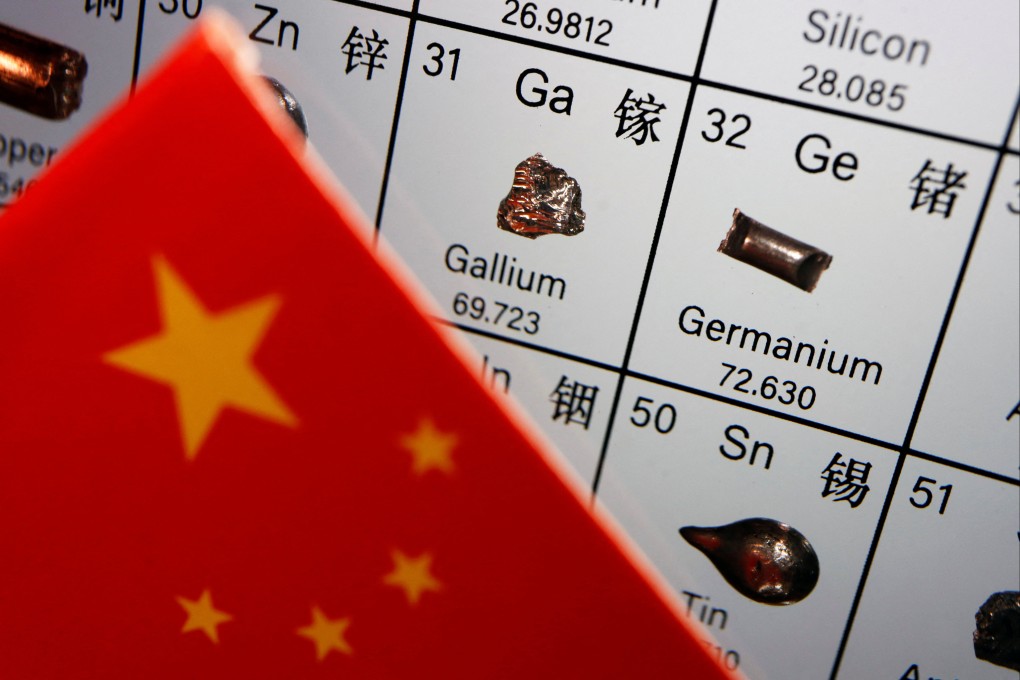

China exports of gallium and germanium surged before restrictions took effect in August, report shows

- Both gallium and germanium are key to the production of semiconductors and other electronics

- Beijing’s move to ‘safeguard national security’ was seen as retaliation against US and its allies for imposing chip restrictions on China

China’s exports of gallium and germanium, important materials used in semiconductor manufacturing, increased more than 10 per cent in July from a month earlier, as buyers ramped up purchases ahead of export controls imposed by Beijing in August.

In July, exports of gallium, germanium and related products reached US$121 million, up 12.1 per cent from July and 22.7 per cent from the same period last year, according to a report from Chinese chip industry portal Ijiewei on Wednesday, citing data from Chinese customs.

Both gallium and germanium are key to the production of semiconductors and other electronics, with gallium used in power devices for electric vehicles and high-speed switching circuits, while germanium is used in fibre optic systems, infrared optics, solar cells and light-emitting diodes.

China’s commerce ministry and customs administration announced the export controls in early July, requiring that anyone selling these critical metals and related products outside China would have to submit an application and obtain government approval from August 1.

Beijing said the move, widely seen as retaliation against the US and its allies for imposing chip restrictions on China, was necessary to safeguard “national security and interests”.