Amazon says it risks loss on spending rise for pandemic

- The online retail giant projected its operating income to range from US$1.5 billion to a loss of US$1.5 billion in the second quarter

- Its coronavirus efforts include increased spending on personal protective equipment as well as enhanced cleaning of warehouses and stores

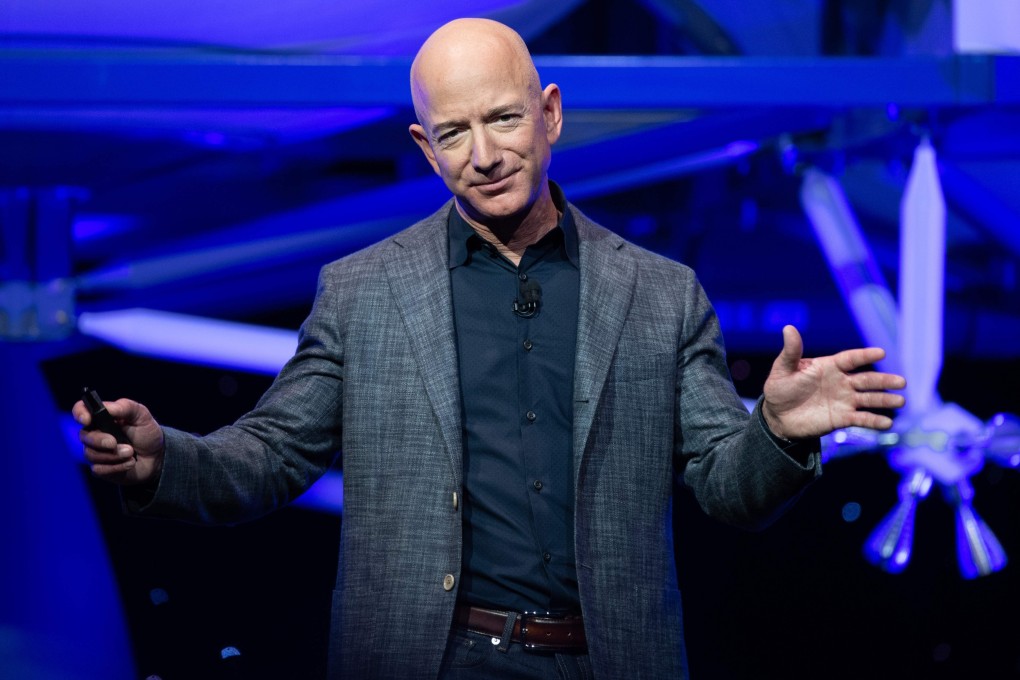

Amazon.com chief executive Jeff Bezos normally uses the company’s earnings report to extol the virtues of smart assistant Alexa or the benefits of paid subscription service Prime. On Thursday, he told investors to hold on tight as his company navigates “the hardest time we’ve ever faced”.

The largest US online retailer saw profit shrink and said it may incur a loss in the current quarter as it boosts spending to keep logistics operations running smoothly during the coronavirus pandemic.

“Under normal circumstances, in this coming Q2, we’d expect to make some US$4 billion or more in operating profit,” Bezos said on Thursday in a statement reporting Amazon’s results. “But these aren’t normal circumstances. Instead, we expect to spend the entirety of that US$4 billion, and perhaps a bit more, on Covid-related expenses getting products to customers and keeping employees safe.”

Operating income could range from US$1.5 billion to a loss of US$1.5 billion in the quarter ending in June, the Seattle-based company said.

Forecasting a potential loss added a dour note to financial results that showcased the success of a company built to thrive when online shopping is the only option for many shoppers. Unit sales, a closely watched metric, surged 32 per cent in the first quarter. That was the fastest pace since the fourth quarter of 2012.

Amazon shares slid 6.1 per cent in early trading Friday. The stock closed at US$2,474 in New York on Thursday and has jumped more than 33 per cent in 2020.