Amazon says it risks loss on spending rise for pandemic

- The online retail giant projected its operating income to range from US$1.5 billion to a loss of US$1.5 billion in the second quarter

- Its coronavirus efforts include increased spending on personal protective equipment as well as enhanced cleaning of warehouses and stores

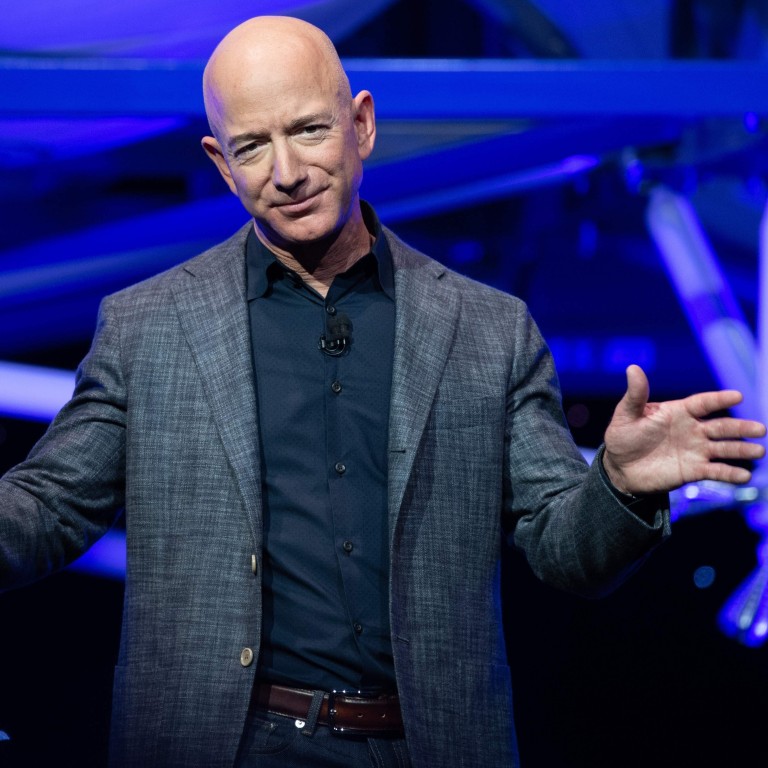

Amazon.com chief executive Jeff Bezos normally uses the company’s earnings report to extol the virtues of smart assistant Alexa or the benefits of paid subscription service Prime. On Thursday, he told investors to hold on tight as his company navigates “the hardest time we’ve ever faced”.

The largest US online retailer saw profit shrink and said it may incur a loss in the current quarter as it boosts spending to keep logistics operations running smoothly during the coronavirus pandemic.

“Under normal circumstances, in this coming Q2, we’d expect to make some US$4 billion or more in operating profit,” Bezos said on Thursday in a statement reporting Amazon’s results. “But these aren’t normal circumstances. Instead, we expect to spend the entirety of that US$4 billion, and perhaps a bit more, on Covid-related expenses getting products to customers and keeping employees safe.”

Operating income could range from US$1.5 billion to a loss of US$1.5 billion in the quarter ending in June, the Seattle-based company said.

Forecasting a potential loss added a dour note to financial results that showcased the success of a company built to thrive when online shopping is the only option for many shoppers. Unit sales, a closely watched metric, surged 32 per cent in the first quarter. That was the fastest pace since the fourth quarter of 2012.

Amazon shares slid 6.1 per cent in early trading Friday. The stock closed at US$2,474 in New York on Thursday and has jumped more than 33 per cent in 2020.

The coronavirus pandemic is accelerating long-term trends in favour of Amazon and online shopping, while further weakening bricks-and-mortar stores. The company, which has prioritised stocking essential goods, is one of the few large retailers that have continued to operate relatively normally during the crisis.

And, as expected, sales increased 26 per cent to US$75.5 billion in the quarter that included the outbreak of Covid-19 in the US. Net income was US$5.01 per share.

Analysts, on average, estimated US$73.7 billion in revenue and earnings of US$6.27 a share, according to data compiled by Bloomberg.

Amazon, the second-largest private sector employer in the US after Walmart, has faced criticism from employees, unions and politicians that it is not doing enough to protect workers. Amazon took the rare step in its earnings statement of recapping the safety measures it has enacted during the pandemic – and its contributions to food banks, students and health care workers – before its typical list trumpeting the quarter’s new products and services.

Amazon fires three critics of company’s pandemic response for workplace violations

Bezos said the coronavirus effort included spending on personal protective equipment, enhanced cleaning of warehouses and stores and operational changes to promote social distancing.

“Providing for customers and protecting employees as this crisis continues for more months is going to take skill, humility, invention, and money,” he said. “If you’re a share owner in Amazon, you may want to take a seat, because we’re not thinking small.”

Amazon spokesman Dan Perlet declined to disclose the number of Covid-19 cases in the company’s ranks.

Amazon and other large web retailers have a sense of duty because they’re so ingrained in people’s lives as a result of the pandemic, said Martin Garner of CCS Insight. “They have a clear role in society to help,” he said. “Amazon has also taken a lot of negative publicity recently, so this massive Covid-19 spend should help address that.”

Amazon stops accepting new grocery delivery customers amid surging demand

Amazon’s big investments, in new data centres to expand its cloud computing business and warehouses to expand its e-commerce capacity, have historically paid off for investors by leading to increased revenue, but it is not clear that will be the case with spending in response to the pandemic, said Brian Yarbrough, analyst at Edward D Jones & Co. Amazon is hiring people, buying Covid-19 tests and cleaning facilities, which can be ongoing costs without providing any long-term gains, he said.

The company had previously said that a hiring binge beginning in mid-March and a temporary US$2 an hour danger money raise for its hundreds of thousands of warehouse workers would ultimately cost some US$700 million. On a conference call with reporters, chief financial officer Brian Olsavsky said 175,000 additional jobs had been filled to help meet demand and take the place of workers sheltering at home.

Amazon’s fulfilment costs surged 34 per cent to US$11.5 billion from the period a year earlier. Shipping costs rose 49 per cent to US$10.9 billion.

How has Amazon’s Jeff Bezos added US$6 billion to his fortune while other billionaires lose money?

“They’ve got a choppy history and investors have given them a lot of leeway because they’ve harvested the benefits of those investments later, but this one is a little more tricky,” Yarbrough said. “Some of these costs seem like they’re going to stick around, which brings the profitability of the company into question.”

Sales in Amazon’s physical stores category, which is almost entirely Whole Food Market stores, rose 8 per cent to US$4.6 billion in the quarter, the largest increase since Amazon bought the organic grocer in 2017. That tally does not include online sales from Whole Foods, which surged in March as people stocked up and overwhelmed Amazon’s food delivery infrastructure. Olsavsky did not offer a combined revenue growth rate for Amazon’s grocery business, but said the company had expanded grocery delivery capacity by 60 per cent during the quarter.

Amazon Web Services, the cloud computing unit that in recent years has accounted for most of the company’s operating income, posted sales of US$10.2 billion, up 33 per cent, and just below analysts’ estimates.