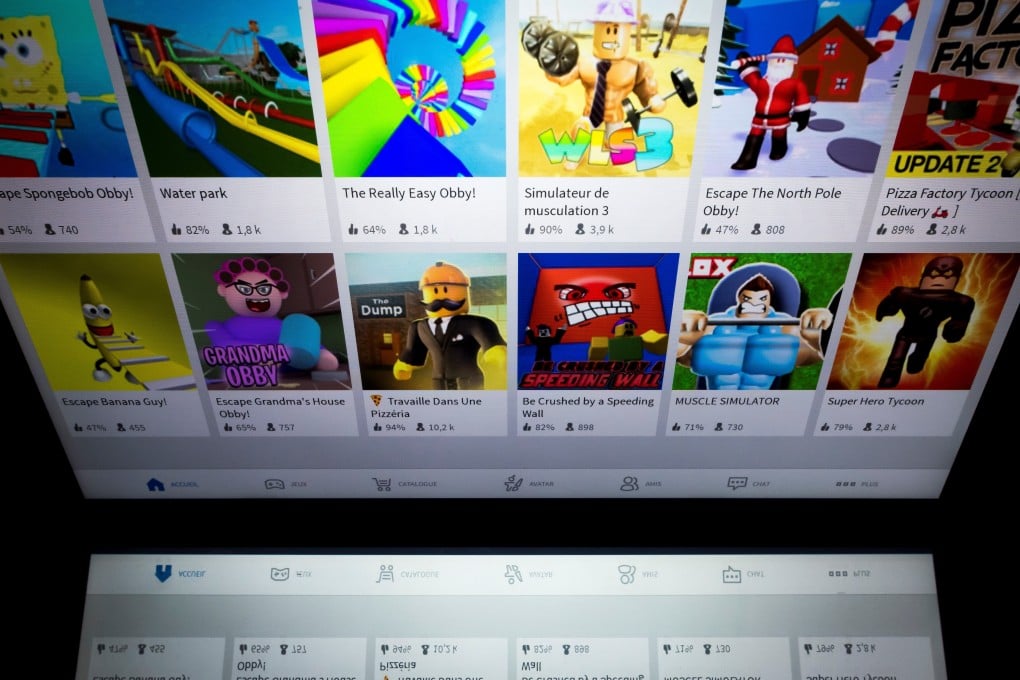

Gaming platform Roblox said to be preparing plans for US listing

- US consumer spending on video gaming hit a record US$11.6 billion in the second quarter

- Roblox is weighing whether to go public through a traditional initial public offering or a direct listing

Roblox Corporation is working with investment banks to prepare for a US stock market listing that could come early next year and which the online gaming platform expects could double its recent US$4 billion valuation, people familiar with the matter said.

US demand for video games has surged as consumers seek home entertainment while living under lockdown measures to curb the spread of the novel coronavirus.

US consumer spending on video gaming hit a record US$11.6 billion in the second quarter, up 30 per cent on the year-ago period, according to research firm NPD Group.

Roblox is weighing whether to go public through a traditional initial public offering or a direct listing, the sources said, cautioning that the plans are subject to market conditions.

The sources requested anonymity as the plans are private. Roblox declined to comment.

In a direct listing, no new shares are sold and underwriting banks do not weigh in on the pricing, unlike in an IPO.