Inside China Tech: chipping away at Huawei

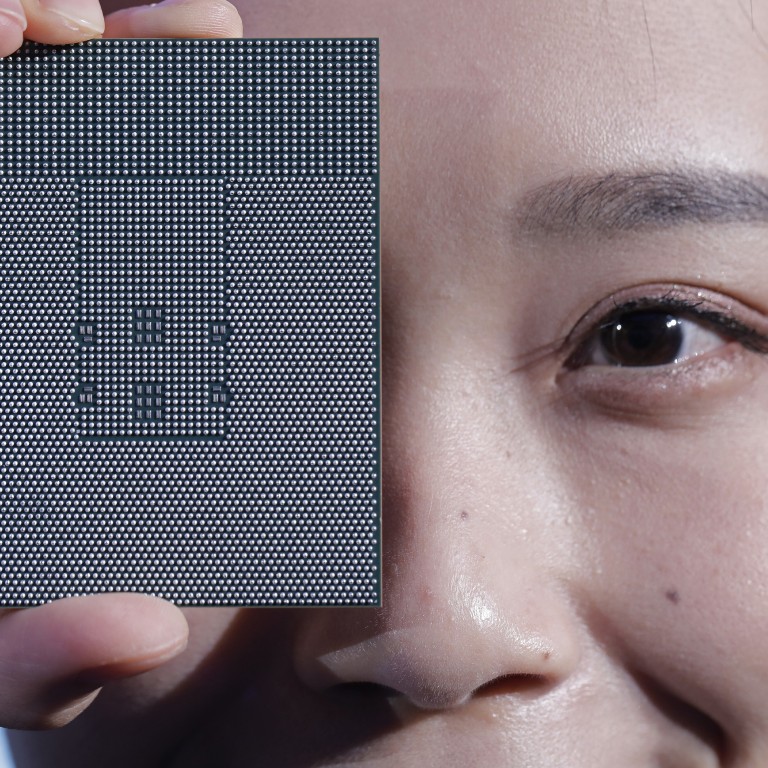

- A new US rule threatens to derail Huawei’s advanced semiconductor development efforts

- It specifically targets the operations of chip design subsidiary HiSilicon

Hello, This is Bien Perez from the South China Morning Post’s Technology desk, with a wrap of some of our leading stories this week.

05:22

Huawei founder on cybersecurity and maintaining key component supply chains under US sanctions

The new restriction reflects momentum in the US government’s effort to decouple from China’s tech supply chain, as Washington officials and lawmakers raise concern that such ties could threaten America’s national security.

The new US rule, which has a 120-day grace period, expands Washington’s authority to require licences for sales of semiconductors made abroad with US technology to Huawei. It covers only chips designed by HiSilicon and does not cover shipments if these are sent directly to Huawei’s customers.

In its statement released on Monday, Huawei described the new rule as not only “arbitrary and pernicious”, but something which would have a serious impact across many industries worldwide.

“In the long run, this will damage the trust and collaboration within the global semiconductor industry,” the company said.

NetEase CEO wants coding to form part of China’s basic education

He suggested that the country establish a continuous curriculum for coding, from primary to secondary school, and build a resource library to help young learners learn this discipline.

That proposal comes amid China’s goal to take the lead in multiple hi-tech sectors, including artificial intelligence and financial technology, which could drive up the nation’s demand for more software developers and computer engineers.

Alibaba-backed Xpeng gets green light for electric car assembly

Xpeng, which is backed by e-commerce giant Alibaba, expects to roll out and deliver the first batch of P7 cars from the facility by the end of June, according to the company. Alibaba is the parent company of the Post.

Xpeng’s first production model, the G3 electric sport utility vehicle released in 2018, was previously assembled by contract manufacturer Haima Automobile Co, a subsidiary of state-owned car maker FAW Group Corp.

Its latest move comes at a time when China’s car industry is searching for increased momentum to overcome the challenges brought by the coronavirus pandemic, which has upended sales and manufacturing in the world’s largest car market.

And that is all for this week. Until next time.