Here’s what you need to know about Hikvision, the camera maker behind China’s mass surveillance system

- Hikvision has been a supplier to hundreds of government-led surveillance projects in major cities including Shanghai, Hangzhou and Urumqi

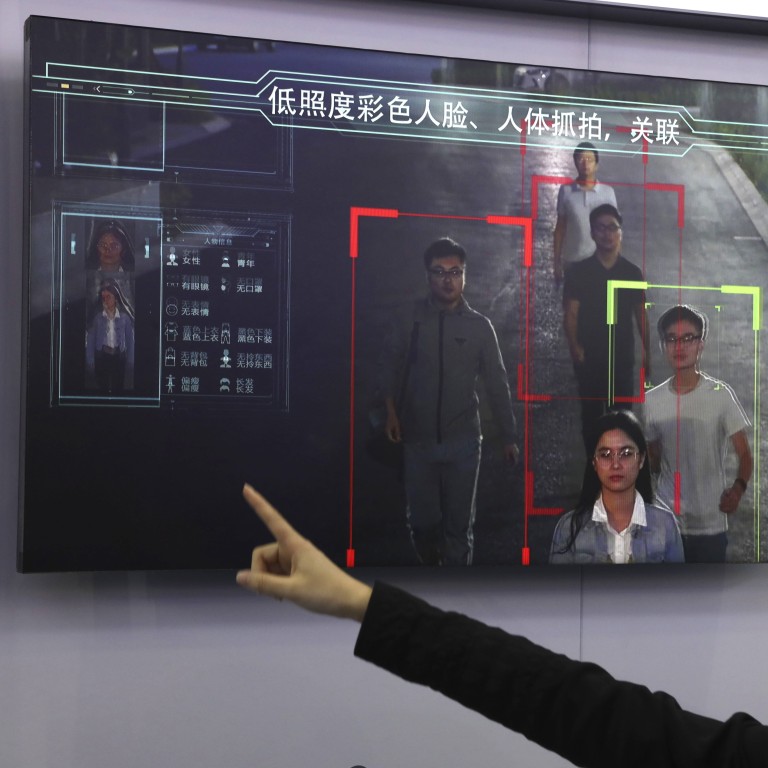

Big brother in China is watching you, and there is a good chance that it is watching through a camera made by Hangzhou Hikvision Digital Technology, one of the world’s largest suppliers of video surveillance equipment. Here’s what you need to know about Hikvision.

What does Hikvision do?

Founded in 2001, Hikvision has morphed from a former Chinese government research institute into a US$39 billion business specialising in professional video surveillance cameras.

Headquartered in Hangzhou in eastern China and listed on the Shenzhen Stock Exchange, Hikvision has been a supplier to hundreds of government-led surveillance projects in major cities including Shanghai, Hangzhou and Urumqi, where its cameras can take clear shots of vehicles and passengers even in poor visibility conditions. Hikvision expanded into the consumer space in 2013 with EZVIZ, a brand that makes surveillance equipment for the home and office.

Who owns Hikvision?

Around 42 per cent of the company is controlled by state-owned enterprises, with China Electronics Technology HIK Group owning 39.6 per cent of the company as the biggest shareholder.

Chairman Chen Zongnian, 54, founded Hikvision with two alumni from Huazhong University of Science & Technology, when he was working in a research division of China Electronics Technology Group Corporation.

How big is the surveillance market and what’s Hikvision’s position in it?

The global video surveillance equipment market is expected to grow 10.2 per cent to US$18.5 billion in 2018 thanks to increasing demand for security cameras, according to a report by London-based market research firm IHS Markit in July. China’s professional video surveillance equipment market, which accounts for 44 per cent of all global revenue, grew by 14.7 per cent in 2017, outpacing the rest of the world, which grew by only 5.5 per cent, the report showed.

Hikvision had a leading share of 21.4 per cent for the global closed-circuit television and video surveillance equipment market in 2017, according to IHS Markit.

The meteoric rise of Hikvision comes amid booming demand for public surveillance by the Chinese government. China’s Skynet Project, a national surveillance system aimed at “fighting crime and preventing possible disasters”, according to authorities, had more than 20 million cameras installed in public spaces in Chinese cities in 2017, while the Sharp Eye Project has extended the watch to rural areas across China, according to state media.

IHS Markit estimated that China had 176 million surveillance cameras in public and private areas in 2017, compared to only 50 million cameras in the US. The researcher expects China to install about 450 million new cameras by 2020. The researcher expects about 450 million new cameras to be shipped to the Chinese market by the end of 2020.

What are the challenges for Hikvision overseas?

Hikvision’s products are in use in more than 150 countries and regions globally including the US and the United Kingdom. Some of its major overseas projects include the surveillance systems in Philadelphia Safe Communities in the US, Nuremberg railway station in Germany and a Brazilian World Cup stadium.

In the first half of 2018, sales from the overseas market grew 26.7 per cent year on year to reach 6.2 billion yuan, accounting for 30 per cent of Hikvision’s total revenue.

However, the company’s ambitions face some hurdles amid the ongoing US-China trade war and US moves to cut off business ties between federal agencies and Chinese surveillance equipment suppliers.

The US Senate passed the 2019 National defence Authorisation Act in August under which the US government will be banned from buying Chinese-made surveillance equipment from several Chinese firms including Hikvision and Hangzhou-based Zhejian Dahua Technology. Hikvision has previously supplied equipment to the US Army to monitor its base in Missouri and to the Memphis police department, according to The Wall Street Journal.

In September, Australian media reported that devices from Hikvision and Dahua were being used for spying in the country. The two companies supply most of the surveillance cameras installed in Australia, according to the report.