Did a property billionaire invest in a flailing Tesla wannabe to gain tech for China? The US thinks so

- An Evergrande Group subsidiary’s US$2 billion deal to buy a stake in Faraday Future seen as scheme for China to obtain advance technology in new energy vehicles

The United States singled out a cash-strapped Tesla wannabe, a top university in Beijing and government-backed venture capital firms as part of China’s programme of unfair technology transfer and intellectual property theft, as the trade war between the world’s two largest economies escalate.

Those entities were identified in a 53-page report released on Tuesday by the Office of the US Trade Representative ahead of a scheduled meeting next week between President Xi Jinping and Donald Trump on the sidelines of the Group of 20 Summit in Buenos Aires, Argentina.

The report, which updated information about the US agency’s Section 301 investigation of China’s technology and innovation-related policies and practices, looks to add more urgency to that meeting, which could lead to a possible truce in the two countries’ trade dispute.

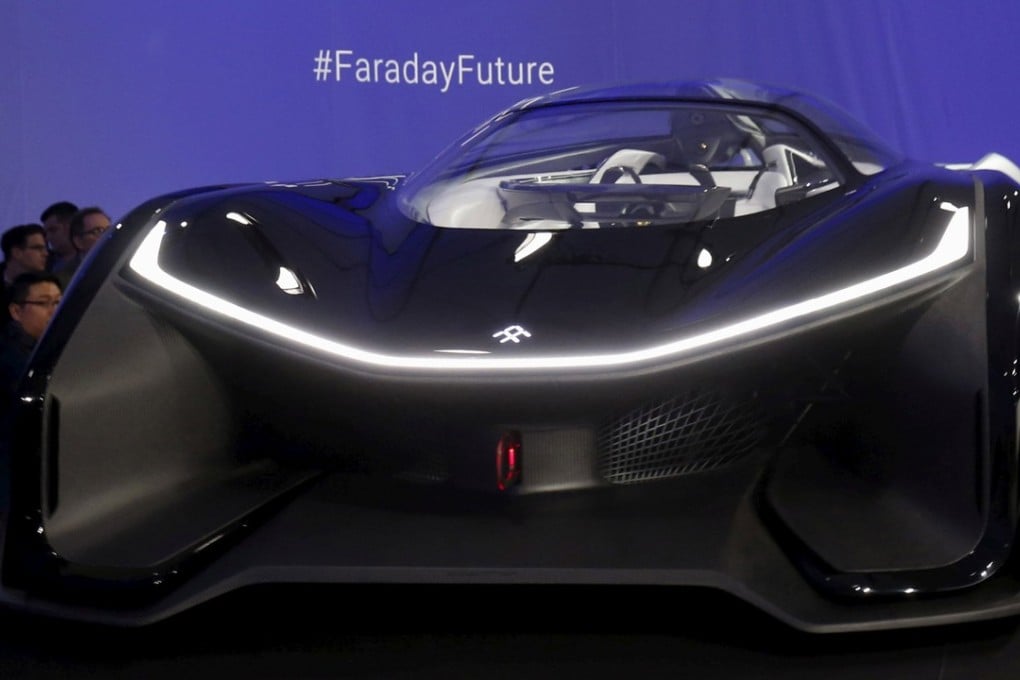

The US$2 billion acquisition of a 45 per cent stake in California-based electric car maker Faraday Future by Evergrande Health, the Hong Kong-listed subsidiary of China’s largest property company the Evergrande Real Estate Group, was cited by the report as an example of how Beijing makes use of outbound investments to obtain advanced technologies favoured by state industrial plans.

It said Xu Jiayin, the group’s founder and chairman, has been the chairman of his company’s Chinese Communist Party (CCP) cadre since 2002, which deemed that connection a red flag in light of Beijing’s focus on new energy vehicles as part of the state’s “Made in China 2025” initiative.