to China covering certain advanced chip-making equipment.

Japan’s semiconductor equipment controls are slated to come into effect next week. Meanwhile, Dutch company ASML, which has a monopoly on high-end lithography systems for chip making, will need a government export license to sell some of its most advanced systems to China starting on September 1.

China’s added value to the broader manufacturing industry was up 4.2 per cent in the first half of 2023 compared to last year, according to NBS. But, in addition to IC output drops, production of microcomputers dropped about 25 per cent, while smartphone output in China fell about 9 per cent.

China’s overall factory activity contracted for a third straight month in June amid an overall slowing economic recovery, according to China’s official manufacturing purchasing managers’ index.