Europe’s chip makers are vulnerable in US fight with Huawei

- These chip makers face a potentially greater threat to business if China chooses to retaliate against the US by targeting one of their most important clients, Apple

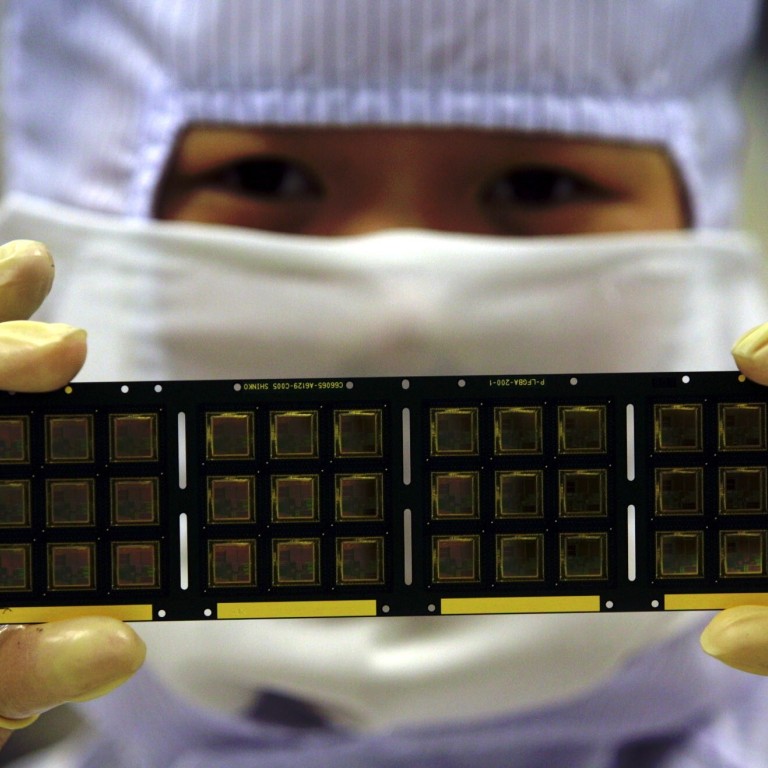

- A chunk of the components made by European chip makers, such as STMicroelectronics and AMS, end up in Huawei’s smartphones

“If Huawei can’t source other parts for their phones, then it is fair to assume that STMicro could see a revenue hit of up to 6 per cent,” brokerage Liberum said in an emailed reply to questions from Bloomberg.

As Huawei struggles to find alternatives to US chip tech, it finds itself a pawn in a much bigger power game

Europe has been caught in the middle of escalating tensions between the US and China, with countries in the bloc forced to balance ties with an important security ally and a global trading partner. Britain has decided to ban Huawei from future wireless infrastructure following intense pressure from Washington.

Austrian-based AMS does not need US software or equipment to make its products, such as 3D sensing components. The US restrictions, however, will still have an impact “if Huawei cannot ship phones”, JP Morgan analyst Sandeep Deshpande said in a report.

AMS said it was assessing the legal situation around the latest US restrictions and added “we are not able to speculate at this point to what extent they could apply to our products”.

STMicro is “evaluating the new amendments to the rule and will comply accordingly”, a spokeswoman said.

02:27

UK bans Huawei from 5G network after US sanctions

Infineon Technologies – one of Europe’s largest chip makers – said it is evaluating the US decision and will react accordingly. British tech company Dialog Semiconductor, which supplies power-management chip for various Huawei products, is monitoring the situation closely, according to a person familiar with the matter. Another European chip maker, NXP Semiconductors, did not respond to requests for comment.

The European manufacturers face a potentially even greater threat to business if China chooses to retaliate against the latest US move by targeting one of their most important clients, Apple.

“The European semiconductor industry is more exposed to Apple than they are to Huawei in handsets,” said Dan Ridsdale, global head of technology, media and telecoms at Edison Investment Research. “If Apple did lose market share in China, those market share shifts always impact the supplies into them.”